The Ultimate Guide to

Buying Mineral Rights

Sell Your Mineral Rights (Request an Offer):

Overview on Buying Mineral Rights

Types of Mineral Rights

Where to Find Mineral Rights for Sale

Where do you purchase mineral rights? There are multiple ways to buy minerals, the most common being at auction, from brokers, by negotiated sale, tax sales, and directly from mineral owners.

How to Buy Mineral Rights

The process of buying minerals varies depending on where you buy them. However, once an offer is accepted, transferring ownership and getting into pay status with the operator is pretty much the same.

Due Diligence

When buying mineral rights, due diligence is essential. We’ll discuss some things to look into as well as tools and resources to help with your research.

Common Pitfalls

Owning oil and gas royalties and mineral rights is risky – especially when you fork out money to buy minerals rather than inherit them. We’ll discuss some common risks and pitfalls to look out for when buying minerals.

Financing and 1301 Exchanges

We all know that “Cash is King,” but how do you buy minerals when you don’t have enough cash? And how can a 1031 Exchange help?

Types of Mineral Rights

Image Description: An pumpjack pumps oil at sunrise.

Mineral Interest (MI)

When mineral interest (MI) is listed for sale, it usually refers to non-producing minerals. This means that there are no oil or gas wells on the property, and therefore, the owner does not receive royalty checks. Perhaps, one day in the future, an exploration and production (E&P) company may lease the mineral rights and try to drill a well. Some wells are successful, while others are not.

Royalty Interest (RI)

When “royalty interest” is listed for sale, it refers to producing minerals with an active oil or gas well. The royalty interest owner should be receiving royalties on the sale of oil and gas – based on the owner’s decimal interest in the well. When the oil and gas lease ends, the royalty interest ends, and the mineral interest owner can re-lease the mineral rights.

Mineral Interest / Royalty Interest (MI/RI)

The combination of mineral interest and royalty interest indicates the seller is selling both the mineral interest (usually with executive rights) and royalty interest in a producing property with revenue. If you buy both the mineral and royalty interest, you will still own the mineral rights when the current least expires.

Overriding Royalty Interest

Like royalty interest (RI), Overriding Royalty Interest (ORRI) ends when the lease ends. You will only own interest for the duration of the lease – so don’t buy something that is about to be plugged!

Wellbore Only Interest

Wellbore-only interest is similar to royalty interest, but rather than receiving royalties on all wells in the lease, you will only receive royalties on the sale of production from one or more specific wellbores. When the well stops producing, your interest ends.

Learn more in our in-depth guide to the different types of mineral rights.

Two Paths, Similar Destinations

Two Ways To Own Minerals

Direct Title

Mineral rights are real property, just like your house or a farm. They are transferred by deed (or court order) and you are in charge of managing your own mineral rights. The hardest part of buying direct title minerals is access to minerals to purchase. There are a LOT more buyers than sellers.

Invest in a Fund

Investing in a fund is often the easiest way to get started in oil and gas. Investing as a limited partner gives you access to mineral rights as an investment vehicle without having to source deals yourself or manage the mineral rights. Funds can be a good option for accredited investors with limited knowledge of the oil and gas industry.

Finding Mineral Rights for Sale (Direct Title)

Mineral purchases are often conducted behind closed doors. However, you can also find minerals listed for sale through auctions, from brokers, via negotiated sales, sealed bids, tax sales, and directly from mineral owners.

Buying Mineral Rights at Auctions and Brokers

The easiest way to buy mineral rights is through a reputable auction house. The quality and price of mineral rights sold at auctions vary widely. You will find rip-offs with a 60-year return on investments (ROIs) as well as high-quality assets at a reasonable market price. You have to be educated enough to know the difference and be willing to put in the due diligence of thoroughly researching each listing before you bid.

Accredited vs. Unaccredited Investors

There are two main categories of bidders: accredited and unaccredited investors.

Some auctions, such as EnergyNet, are only open to accredited investors, and they will call your financial advisor to make sure you meet the qualifications. Other auctions are open to all investors regardless of qualifications.

