Sell Your Oil and Gas Mineral Rights

We buy oil and gas royalties and mineral rights throughout the United States.

Sell Your Mineral Rights (Request an Offer):

Easier Than You Think

Our Process is Quick and Easy

We buy oil and gas royalties and mineral rights in Texas, Kansas, Oklahoma, New Mexico and throughout the United States. If you have a clean title and relevant documents (royalty statements, division orders, lease, title documents), we can move this process along quickly. We can usually give you an offer in 48 hours. Unlike a lot of companies, we don’t flip minerals. We pay cash, and we keep what we buy, which allows us to offer a fair market price and close quickly.

Our 4-Step Process

We won’t pressure you to sell your mineral rights. We are here to give you information so you can make an informed decision.

1. Request an Offer

Request and offer, and we’ll be happy to evaluate your mineral rights and present you with an offer.

2. Submit Supporting documents

Send your last few months of royalty statements (check stubs) and any supporting documents (deeds, leases, division orders, etc).

3. Review and Accept Offer

We will evaluate your mineral rights and provide you with a competitive offer. Let us know if you would like to proceed with the sale.

4. Sign Deed and Receive Payment

Once we agree on a price, a closing date will be scheduled (usually in a few days to a week). You will sign and notarize the deed. When we receive the documents, we will immediately wire the funds.

Minerals & Royalties

What We Buy

Blue Mesa Minerals buys mineral interest (MI), royalty interest (RI), non-participating royalty interest (NPRI), or overriding royalty interest (ORRI). The only type of mineral rights that we don’t buy is working interest (WI). We acquire mineral rights from individuals, family trusts, and non-profit organizations that would rather focus on their core mission rather than mineral management. We also accept donations.

Mineral Interest (MI)

Royalty Interest (RI)

Non-Participating Royalty Interest (NPRI)

Non-Participating Royalty Interest (NPRI) includes rights to oil and gas production revenue but no rights to enter into a lease.

Overriding Royalty Interest (ORRI)

We work with sellers throughout the United States and around the world. If you live overseas, learn about selling US mineral rights from abroad.

