West Virginia Mineral Rights

Learn about West Virginia mineral rights, the best counties, how to find your wells on a map, valuations, transferring ownership, paying taxes, and more.

Sell Your Mineral Rights (Request an Offer):

Mineral Owner Resources

West Virginia Mineral Rights

WV ranks #9 in the United States natural gas production and #10 for oil.

Top Producing Oil & Gas Counties in West Virginia

West Virginia has 55 counties, and 40 of them produce some amount of oil and gas. However, the vast majority of the oil and gas is extracted from just 9 counties. Is your county one of them?

Value of West Virginia Mineral Rights

The value of mineral rights in WV depends on a variety of factors, including location, production status, decimal interest, production volume, commodity price, lease development, lease terms, and the operator.

How to Locate Your WV Mineral Rights

West Virginia provides an interactive map that allows mineral owners to search by well API. Unfortunately if you do not know the API, you may be out of luck.

Transferring Ownership of West Virginia Mineral Rights

It’s best to have an attorney help you transfer the ownership of WV mineral rights. Learn why.

Find Your WV Mineral Deed

Looking for proof that you own mineral rights? Follow these steps to search the deed records.

Sell Your WV Mineral Rights

Get an offer for your WV mineral rights. There is no obligation to sell, and it won’t cost you anything.

Best Locations

Top Oil & Gas Producing Counties in West Virginia

We buy mineral rights throughout West Virginia. Minerals in the northern part of the state have the most prolific wells, but we will buy minerals anywhere in West Virginia as long as they have producing wells. These are the top-producing counties:

|

|

NOTE: It is important to realize that, even in the top counties, there are areas of the county that produce large amounts of oil and gas but other areas that produce none. The location is very so important!

Shale Basins

Marcellus & Utica Shale

The Marcellus and Utica shale basins extend into the northern part of West Virginia, but the most productive shale is in the northern counties. The Marcellus shale lies above the Utica shale, so most fracked horizontal wells are produced from the Marcellus formation.

Marcellus Shale

The Marcellus shale is a geological formation rich in natural gas, spanning New York, Ohio, Pennsylvania, and West Virginia. Hydraulic fracturing technology, commonly referred to as fracking, has allowed for the extraction of vast quantities of natural gas.

Utica Shale

The Utica Shale, primarily located in Ohio and extending into parts of Pennsylvania, West Virginia, and New York, is another key geological formation rich in gas, oil, and natural gas liquids. Despite its deeper depths compared to the Marcellus Shale, advancements in drilling technology continue to facilitate development through horizontal drilling and hydraulic fracturing techniques.

Image Description: Outline of the Marcellus and Utica shale basins.

Valuation Basics

West Virginia Mineral Rights Value

Oil and gas royalties and mineral rights in West Virginia are valued differently if they are producing vs. non-producing.

Producing Mineral Rights Value

Producing minerals are mineral rights with an active oil or gas well that is producing economically viable quantities of oil or gas.

Modern Valuation Method

Modern valuation methods use data from royalty statements and public data sources to model future revenue based on various pricing scenarios. This method takes into account the production volumes, decline, deductions, and commodity prices. Most mineral buyers use this valuation method.

In the past, they used to use the Rule of Thumb, which is roughly 30 – 60 months of royalty revenue based on a variety of factors.

Non-Producing Mineral Rights Value

Non-producing minerals do not have a producing oil or gas well. Because there are no wells, there will be no royalty payments.

Typically, non-producing minerals are valued based on a multiple of the expected lease bonus.

For example, if the going lease bonus in the county ranges from $100-$500, you can expect to sell your mineral rights for the lease bonus times the number of net mineral acres (NMA) you own.

The value of non-producing minerals is usually stated as a price per net mineral acre. The price per acre varies from state to state, county to county, and even within a county.

Interested in learning more about the value of your mineral rights? Check out this guide on 7 Factors That Influence the Value of Mineral Rights or this video about why Location is Everything (via YouTube).