Types of Auctions

The auctions that are open to all investors (not just accredited) vary considerably. Some auctions will specialize in oil and gas mineral assets, while others will sever fee-simple farmland and auction the surface and minerals as separate listings. You might even find minerals included in general auctions that are selling estate goods or in local small-town auctions.

Auction Frequency

Some online oil and gas royalty auctions are on a rolling cycle, with multiple lots ending each week or even bi-weekly. Other auction houses hold quarterly events, coordinating in-person auctions with live-stream video feeds and online bidding.

Negotiated Sales & Sealed Bids

Mineral brokers often negotiate sales, acting as the middle-man between buyer and seller. Very often, sealed bids and negotiated sales are for larger properties valued at 6-7 figures. You can expect to see an extensive data room to facilitate due diligence.

Negotiated sales also come into play when an auction closes without meeting the reserve. In this scenario, the account manager will try to facilitate a deal between the high bidder and seller in a negotiated sale. If a deal cannot be reached, the account manager may reach out to the other bidders.

Options for Accredited Investors

Popular Mineral Auctions & Brokers

While Energy Net is one of the most popular mineral auctions, there are several other auctions and brokers where mineral rights can be purchased.

EnergyNet is probably the most popular online mineral auction. EnergyNet offers a continuous auction, with small properties selling for a few hundred dollars to larger properties selling for several hundred thousand dollars.

During the first quarter of 2020 EnergyNet sold $4,836 assets for more than 78 million dollars at auction, through negotiated sales, and sealed bids.

EnergyNet is only for accredited investors. They will contact your financial advisor to confirm your status as an accredited investor and verify that you have sufficient funds to meet your bid allowance.

OGAC does not require banking information to sign up for a buyer’s account, making them accessible to buyers who may not be eligible for EnergyNet.

Additionally, Oil & Gas asset Clearinghouse ‘s primary goal is to put deals together – online or offline. If they know what you are looking for, they will keep you in mind when they come across a relevant property

Mid-Continent Energy Exchange (MCEE) offers an ongoing bid-exchange auction with bi-monthly live auctions containing a variety of mineral rights located in Oklahoma, Kansas, Texas, and other mid-content oil and gas states.

Mid-Content Energy Exchange has an online bidding system so internet bidders can participate in the live auction (via simulcast) without being there in person.

They also offer a BidEX auction in-between the regular auctions.

America’s Oil and Gas Exchange is a newcomer to the online mineral auction space (as of 2023). Their goal is to make oil and gas investments accessible to a wider range of investors – even those who just want to dip their toes into buying mineral rights with a smaller investment.

Wiggins Auctioneers is a well-known auction service based in Oklahoma. They are open to the public, and bidders do not have to be accredited investors.

Every few months, Wiggins auctions off various properties in Oklahoma and Kansas. They usually sever the minerals from the surface and sell each separately.

Evanson has an email list to notify buyers of upcoming auctions.

Mineral Right Purchase Process

Purchasing mineral rights from any source follows the same general process of research, making an offer (or placing a bid), wiring funds, transferring ownership, getting into pay status, and mineral management.

1. Develop a Plan

Develop an acquisition plan and preferred location to buy minerals. For some people, it’ll be whatever they can find for less than “x” number of months ROI. For others, it’s a specific type of interest in a specific area. It’s usually wise to diversify your mineral portfolio.

2. Browse Minerals for Sale

Look through the auctions, sealed bids, negotiated sales, and minerals for sale listings on the websites above to get a sense of what is available and see what fits into your acquisition plan.

3. Perform Due Diligence

Once you find some listings that interest you, do your research. Thorough due diligence is essential. Look up the property on the state’s oil and gas regulatory commission’s website (and GIS viewer). View the production (if any) as well as offset production. Look at the lease terms. Run the title to verify ownership..

4. Wire Funds

5. Transfer Ownership

Some firms send the conveyance document or deed to the county clerk where the minerals are located for recording. Others send you the original documents, and you need to have them recorded with the county clerk. If you purchased producing minerals, a copy of the recorded document needs to be sent to each operator to transfer the minerals into your name and get into pay status. Once the ownership is transferred, the operator will send out new division orders, which you need to review, sign, and send back with a form W9.

