Donate Your Mineral Rights

We acquire oil and gas mineral rights through out the United States.

Sell Your Mineral Rights (Request an Offer):

Two Reason Mineral Rights are Donated

Mineral rights are donated for two main reasons – to leave a legacy or get rid of a burden. Everyone wants valuable minerals, making them easy to pass to your heirs, sell, or donate. Smaller mineral rights can be a burden to manage. They can also negatively impact your long-term care plans and burden your heirs. Working Interest (WI) can be especially difficult to sell or donate – especially if the expenses are more than the income!

Leave a Legacy

Donating your mineral rights to charity can be a beautiful legacy and is one way to make a lasting impact on a cause close to your heart. When you donate producing minerals (those with an active oil or gas well), the organization will benefit for years (or decades). Many of the larger charities and even some universities have teams of mineral managers whose sole job is to accept donations and manage the mineral rights. However, organizations may have specific requirements regarding the value, status of the minerals, type of mineral right, and clarity of the title. You can also donate to Blue Mesa Minerals. We accept small donations and will even plant a tree in your honor (or in the honor of someone else).

Get Rid of a Burden

How to Donate to Blue Mesa Minerals

A lot of mineral buyers will not purchase smaller mineral rights. It can take more time and effort to acquire the minerals than they are worth. In fact, it might even cost more to record the new deed than there is value in the minerals! Blue Mesa Minerals accepts donations of mineral rights (with a few expectations), and we don’t mind acquiring your very small minerals – even if they cost more to record than they are worth. We don’t do it all that often, but we are happy to relieve you of your burden if you just want to get rid of your mineral rights. In will even plant a tree in honor of you (or someone else).

Our 4-Step Process

We won’t pressure you to sell your mineral rights. We are here to give you information so you can make an informed decision.

1. Inquire About Donating

Contact us and we will be happy to evaluate and acquire your mineral rights.

2. Submit Supporting Documents

Send us the last few months of royalty statements and any supporting documents (leases, deeds, division orders etc.).

3. Review and Accept Offer

We will review and appraise your mineral rights and provide you with a competitive offer.

4. Sign Deed and Receive Payment

Once we agree on a price, a closing date will be scheduled. You will sign and notarize the document. When we receive the paperwork, we will immediately wire the funds.

What We Buy

We accept donations of mineral interest (MI), royalty interest (RI), non-participating royalty interest (NPRI), or overriding royalty interest (ORRI).

Mineral Interest (MI)

Royalty Interest (RI)

Non-Participating Royalty Interest (NPRI)

Non-Participating Royalty Interest (NPRI) includes rights to oil and gas production revenue but no rights to enter into a lease.

Overriding Royalty Interest (ORRI)

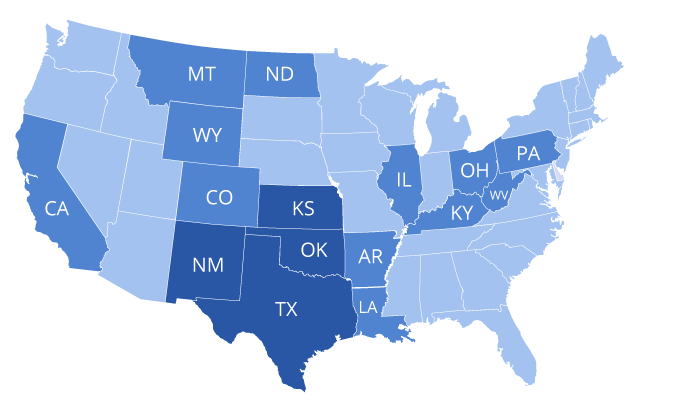

Nationally Focused

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

When to Donate Mineral Rights

Should I donate my mineral rights before or after I pass away?

Mineral rights can be donated before or after your pass away. While many mineral owners like the idea of passing their mineral rights to the next generation, the cost of transferring the ownership can be more than the minerals are worth.

If you own small mineral rights (earning less than $3,000 in royalty revenue per year), it is best to donate, sell, or pass your minerals while there is still value. Smaller mineral rights are difficult to sell and can complicate your estate and future assisted living plans.

In many cases, “real property” can only be transferred by deed from a living person, or court order (such as probate).

Ancillary Probate Info

If the mineral owner dies in a state other than where the minerals are located, the heirs may have to open probate where they died and file ancillary probate in each state and county where the mineral rights are located. This can be an expensive and time-consuming process.

In many cases, it may be better to sell or donate your mineral rights before you pass away.

What Documentation is Needed?

In order to donate your mineral rights, you need documentation about the minerals. Most organizations that accept donations of mineral rights have a special land management team that knows how to figure out what you own and can prepare the deed. The most helpful documentation includes royalty statements, property deeds, probate documents, oil and gas leases, and tax bills.

Any of the following documents can help us figure out what you own and how to properly draft the deed:

- Royalty Statement

- Mineral Deeds

- Oil & Gas Leases

- Probate Documents

- Ad Valorem Tax Bills

Don’t have documentation? Don’t worry – we can help you get the necessary documents (or we can work around it).