Conveying to the Next Generation

Transferring Ownership in West Virginia

You should consult an attorney regarding the transfer of oil and gas mineral rights in West Virginia. The proper way to transfer title is by deed or court order (including probate). However, sometimes, mineral rights may be transferred with an Affidavit of Heirship (AOH), which allows the next generation to get into pay status with the operator, but can cause problems down the road when it’s time to sell.

You always want to have a “marketable title” to your mineral rights, so it’s worth doing the transfer correctly. Consult a West Virginia oil and gas attorney and get professional advice on transferring mineral rights.

Not sure where to find a WV attorney? Google, “WV oil and gas attorney.”

Once you have a legal document conveying the mineral rights from the previous generation to you, you’ll have to have it recorded with the county clerk (where the minerals are located). The mineral rights are not really owned until the deed is recorded, so don’t leave it in a drawer – do it right away!

Once the document has been recorded, send a copy to each operator. More than likely, the operator will send you a division order and put you into pay status.

Need more help (transferring before/after death, after a divorce, or into/out of a trust)? Our guide to Transferring Mineral Rights may help.

Searching County Records

Finding Your Mineral Deed

The first step in being a responsible mineral owner is the know what you own so that it can be properly managed. There will come a time, either before you die or after, when the minerals will need to be transferred to the next generation or sold.

It’s a good idea to keep a copy of your mineral deed (and the previous deeds) in your files. Non-producing minerals tend to be “out of sight, out of mind” and are easily forgotten. Having a copy of your deed will help prevent this from happening.

Fortunately, it’s easy to locate most mineral deeds and other title documents related to your mineral rights.

Google search: [County Name] + “IDX”

Example: Tyler County IDX

One of the top results should take you to the county’s deed records. Simply search the county records for your name and the names of the people from whom you inherited the mineral rights. Most of the time, you can search for free, and documents can be purchased for a few dollars.

You might find conveyances, deeds, assignments, affidavits of heirship, lease memos, and other relevant documents.

If you’re thinking about your estate plan, you might find our guide, Four Things Older Mineral Owners Should Consider,” to be thought-provoking.

Image Description: WVDEP interactive oil and gas well map.

WV Interactive GIS Map

Locating Your West Virginia Mineral Rights

In most states, you can locate your mineral rights by searching for the legal description (on your deed) or by searching for the wells on your royalty statement. This is not the case in West Virginia. WV’s public data is extremely limited unless you know the API numbers of your wells.

The API number will not be on any of your documents, so the only way to find it is to call the West Virginia DEP at 304-926-0440 and see if they can help you locate it.

Once you find the API, you can use the WVGES interactive map to locate your wells.

An Additional Tax Burden

West Virginia Mineral Taxes

All West Virginia oil and gas royalty owners pay federal income taxes on their royalty revenue. The IRS allows royalty owners owners to deduct a 15% depletion on Federal taxes.

State Taxes

Royalty income is typically considered ordinary income for tax purposes and is subject to West Virginia’s graduated income tax rate ranging from 3% to 6.5% on individual taxpayers, depending on their income level.

Property Taxes

Ad Valorem Taxes are county taxes that are levied on both producing and non-producing mineral rights in West Virginia.

The state tax division uses an income approach to estimate the market value of the property and asses a tax based on the market value (not the income generated).

The county will auction your mineral rights if you don’t pay your property taxes! So, you want to keep your address current with both your operator and the county where the mineral rights are located (even if you are on direct deposit).

Image Description: Example Wetzel County West Virginia property tax bill.

Frequently Asked Questions

West Virginia Mineral Right FAQs

Browse these frequently asked questions about WV minerals.

How do I know if I own WV mineral rights?

Let’s go over a couple of scenarios:

You purchased a home with 5 acres 10 years ago

If you purchased the surface, the title company probably knows if you own the mineral rights as well. You can ask them (or it might be in your documents).

The farm has been in your family for generations.

You may or may not own the mineral rights. You would have to do a title search and trace the ownership records back to the original land patent, then trace it forward and look for any reservations or conveyances of mineral rights. Most people do not have the skills to do this, so you may need to hire a landman.