6. Manage Your Minerals

Make sure you know what you own and keep good records. Original documents should be well-organized in folders, and digital copies should be placed in digital folders. You should also have a spreadsheet detailing everything you own. Download a free mineral management spreadsheet (Google sheet). Alternatively, there are several good mineral management software packages that can be helpful.

Due Diligence

Extensive due diligence is essential for anyone buying mineral rights. Skipping this step can result in obtaining a bad investment or even buying interest from someone who doesn’t even own it!

So, where do you start?

Experienced mineral buyers each have their own individual due diligence process but most probably include some variation of the following:

- Geology and engineering review

- Production analysis

- ROI analysis

- Lease & operator review

- Royalty statement analysis and future cash flow estimates

- Title history

- Outgoing conveyance review

Some of the mineral acquisition and divestiture (A&D) firms have land departments with landmen, petroleum engineers, and geologists who perform due diligence on new mineral acquisitions. Other firms consist of a single, experienced individual who does the research themselves.

Private mineral buyers will sometimes do the research themselves, but often enlist the professional services landmen, geologists, reservoir engineers, CPAs, and attorneys.

The amount of information available will also vary, depending on the source of the minerals. The more popular auctions and brokers have data rooms with pertinent documents. Smaller auctions may have less information available. When you buy from mineral owners directly or “minerals for sale” listings, you will probably have to acquire relevant documents needed for sufficient due diligence.

The most significant factor affecting the value of your mineral rights is the location. Each area has its own geography, making some sites more desirable than others.

The Permian, Eagle Ford, Haynesville, Bakken, Niobrara, and Marcellus are the most popular and therefore demand the highest prices.

Giant horizontal fracked wells of the Delaware Basin (the deepest part of the Permian) are some of the most valuable mineral rights. These wells generate a massive amount of oil and natural gas and, because there are multiple layers of shale, multiple stacked horizontal wells can be drilled in a given tract of land.

While these wells are prolific, they also have steeper decline curves and shorer economic lives than their conventional (vertical) counterparts.

Both are valuable, but there is a massive difference in the value of mineral rights in the Delaware Basin vs. the Panhandle of Texas. Permian valuations will typically far exceed those in conventional oil fields.

The location also dictates the royalty percentage. For example, in Texas, the standard royalty is 25% but, it’s common to see royalties range from 12.5% to about 16% in other areas – especially in older leases.

Image Description: Screenshots of a specific tract of land and the production from an oil well on the property.

Geology Review

Producing Mineral Rights Value

The first thing to look at is the geology of the mineral rights in question. It’s almost shocking how often you see non-producing minerals for sale in areas where there is no oil or gas (or very little).

Even in known oil and gas producing counties, drilling activity and production vary dramatically from one part of the county to another. It is important to see exactly where the minerals are located.

Sometimes a quick look at the geology and production maps will tell you if the minerals for sale are worth a closer look.

Start with a few google searches – especially if the county is unfamiliar.

- Google “[county] oil and gas map” or “[county] drilling activity”.

- View ShaleXP’s production graphs and maps

- Google the shale maps in the area of interest

ShaleXP is an excellent resource for quickly checking the oil and gas production graphs and maps for each state and county. You can also find useful maps by googling the county plus words like “oil map,” “drilling activity,” or “shale map.”

Overlaying multiple maps and adjusting the opacity of each layer can reveal some interesting and insightful information. Try overlaying your most detailed maps with the Public Land Survey System (PLSS) map and the regulatory body’s GIS map.

Looking at maps in this way can show you if the property for sale is in:

- The core of the basin

- A highly productive area

- An upcoming drilling area

- Just outside the desirable area

- A non-producing area

This information may help you decide that one property is worth more than another or that a particular property isn’t worth looking into. If you determine the minerals are worth a closer look, it may be worthwhile to seek a geologist or reservoir engineer’s opinion.

Measuring Long-Term Value

ROI Analysis

Return on Investment (ROI) analysis will tell you approximately how long it will take to make your money back.