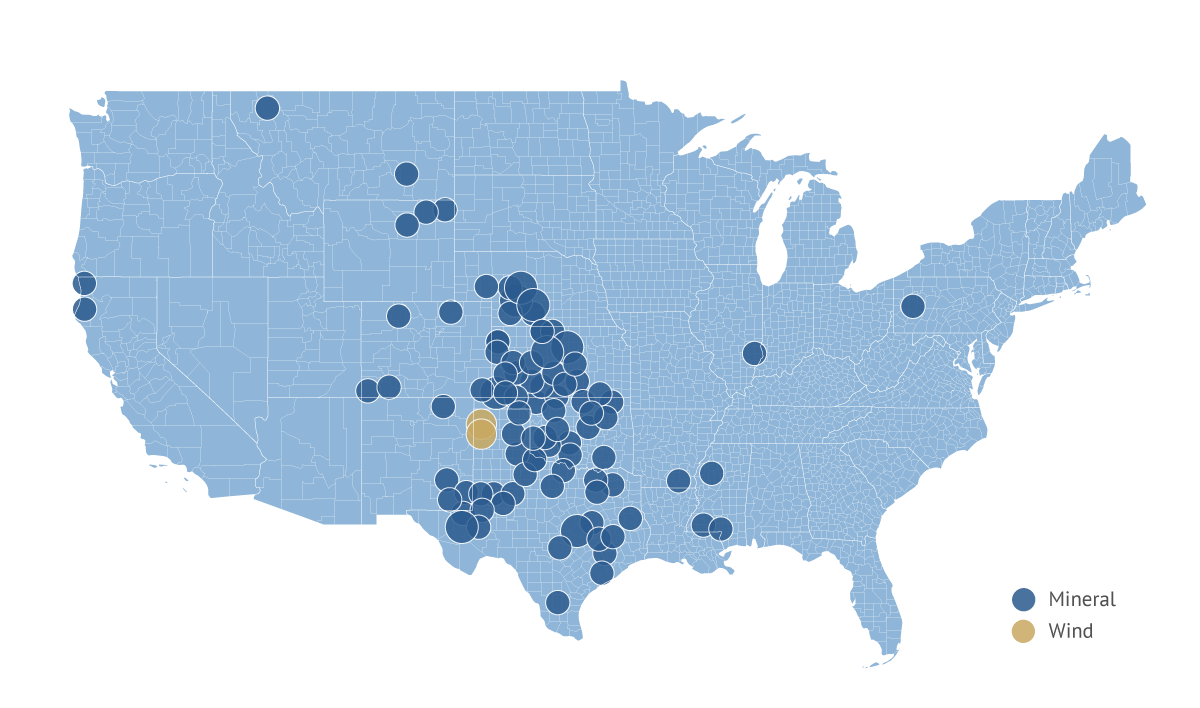

National Focus

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

A rough ballpark Estimate

Mineral Rights Value Calculator

Use this calculator to get a rough estimate of your mineral rights value. This estimate is based on industry-standard multipliers and the age of your wells and is not suitable in all situations. Interested in learning more? Check out the eight factors that influence the value of your mineral rights.

Mineral Rights Value Estimator

Get a rough estimate based on industry averages

Calculator Limitations

Online calculators can provide a ballpark, but cannot account for:

- Location

- Lease terms and royalty percentages

- Decline curves and forecasted production

- Title issues or ownership disputes

- Commodity prices

- Impact of geopolitical events (Ukraine, Venezuela, etc).

For an accurate valuation, request a formal offer, and we will evaluate your specific property and situation.

You Have Choices

Why Sell to Blue Mesa Minerals?

Unlike most buyers, we keep what we buy

We’re a woman-owned mineral rights company that invests our own capital for long-term royalty income. We don’t flip properties, and we are not brokers.

We’re just like you: Our founder, Ellery Wren, is not a landman and doesn’t have an MBA. She inherited her dad’s small mineral rights and bought more. The more she bought, the more fun she had. She studied energy management in graduate school and greatly appreciates all those who helped her along the path – mentors, teachers, and hired experts. See her story via YouTube.

Self-Funded: We aren’t backed by private equity or venture capital. We are entirely self-funded, using the royalties we earn to buy more mineral rights. We are spending our own money (not private equity), which gives us full control and autonomy.

Woman-Owned: Blue Mesa Minerals is a woman-owned business. Our Founder and President is a woman, and you don’t see many women in the mineral acquisition space.

Focus on Small Minerals: Most mineral buyers turn away small minerals because of the time and cost involved. We welcome small mineral owners and treat them the same as someone with much more valuable minerals.

We Don’t Flip Minerals: We are end-buyers, which means we keep what we buy. We are not brokers (connecting buyers and sellers), and we do not flip minerals (a common strategy).

Education-Focused: Our goal is to educate mineral owners so you know what you own and what you are potentially selling. Many of our conversations with mineral owners are not with the goal of buying your minerals, but rather trying to help you along your journey, whether that’s figuring out what you own, transferring ownership, or potentially selling your minerals.

Since 2016: 120+ closings • 2,800+ wells • 13 states • 86 Counties

Ellery Wren

Founder of Blue Mesa Minerals LLC

We Are an End Buyer

Blue Mesa Minerals Portfolio

Testimonials

“I am immensely pleased with the process of selling my inherited royalty properties to Blue Mesa Minerals. Ellery made the transaction easy and fast with quick responses on all communication and quick payment to close out the deal. My headache with managing these mineral interests and dealing with tax filings is now gone for good. HOORAY! Thank you Ellery Wren. Highly recommended”.

“My small mineral rights came with stories and sentiments that far exceeded their monetary value. Ellery understood both sides of the transaction, providing me with the documentation, perspective, and time I needed to make the best decision for me and my family. I had a million questions, and she addressed each one with professional care. Ellery is a joy to work with, and I highly recommend her exceptional services.”

“I am so glad I contacted this company to see if they would be interested in making an offer on my mineral rights. Ellery helped me from start to finish. She provided me with honest and informative answers to my never-ending questions, and made the process a lot less stressful for me. I am so thankful! I highly recommend this company.”

Read more of Blue Mesa Minerals’ reviews.

Your Questions Answered

Frequently Asked Questions (FAQ)

What is the difference between selling mineral rights to an end-buyer, through a broker, or at auction?

There are three ways to sell mineral rights: to an end buyer (harder to find), through a broker, or at auction.

