Types of Mineral Rights

Learn about the different types of mineral rights: mineral interest, royalty interest, overrides (ORRI), NPRI, and working interst.

Sell Your Mineral Rights (Request an Offer):

Starting With The Basics

Oil and Gas Mineral Rights

In most countries, oil and gas minerals are owned by the government. However, in the United States, private citizens own a majority of the minerals. Minerals can be severed from the surface, creating two different chains of title or ownership, which is further complicated by the varying types of mineral rights.

Types of Mineral Rights

The eight primary types of mineral rights including mineral interest (MI), leasehold interest, royalty interest (RI), overriding royalty interest (ORRI), non-participating royalty Interest (NPRI), working Interest (WI), non-operated working interest, and net profits interest.

We’ll explore each of these briefly and then look at the eight most common mineral rights in greater detail.

Mineral rights may be acquired by inheritance, purchase, or court order, and the various types of mineral rights each come with their own advantages, disadvantages, and risk profile.

Different Risks & Benefits

Eight Types of Mineral Rights

Mineral Interest (MI)

A mineral interest ownership includes the executive rights to explore, develop, and produce the minerals under a specific tract of land.

Royalty Interest (RI)

Royalty interest owners are entitled to a percentage of the well’s revenue without having to pay for any of the expenses associated with drilling or operating the well.

Working Interest (WI)

Working interest includes the right to explore, develop, and produce minerals granted by an oil and gas lease but also the obligation to pay expenses (including royalty payments).

Non-Operated WI (Non-Op)

Non-operated working interest owners do not make operating decisions but are still obligated to pay for the drilling and operating expenses. Both types of working interest receive tax benefits.

Non-Participating Royalty Interest (NPRI)

Overriding Royalty Interest (ORRI)

Carved out of the working interest, ORRI is in interest in the proceeds from the sale of minerals rather than an interest in the actual minerals.

Leasehold Interest

Net Proceeds Interest

Net Proceeds Interest (also called Net Profits Interest) is an interest in proceeds from the net profits. This is least common type of mineral rights.

Ownership of the Subsurface Minerals

Mineral Interest (MI)

Executive Rights to Explore, Develop and Produce the Minerals

The owner of a fee-simple estate owns both the surface and the minerals. When the mineral rights are conveyed to another person or entity, they are “severed” from the land, and a separate chain of title begins.

When a person owns less than 100% of the minerals, they are said to own a fractional or undivided mineral interest.

Fractional Interest Example

If Sam dies and leaves his mineral interest to his two children, John and Sarah, they each inherit 50% of the mineral interest. Let’s say 30 years go by, and John passes away, leaving his share to his two children, Liz and Jane. Now Sarah owns 50% of the minerals while Liz and Jane each own 25%. It’s easy to see how quickly a mineral estate can become split with dozens (or even hundreds) of owners in just a few generations.

Non-Executive Mineral Interest

Non-Executive Mineral Interest (NEMI) is similar to mineral interest, but the owner does not have the right to execute an oil and gas lease. Often, the surface owner retains the executive rights (and fiduciary duties to the non-executive mineral owner).

Mineral Interest Rights:

-

- Explore, develop and produce the minerals under a tract of land

- Execute an oil and gas lease to transfer the above rights to the lessee

- Receive an upfront leasing bonus

- Receive delay rental payments

- Receive royalties on the well production

Which is dominant, minerals or surface?

Believe it or not, the mineral estate is often dominant over the surface, giving the mineral owner the right to enter the property and use as much of the surface as is reasonably necessary to remove the minerals efficiently.

Producing Minerals

Royalty Interest (RI)

The second most common type of mineral right is royalty interests. When a mineral interest owner signs an oil and gas lease, they are leasing their mineral interest to a company that plans to drill one or more wells. By signing an oil and gas lease, the mineral owner acquires “royalty interest”. The royalty interest owner is entitled to a percentage of the revenue from the sale of oil and gas without paying for any of the expenses associated with drilling or operating the well.

Royalty Reservation

When a mineral owner signs an oil and gas lease, they “reserve” a royalty.