Generally, you can estimate the monthly revenue based on the last 3 – 6 months of revenue, taking into consideration the age of the well and commodity prices.

Don’t assume the revenue earned during the first few months of production will continue through the life of the well. Oil and gas wells decline steeply, especially horizontal wells. You’ll have to use your experience, the age of the well, and production data to make this estimate.

There are tools that can help you estimate the decline curve and future revenue. If the well is new, base the sale price on what you think the well will “settle” at – not the current revenue. Otherwise, you may never make your money back.

Divide the sales price by the estimated monthly revenue to figure out how long it will take to make a return on your investment.

If you can buy mineral rights for the standard 36 – 60 months of revenue, you’ll have a better chance of getting a return on your investment.

Image Description: Copies of three royalty statements showing the monthly well production and earnings.

Image Description: A standard oil and gas lease from the University of Texas

Lease and Operator Review

If you are considering buying producing minerals, look to see who the operator is. If they are not familiar, look at their website (many have investor information detailing their upcoming plans). You may be able to find out if they plan to continue drilling operations in the area.

You should also examine the lease in detail. Read it thoroughly and look at each clause. Unfortunately, most mineral owners do not hire an attorney to negotiate the lease on their behalf, resulting in lease terms that favor the operator. For example, the lease may hold multiple tracks of land as long as a single well is producing. The lease might allow the operator to use the gas free of charge (some operators run their frack fleets at the mineral owner’s expense). There are many clauses in the lease that could potentially be problematic. You have to decide if these are deal-breakers or if the purchase price should be adjusted.

The best way to avoid problematic leases is to buy mineral interest in non-producing minerals. If an exploration and production (E&P) company decides to drill on your property, you will negotiate the lease (ideally with the help of an attorney). However, non-producing minerals are extremely risky. You may be waiting for decades (or generations) for someone to come by and drill a well – if ever. It may be worth hiring a reservoir engineer to analyze the property.

For more information, check out our guide on producing vs non-producing mineral rights.

Royalty Statement Review

The royalty checks and accompanying statements will give you a good idea about the monthly revenue. The interest listed on the royalty statements should match the division order and the interest calculated from the title search.

Some buyers omit a title search when the seller is in pay status, assuming that the operator has already done the research. However, it’s always best to run the title. Mistakes happen, and sometimes mineral owners own more or less than what is on their check subs. As one operator sells to another operator, errors can occur if data is transferred incorrectly.

If the mineral owner has a cost-free lease, that should also be reflected in their royalty statement.

Image Description: A sample royalty statement breaking down the three sections of information

Image Description: Images of a land patent, deed index, and plat.

From Land Patent to Present

Title Search

You will need to trace the title back to the original land patent (the first time the land was granted by the government). This is why most companies take an average of 60 days to close on a mineral property. With auctions and negotiated sales, you often have 2-4 weeks to do your research.

Of course, when you bid in a mineral rights auction, you run the risk of having done all this research only to be outbid. It’s a common problem and one of the bigger challenges with buying minerals at auction.

Outgoing Conveyance Review

Some auctions/brokers include the outgoing conveyance in the data room. If this is available, look it over. Make sure the legal descriptions match and the expected rights are conveyed or deeded.

Sometimes a listing will be for royalty interest (RI), but when you look at the conveyance language, mineral interest (MI) and royalty interest (RI) are conveyed. Sometimes what is conveyed is interest in one or more wellbores rather than all the oil, gas, and other minerals in a specific tract of land or associated with a particular lease.

You can’t assume the outgoing conveyance (or even the source conveyance) means the seller owns the minerals. Anyone can create a mineral deed or conveyance, but it doesn’t mean the minerals were not previously reserved or deeded to someone else.

Be especially careful when dealing with Relinquishment Acts Lands in Texas, where the state may own the mineral rights.