End Buyer: A person or entity that buys mineral rights and keeps them in a portfolio, using the royalties to buy more mineral rights. End buyers do not charge a fee (they pay the closing costs).

Broker: A person or entity that connects buyers and sellers – usually marketing a seller’s property to a network of buyers. Seller pays a 6-10% commission, and brokers typically only take on bigger, more valuable properties (over 50K).

Auctions: True auctions list properties on an open market (to accredited investors only). There may be multiple bids, but the top bid might not meet the reserve price, leaving the seller to negotiate below their reserve price or list again and hope for better results. Sellers usually pay a commission of 5-20% (but in some auctions, the buyer pays this fee). Minerals with a value under 10K will likely be rejected by many auctions.

Blue Mesa Minerals is an end buyer. We do not flip minerals, and we do not connect buyers and sellers. We keep what we buy and use the royalties to buy more. Contact us for an offer.

What is the smallest mineral property you will consider?

This is a great question. It’s really hard to find a buyer for small mineral rights. It takes nearly the same effort regardless of deal size to:

- Perform due diligence

- Run title (check prior deeds)

- Draft closing documents

- Navigate the closing process

- Have deeds recorded

- Navigate ownership transfer

- Management minerals (pay taxes, track operator changes, etc).

We buy smaller minerals, but many buyers do not. It’s simply not worth their time.

How small is too small?

The word small is subjective. Generally speaking, minerals generating less than $3,000 in royalties per year are classified as “small”. However, because acquiring mineral rights can be labor and time-intensive, some buyers will not purchase minerals valued below 30K. Others might not consider properties valued at less than 250K. It’s highly variable from buyer to buyer.

Blue Mesa Minerals specializes in smaller minerals, and we buy properties that many other buyers reject. We specialize in acquiring minerals valued between $1,000 and $100,000 (usually between 5K and 40K).

What do I do with very small minerals?

If you can’t find a buyer for your tiny minerals (making less than $500 per year), you may want to consider donating your mineral rights.

Do you buy mineral rights that are in a family trust?

Yes. Blue Mesa Minerals frequently buys minerals owned by a family trust (and even partnerships and LLCs). The process is largely the same, but there are additional documents required. We will need a copy of the trust agreement (or certification), showing that the trustee has the right to sell real property from the trust.

Do I need to hire an attorney to sell trust-owned minerals?

It’s always advisable to have an attorney review legal documents before you sign them, but not everyone does. We will prepare the closing documents for the trustee (or co-trustees) to execute and guide you through the process. There is no cost to you or the trust.

What are some common red flags to watch out for?

I don’t share the belief that most buyers are scammers, but there are some. Others are simply unethical (which is subjective). Here are some things to watch out for:

- Offers that expire in 24-48 hours (we give 7 days with the option to renew).

- Buyers who charge a closing fee or commission (unless they are a broker or auction service).

- Buyers who need more than 30 days to close (they are often looking for an end-buyer or flipping minerals).

At Blue Mesa Minerals:

- We disclose we’re the end buyer (not a broker or flipper).

- We give you time to review and consult advisors.

- Pay all the title research and legal fees related to drafting closing documents.

- Our offers are valid for 7 days with the option to renew (we would offer 30 days, but the price of oil or gas could tank quickly, so we are more comfortable with renewable 7-day offers).

Do you buy minerals with title problems?

Sometimes. The honest answer is that it depends on what type of title problem exists and how risky it is. Often minerals with title problems have a lower value due to the increased risk. Here are a few scenarios:

Scenario 1: Texas minerals in an estate with no probate:

This is a common scenario, and depending on the details, we would likely still make an offer.

Scenario 2: Kansas mineral rights with no probate, and the owner passed away in New Mexico.

This one is tricky. Kansas has very strict rules about probate, so probate (and ancillary probate) may be required in order to sell minerals from an estate. We can connect you with a Kansas attorney to help you along this process and then close on the minerals at the appropriate time.

Scenario 3: You want to sell your Oklahoma minerals you think your grandfather owned, but the ownership was never transferred to you.

There are too many potential risks in this scenario. We would likely explore the details with you and do some preliminary research, but you may need to cure the title first.

Scenario 4: You were forcepooled (not Oklahoma) in a way that delays any royalty payments until the well has reached a certain level of payout, which could be years – if ever.