This royalty reservation can be expressed as a fraction (e.g., 1/4 of production) or percentage (e.g., 25% of production). Royalty reservations vary by location ranging between 12.5% to 25%.

Multiple Leases

Some leases have a depth clause, so it is possible to have multiple oil and gas leases for a single tract of land. These leases may expire at different times.

Releasing an Oil & Gas Lease

When the oil or gas well(s) stop producing, the lease is released, and the royalty interest goes away. The mineral interest owner is free to lease to another company. It is possible to own only royalty interest and lose your mineral rights when the lease ends.

Term Royalties

A term royalty is an oil and gas royalty interest only in effect for a specific amount of time. For example, the term may be a specific number of years or while a specific lease is producing. Similar to a regular royalty interest, a term royalty is released when the term expires.

Royalty Interest Rights:

-

- Receive royalties on the well production (free of the cost of production)

Royalty Interest Holders:

-

- Do NOT have the right to surface usage.

- Do NOT contribute toward the cost of drilling or operating the well(s).

- Do NOT have the right to sign an oil and gas lease.

Some mineral owners choose to sell your all or part of their royalty interest, and keep the mineral interest and executive rights in their family. Typically selling only royalty interest results in a lower price because the rights are terminated when the lease ends.

Overrides

Overriding Royalty Interest (ORRI)

An Overriding Royalty Interest (ORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas. ORRIs are often assigned to geologists, petroleum engineers, landmen, and other professionals as compensation for their services.

ORRI vs. Working Interest

Although ORRIs are carved out of the working interest, they are free from the cost of drilling and operating the well. Like Royalty Interest (RI), an ORRI ends when the oil and gas lease ends.

Valuing ORRIs

ORRI and MI/RI (mineral/royalty) interests in the same tract of land may be valued differently. Unlike the mineral interest, which lasts in perpetuity, overriding royalties expire with the lease. Therefore, overrides tend to be worth less than MI/RI.

Least Common

Non-Participating Royalty Interest (NPRI)

An NPRI is carved out of the mineral estate and is an interest in the proceeds from the sale of the minerals. Unlike a mineral interest owner, the NPRI owner does not have “executive” rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.

NPRIs can be complicated. There are fixed and floating NPRIs, and each is calculated differently. With quite a few exceptions to the general rules, it is best to have an oil and gas attorney look at the original granting clause and answer any questions you may have. A mineral owner may own less than expected if the mineral estate is burdened by an NPRI.

Tax Benefits & Higher Risk

Working Interest (WI)

Working interest (WI) is granted by an oil and gas lease between the mineral interest owner and the company that will drill and operate the well. The oil and gas lease gives the working interest owner the right to explore, develop, and produce the minerals beneath the land. The mineral interest owner reserves a royalty (modern leases usually reserve 25%). Because the working interest holder is responsible for all expenses, they typically hold a large percentage of the royalties (upward of 75% or more).

Working Interest Rights:

-

- Rights to search, develop and produce oil and gas

- Rights to a high percentage of royalties

- Tax advantages

Working Interest Obligations:

-

- Obligation to pay all costs associated with drilling and operating the well or wells

There are two types of working interest – operated and non-operated. Non-operated working interest owners do not make operating decisions but are still obligated to pay for the drilling and operating expenses.

Working interest is, by far, the riskiest type of mineral right. While the upside potential is enormous, and the tax incentives can offset losses, many working interest owners have lost everything.

It can be difficult to sell working interest that is not profitable or working interest in older wells (that might need to be plugged).

Leased but Not Producing

Leasehold Interest

A leasehold interest is another term for working interest and is typically used to describe working interest in an oil and gas lease that has not yet been developed. When an oil and gas lease is signed, the Lessor (mineral interest owner) receives royalty interest, and Lessee receives leasehold or working interest.

Sometimes mineral owners will sign an oil and gas lease with a “middleman” who flips the leasehold interest to the company that plans to drill and operate the well.

A leasehold interest is essentially working interest; therefore, the interest owner is responsible for drilling and operating the well and paying all expenses. In exchange for taking on the risk and expenses, the leasehold interest owner is entitled to significant tax benefits.