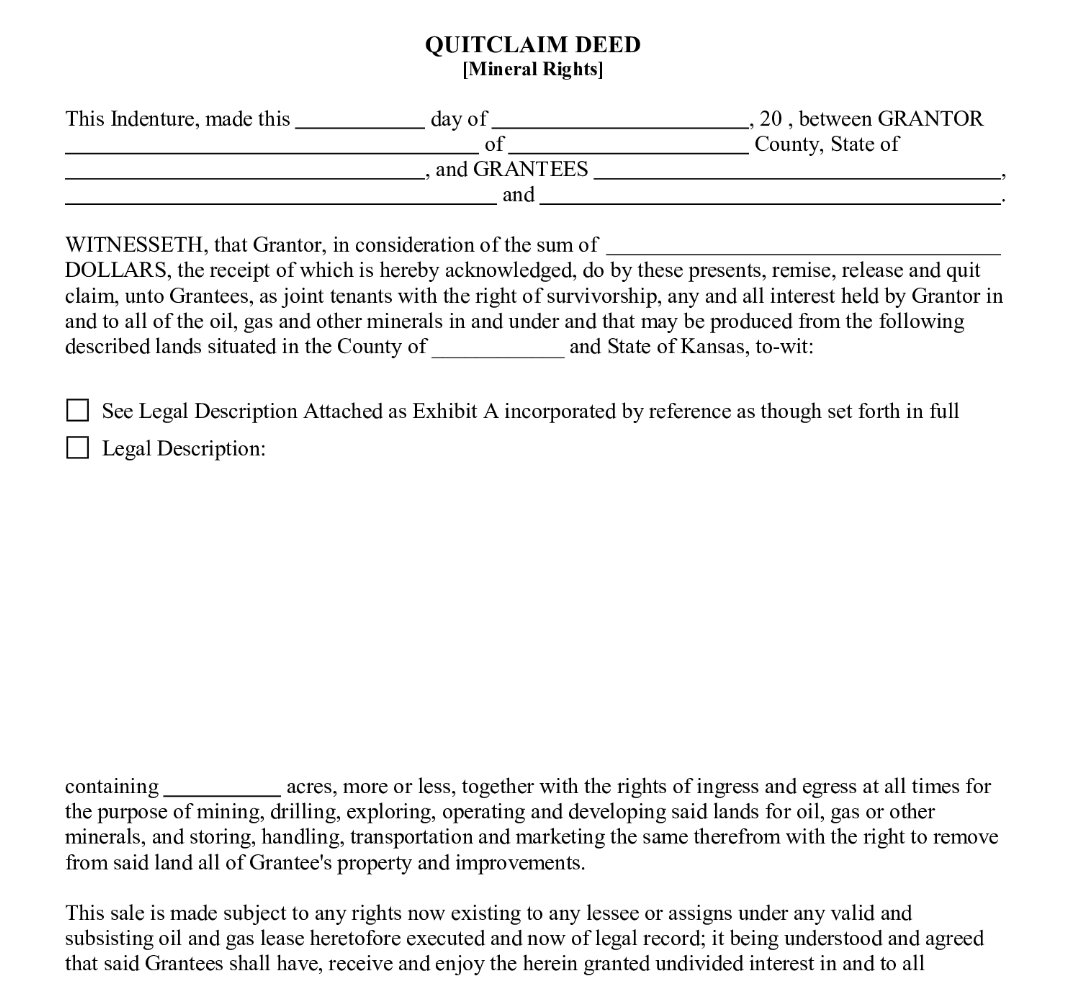

Image Description: Blank Quit Claim deed that can be used to convey property without a warranty.

Pitfalls to Avoid

The easiest way to buy mineral rights is through a reputable auction house. The quality and price of mineral rights sold at auctions vary widely. You will find rip-offs with a 60-year return on investments (ROIs) as well as high-quality assets at a reasonable market price. You have to be educated enough to know the difference and be willing to put in the due diligence of thoroughly researching each listing before you bid. For more risks, check our guide on Risks Associated with Buying, Owning, and Selling Mineral Rights.

Buying Interest in New Wells

New oil and gas wells decline sharply (especially horizontal wells). The royalties from the first few months of production should not be used to value the property. It is quite common for a 1-year old well to produce 1/2 or even 1/3 of its initial production. A valuation based on the first 6-12 months of production will result in dramatically overpaying for the interest. You may never get a return on your investment.