What happens to dormant minerals in WV?

In West Virginia, dormant minerals refer to mineral interests that have become severed from the surface estate due to various circumstances, such as failure to maintain or transfer ownership, lack of activity or development, or abandonment. When mineral interests become dormant, they may still be legally owned by the original mineral owner or their heirs, but their status may be unclear or unknown.

If the mineral interests remain dormant for an extended period, the surface owner or other parties may seek to reunite the mineral estate with the surface estate through a process known as mineral reattachment or mineral reversion. This process typically involves legal proceedings, which may include notifying the mineral owner or heirs, conducting title searches, and potentially filing a lawsuit to establish the surface owner’s right to reclaim the dormant minerals.

However, the process of mineral reattachment in West Virginia can be complex and may vary depending on factors such as the specific circumstances of the mineral interests, the applicable state laws and regulations, and any existing agreements or conveyances affecting the mineral rights. It’s essential for surface owners or parties seeking to reattach dormant minerals to consult with a qualified attorney experienced in West Virginia mineral law to understand their rights, obligations, and legal options.

Additionally, West Virginia has laws and procedures related to the acquisition of dormant mineral interests through adverse possession or abandonment, which may apply in certain situations where mineral owners fail to assert their rights or maintain their interests. Surface owners or parties interested in acquiring dormant mineral interests should consult with legal counsel to determine the most appropriate course of action based on their specific circumstances and objectives.

I just inherited mineral rights. What should I do first?

Congratulations! Welcome to the club of 12 million mineral owners. The United States is the only country where mineral rights are owned by individuals.

The first thing you need to do is make sure the minerals are transferred to your name. This process is not necessarily automatic, so it may require hiring an attorney to probate an estate or draft mineral deeds.

If you have producing minerals (there are one or more wells on the property), you need to send your proof of ownership (usually a deed, divorce decree, or recorded probate documents) to the operator and ask them to transfer the ownership.

The operator will do their research, and if everything checks out, they will transfer the ownership to you. They may send a division order to make sure that both of you agree about the amount of interest you own.

Be sure you keep copies of all your mineral documents – they will come in handy later and help you effectively /mineral-management/.

How do I sell WV mineral rights?

It’s easy to sell your WV mineral rights and it doesn’t cost you anything. Here is the basic process:

1. Request an offer. We’ll need to see your latest royalty statements. If you have more documents, such as deeds or 1099s, that’s great, but don’t worry if you have limited info.

2. We will give you an offer. You can decide if you want to accept it, look for competing offers, or reject it. Requesting an offer doesn’t obligate you to sell.

3. If you want to proceed with the sale, we will do a title search and draft the closing documents.

4. We will coordinate the closing process to meet both of our schedules. It is usually done remotely, but if you are in the DFW area, we can close in-person if you want.

Image Description: Conventional and unconventional (horizontal) oil and gas wells in West Virginia. Oil wells are green, gas wells are red, and permits are orange.

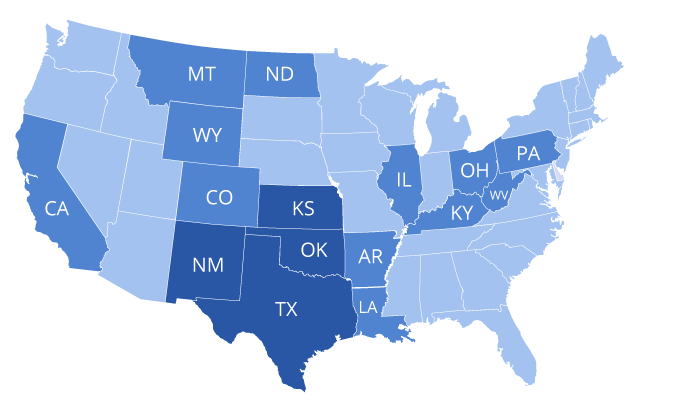

Nationally Focused

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Variety of Motivations

Why Sell Your Mineral Rights?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.