Far Less Common

Net Profits Interest

Net Profits Interest, which is also called Net Proceeds Interest (NPI), is a contractual share in the net profits generated from the production of oil, gas, or other minerals. It’s a type of non-operating interest.

The net profit for an NPI is calculated by subtracting certain specified expenses from the gross revenue generated by the production of minerals or hydrocarbons.

Non-Operating Interest: Holders of NPI are not involved in the operational aspects of the mineral property or oil and gas production. They are passive recipients of a share of the profits.

Duration: The duration of an NPI can vary. It may be limited to a specific period, the life of a well, or as long as there is profitable production from the property.

Expense Deductions: The types of expenses that are deducted before calculating net profits can vary but typically include operating costs, maintenance expenses, and sometimes capital expenditures.

Frequently Asked Questions

Types of Mineral Rights FAQs

Understanding the differences between the eight main types of mineral rights is an essential part of owning and managing your mineral rights.

What are the different types of mineral rights?

There are eight main categories of minerals rights, which include mineral interest (MI), leasehold interest, royalty interest (RI), working interest (WI), non-operated working interest, overriding royalty interest, non-participating royalty interest (NPRI), and net profits interest.

What is the riskiest type of mineral right?

By far, working interest is the riskiest type of mineral right. Both operated and non-operated working interest owners must pay their share of the costs associated with drilling and operating the wells. At any time, a working interest owner can be required to pay a very large sum of money to drill new wells, which may or may not be successful. It can be difficult to sell non-operated working interest which is not profitable. It’s also hard to sell working interest in older wells that may need to be plugged.

Are producing and non-producing minerals types of mineral rightS?

Mineral rights are either producing (active wells) or non-producing (no active wells). This classification is more about the status of the mineral rights rather than the type of mineral rights. Genrally speaking, mineral interest can be producing or non-producing. Leasehold interest in non-producing but ORRIs and royalty interests are producing.

How does a mineral interest become a royalty interest?

Mineral interest can become a royalty interest when an oil and gas lease is signed, and then a successful well is drilled. Technically, when a mineral owner signs a mineral lease, they are leasing the mineral rights and receiving a royalty interest.

Why would someone create an NPRI?

Most often an NPRI is created when a mineral owner passes their interest to their heirs but designates one, particularly responsible heir, to be in charge of leasing the mineral rights. This presumably responsible individual holds the executive rights and the other heirs receive a non-participating royalty interest. However, this can created a complicated situation as the mineral rights are passed from generation to generation and fractioned.

Which type of mineral right is most valuable?

Mineral valuations are not solely dependent on the type of mineral right. Each type of mineral right is distinct from the others and there are benefits and drawbacks to each type. For example, royalty owner have no control over the development of their mineral rights and they only get a small fraction of the revenue (usually their fractional percentage of 12.5-25%), but they also don’t pay any of the costs associated with drilling or operating the wells. Working interest owners get a much larger percentage of the proceeds (usually 75-87.5%) and receive tax benefits, but they are also expected to pay their share of the costs.

National Focus

Where We Buy Mineral Rights

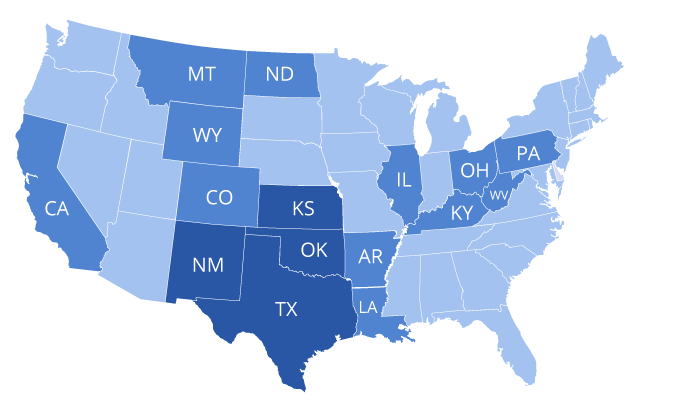

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Variety of Motivations

Why Sell Your Mineral Rights?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.