Buying Interest in Old Wells

Hydrocarbons are finite resources. Successful conventional wells generally produce smaller amounts of oil and gas for long periods of time. The newer horizontal wells produce large quantities of hydrocarbons, but the wells do not produce as long. Buying interest in a well that is near the end of its life is risky. It may be plugged and abandoned before you get a return on your investment. And if your interest terminated with the lease, you no longer have the ability to generate income in the future.

Buying Non-Producing Minerals

Non-producing minerals are mineral rights in a tract of land that does not have an active oil or gas well. Without revenue, there are no royalties. The minerals may remain non-producing for decades, or generations. Many non-producing minerals will never be drilled. Others will be drilled but will result in a dry hole or well with a short economic life. On the other hand, buying non-producing mineral rights in active shale plays can be a good investment – if you pick the right location.

Poor Due Diligence

More often than not, mineral owners don’t really know what they own. The onus is on the buyer to do conduct extensive due diligence before purchasing minerals. Poor due diligence may result in your purchasing minerals from someone who doesn’t actually own any minerals (or who owns only a small fraction of what they thought they owned). It’s risky – especially when buying non-producing mineral rights.

Poor Lease Terms

Most mineral owners do not hire an attorney to negotiate lease terms. This is a huge mistake and usually leaves money on the table. One of the many terrible, but common lease terms is giving free gas to the operator in order to run the well. Some operators have started running their frack fleets on natural gas, and guess who is financing that? Buying mineral rights with poor lease terms exposes you to additional risk.

Buying Working Interest

If you don’t thoroughly understand the different types of mineral rights and accidentally buy working interest, you now have the responsibility of operating the well and paying all the expenses (including the mineral owners)! Non-operated working interest owners are not involved with the day-to-day operations but are still obligated to pay their share of the expenses. For this reason, a lot of buyers stick with mineral interest (MI), royalty interest (RI), overriding royalty interest (ORRI), and non-participating royalty interest (NPRI).

Cash is King

As they say, “Cash is King”. Most mineral purchases and auctions require payment in full within two or three business days (sometimes with 20% down on at the time of the auction).

Oil and gas purchases are so risky that the most popular auctions and brokers only sell to accredited investors. It makes it difficult for non-accredited investors to purchase minerals at a reasonable ROI.

In a way, it’s the old catch-22 where it takes money to make money.

Under federal securities laws, an accredited investor is a natural person with an earned income that exceeds $200,000 (or $300,000 together with a spouse).

You should only use money that you don’t “need” to buy mineral rights. If losing the money would be a financial hardship or cause you emotional strain, then you shouldn’t spend it.

That being said, there are Acquisitions and Divestiture (A&D) firms and publicly traded companies that use private equity to finance mineral purchases. There are also groups of individuals and companies that join together to purchase a bigger property – each receiving a proportionate share based on their capital contribution. Some companies that sell or facilitate the sale of mineral rights also help buyers secure financing.

Image Description: Large stack of one-hundred-dollar bills, folded over and rubberbanded together.

1031 Exchange

A 1031 Exchange allows investors to avoid paying capital gains taxes when selling an investment property and reinvesting the proceeds into a “like-kind” property within certain time limits. The new property must be of equal or greater value.

Because like-kind property is defined according to its nature or characteristics rather than quality or grade, there is a broad range of exchangeable real properties. Vacant land can be exchanged for mineral rights. Commercial properties can be exchanged for industrial property, and so on. However, the property must be an investment property – not something for personal use or resale.

In order to execute a 1031 exchange, the replacement property should be of equal or greater value and must be identified within 45 days of selling the original property. The exchange must be concluded within 180 days.

The following rules apply to 1031 exchanges:

- The three-property Rule: Identify three properties as potential purchases.

- The 200% Rule: Identify unlimited replacement properties (as long as their cumulative value doesn’t exceed 200% of the value of the property sold).

- The 95% Rule: Identify as many properties as you want as long as you acquire properties valued at 95% of their total or more.

1031 Exchanges can be complex and require a qualified intermediary to complete the process, but if you regularly buy and sell mineral rights or real estate, a 1031 exchange can be a beneficial tax strategy.