We’ll be happy to look into this, but in many cases, the value is much lower than expected, and we rarely buy in this situation. Fortunately, this is not a common scenario.

Scenario 5: A company offered to buy your Colorado mineral rights, and you didn’t even know you had mineral rights. You have no idea if this is real or a scam (and no way to determine if the offer is fair).

This scenario is highly dependent on a variety of factors. If you know the legal description and we can find evidence of ownership, we might make you an offer. However, we rarely make an offer in this situation. Most of the time, we try to help you resolve the title yourself and get into pay status so you can receive funds in suspense and start receiving regular royalty checks. We think this is in your best interest. After you get into “pay status”, if you still want to sell, we will be happy to evaluate your minerals and potentially make you an offer.

What makes Blue Mesa Minerals different from other mineral buyers?

We are not going to tell you that we are the only ethical and honest mineral buyers in town because it simply isn’t true. There are lots of reputable buyers. Here’s what really sets us apart:

We’re Just Like You!

I’m not a landman. I don’t have an MBA. I’m entirely self-taught, and I started out like you – I inherited mineral rights and later started buying them.

We are Self-Funded

We aren’t backed by private equity or venture capital. We are entirely self-funded, using the royalties we earn to buy more mineral rights. We are spending our own money – not someone else’s!

We are Woman Owned

Blue Mesa Minerals is a woman-owned business. Our Founder and President is a woman, and you don’t see many women in the mineral acquisition space.

We Also Buy Small Minerals

Most mineral buyers turn away small minerals because of the time and cost involved. We welcome small mineral owners and treat them the same as someone with much more valuable minerals.

We Don’t Flip Minerals

We don’t flip mineral rights. We keep what we buy and use the royalties to buy more minerals.

We Focus on Education

Our goal is to educate mineral owners, so we provide graphs, maps, and background information with each offer. We want you to know what you’re selling!

How long does it take to sell mineral rights?

This is a buyer-specific question. We close on most of our minerals in a matter of days. Sometimes, it might take a week, and in rare cases, where we have to order title docs by mail, it can take a couple of weeks.

In rare cases, we can make this happen the next day, but 2-4 days is more common.

Other Buyers:

Some other buyers can also close quickly, but most require 30-90 days (likely because they are not buying the minerals for themselves – they are looking for an end buyer and planning to take a cut of the deal). It doesn’t really take all that long to run the title and prepare the closing documents.

Exception Scenarios that Might Delay Closing:

Probate: Sometimes the seller is the personal representative or executor of an estate, and probate proceedings must begin (or be at a certain point) before closing.

Trusts: A Trustee might need to get buy-in from beneficiaries or coordinate with an attorney, both of which can take time.

Legal Consults: Some owners have their attorney review deeds and other documents before they sign (which is always a great idea).

International Closings: An international sale of mineral rights typically takes a few weeks longer than a domestic closing.

We are accustomed to working with all of these scenarios, but the vast majority of the time, we close in a few days.

I'm not sure I want to sell everything - can I part of my mineral rights?

Yes, there are lots of ways to structure the sale:

- Sell a percentage (25%, 50% 75%, 75%, etc.), give you cash now, while still allowing you to benefit from future upside potential.

- Sell royalty interest only (retaining the mineral interest).

- Sell wellbore interest only (interest in one or more wells but not future wells that could be drilled).

Selling part of your mineral rights is not very common, but for some sellers, this is the solution that feels right. We’ve had mineral owners sell half in one year and then turn around and sell the other half the next year (but the value might change).

What raises and lowers the value of my mineral rights?

Here are some of the factors that can decrease the value of your mineral rights:

- Title Problems

- Non-producing minerals held by production (HBP) by low-producing wells

- Leases that hold excessive non-producing acreage

- Steep decline curves

- Poor offset production (for non-producing and newly developed properties)

- Low oil and gas prices

- Operator with a poor reputation

- Leases that allow operators to have free use of oil and gas

- Poor economy or recession

The following factors will increase the value of your mineral rights:

- Clear title (expected for a market-rate offer)

- Permitted wells onsite

- Newer wells (but not too new)

- Flatter decline curve

- Favorable lease terms

- High oil and gas prices

- Operator with a good reputation

- Potential for additional wells

There are a lot of factors that go into the valuation of oil and gas royalties and mineral rights.

Multiple Motivations

Why Sell Your Mineral Rights?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.