About Blue Mesa Minerals

Sell Your Mineral Rights (Request an Offer):

Brief Overview

About Blue Mesa Minerals

Blue Mesa Minerals buys oil and gas royalties and mineral rights in Texas and throughout the United States. We buy from individuals, trusts, and non-profits. We also do a bit of consulting.

We love buying in the Permian and other popular shale basins, but we also buy in older, conventional oil and gas fields. Unlike most buyers, we are just as happy to buy small mineral rights (under $3,000 in value) as large ones! We even buy in smaller, less popular states, such as Kansas.

“A good deal is one in which both the buyer and the seller walk away happy.”

We know that mineral rights are a complex topic, and mineral owners (particularly new mineral owners) often need some hand-holding to figure out what they own and sell their minerals. We’ll be happy to walk you through the sales process and help you get the necessary documents.

We also understand that mineral rights aren’t just property – they often encompass decades of family history, sentimental value and symbolize the struggle and triumph of previous generations. We love to hear your family history, and when we acquire your mineral rights, your story becomes part of ours.

Ellery Wren

Founder of Blue Mesa Minerals

The Back Story

How It All Started

My dad’s nearly microscopic interest in a Texas oil well was his pride and joy.

My dad’s father passed away when my dad was very young, which is probably why he was so attached to that oil well. It was the only connection he had to his father and west Texas land that his family once owned.

When the fracking boom hit, my dad started receiving royalties on a new horizontal well. It wasn’t much, but it was really exciting compared to the few dollars of revenue from the original well.

My dad would give me oil updates during every phone call and I’d give him hell about supporting fracking and destroying the earth.

Until he died.

The entire contents of his house were declared a biohazard, so all I had from my father was the mineral interest in these two oil wells.

The weirdest thing happened – I became so attached to his mineral interest that fracking and the fossil fuels no longer bothered me (I did put some solar panels on my roof to balance my karma, though).

After splitting my father’s interest with my sister, the minerals were worth half as much. I wanted to be able to pass them onto to my kids one day, but by the time the two of them split the interest, it would be nearly worthless.

So, I set out to educate myself and buy more minerals. It was like drinking from a firehose! I met a fantastic landman and he helped me buy my first few mineral rights.

After a few years of buying mineral privately, I started Blue Mesa Minerals, which buys mineral rights in Texas and throughout the United States.

I have a bachelor’s degree in Art, Technology, and Emerging Communication (basically web and UI/UX design) and two master’s degrees – one in Interdisciplinary Studies, where I focused on entrepreneurship and energy management and the other in Professional Counseling (I’m also a therapist via Goldfinch Counseling and Sage Finch Counseling.)

I really love acquiring mineral rights. I keep everything I buy and use the royalties to buy more mineral rights.

Testimonials

“I am immensely pleased with the process of selling my inherited royalty properties to Blue Mesa Minerals. Danna made the transaction easy and fast with quick responses on all communication and quick payment to close out the deal. My headache with managing these mineral interests and dealing with tax filings is now gone for good. HOORAY! Thank you Danna Blumeneau. Highly recommended”.

“My small mineral rights came with stories and sentiments that far exceeded their monetary value. Danna understood both sides of the transaction, providing me with the documentation, perspective, and time I needed to make the best decision for me and my family. I had a million questions, and she addressed each one with professional care. Danna is a joy to work with, and I highly recommend her exceptional services.”

“I am so glad I contacted this company to see if they would be interested in making an offer on my mineral rights. Danna helped me from start to finish. She provided me with honest and informative answers to my never-ending questions, and made the process a lot less stressful for me. I am so thankful! I highly recommend this company.”

“Oklahoma minerals have been in my family for 100 years, and as an Ohio resident unfamiliar with the industry I felt the time had come to sell. But how? I found BlueMesaMinerals on U-tube and Danna’s informational videos instructive, so I contacted her. I provided copies of documents for her to research which resulted in her offer to buy. Her offer I felt was fair, very detailed as to production and revenue, with location maps included to support her analysis. Danna was a pleasure to “do business” with – an excellent communicator of details and process, prompt responses to emails and phone calls. Thank you Danna!”

“Danna was so helpful when I recently reached out to her for help with some inherited mineral rights we had considered selling. She even contacted some possible buyers for us as she was not interested in purchasing our rights. We ended up not striking a deal but she gave me an honest professional opinion and advice for any future lease or sale opportunities. Danna also directed me to helpful websites to keep up with current production and drilling information in the two Oklahoma counties we own right in. If you need help with mineral rights contact Blue Mesa Minerals, you will not be sorry!”

Not Your Typical Buyer

What Makes Blue Mesa Minerals Different?

We are not your typical mineral acquisition company. Here is what sets us apart:

1. We are NOT trying to find the “suckers” and give them lowball offers. We strongly believe that a good deal is one in which both the buyer and the seller walk away happy.

2. We don’t flip minerals. A lot of companies don’t have the capital to make mineral purchases. So when they find a seller, they scramble to flip it to a buyer. We don’t do that. We have the cash to pay for all of our deals – that’s why we can close quickly.

3. We are self-funded. We do not seek venture capital or private equity funding. We use our royalties to buy more minerals. That means we aren’t beholden to anyone, and we can make our own decisions. It also means our company is strong and will be around for decades to come. We are in this for the long run despite the oil booms and busts and the transition to renewable energy.

3. We close quickly – usually in 7-10 business days (depending on the seller’s documents and how much due diligence we need to perform).

Guided by Ethics, Grounded in Experience

Our Values

Fair Valuations

Both the buyer and the seller should be getting a fair deal – with neither party receiving the “short end of the stick”. Both parties should walk away happy.

Quick Closing

We know people sometimes sell their minerals because they need money yesterday – so we make every effort to close quickly (ideally within two weeks).

Integrity

No Pressure

Selling your mineral rights is a big decision, and one that you shouldn’t take lightly. We are happy to answer questions and we will not pressure you to sell.

Nationally Focused

Where We Buy Mineral Rights

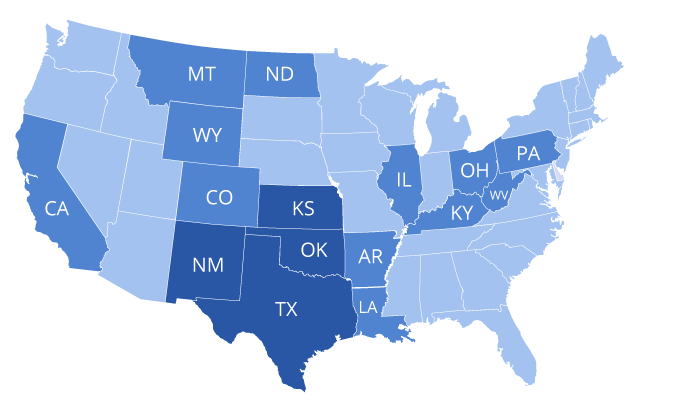

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.