8 FACTORS THAT

Influence the Value of Mineral Rights

Learn about the seven factors that influence the value of oil and gas royalties and mineral rights.

Sell Your Mineral Rights (Request an Offer):

Valuation Factors

How Are Mineral Rights Valued?

There are two ways to value mineral rights. The first method is to use a multiple of the royalty revenue, which is usually 3-5 years. The value is adjusted up or down based on a variety of factors. The second method is a complex calculation estimating potential future royalty revenue based on a variety of assumptions. While the second method became popular during the shale revolution, it is falling out of favor as buyers realize they may never get a return on their investment. Regardless of the valuation method, the following factors influence the value of mineral rights:

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are generally worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operations.

Well Production

Highly productive wells (and off-set wells) can increase the value of your mineral rights.

Lease Terms & Operator

Lease terms vary and can impact royalty revenue dramatically. A high royalty reservations and cost-free leases are more valuable.

Lease Development

Leases may be fully developed, or there may be room to drill additional wells and take advantage of the initial production.

Decimal Interest

The decimal interest profoundly impacts your royalty revenue. Generally speaking, the higher your interest, the higher your checks.

Operator

Some operators are better than others, which may impact the well performance and the percentage and types of deductions you may be subject to.

Valuation 101

Factors that Influence the Value of Mineral Rights

Like real estate, location is everything! Well, almost. While location is the primary factor that determines the value of your mineral rights, the production status, oil and gas prices, well production, lease terms, operator, and the lease development are also important.

Traditional & Data Driven Methods

Three Mineral Valuation Methods

Mineral rights are typically valued in one of three ways, using a data-driven valuation method, the Rule of Thumb, or a price per acre.

Revenue Modeling

Modern valuation methods use data from royalty statements and public sources to model future revenue based on various pricing scenarios. Decline rates, deductions, and net present value are all considered.

Rule of Thumb

Older valuation methods use the “Rule of Thumb,” which is a multiple of the monthly royalty revenue. Unless the wells are very new or very old, the rule of thumb is 3-4 years of monthly revenue.

Price per NMA

Non-producing mineral rights can be valued by multiplying the number of net mineral acres (NMA) that you own by the going lease rate, which is often the same as the lease bonus, but can be higher in some areas.

Location is everthing

Location, Location, Location!

The most significant factor affecting the value of your mineral rights is the location. Each area has its own geography, making some sites more desirable than others.

The Permian, Eagle Ford, Haynesville, Bakken, Niobrara, and Marcellus are the most popular shale plays and therefore demand the highest prices.

Giant horizontal fracked wells of the Delaware Basin (the deepest part of the Permian) are some of the most valuable mineral rights. These wells generate a massive amount of oil and natural gas and, because there are multiple layers of shale, multiple stacked horizontal wells can be drilled in a given tract of land.

While these wells are prolific, they also have steeper decline curves and shorer economic lives than their conventional (vertical) counterparts.

Both are valuable, but there is a massive difference in the value of mineral rights in the Delaware Basin vs. the Panhandle of Texas. Permian valuations will typically far exceed those in conventional oil fields.

The location also dictates the royalty percentage. For example, in Texas, the standard royalty is 25% but, it’s common to see royalties range from 12.5% to about 16% in other areas – especially in older leases.

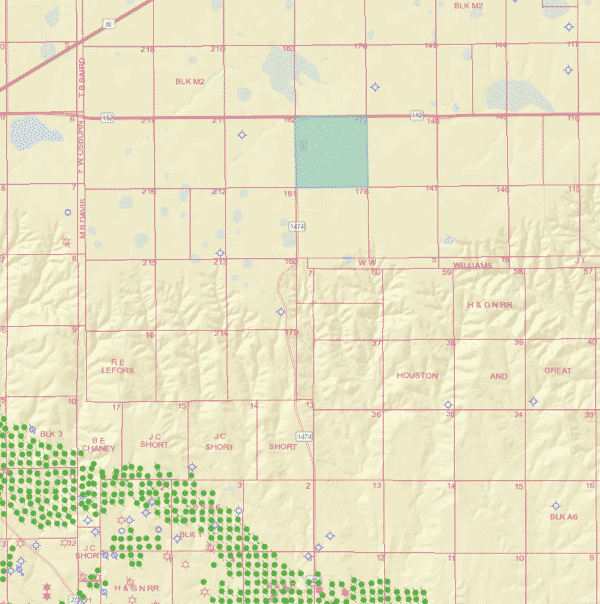

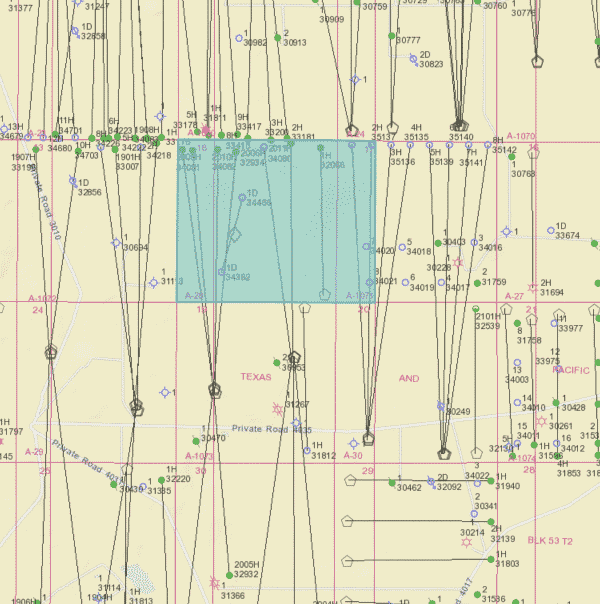

Image Description: The highlighted tract in Texas shows older vertical wells with the future possibility of horizontal drilling.

Oil & Gas Development

Producing vs. Non-Producing

Producing minerals are mineral rights with an active oil or gas well that is producing economically viable quantities of oil or gas. Royalty interest owners who have producing minerals get monthly (or periodic) royalty checks.

Modern Valuation Method

Modern valuation methods use data from royalty statements and public sources to model future revenue based on various pricing scenarios. Most mineral buyers use this method.

Rule of Thumb

Older valuation methods use the “Rule of Thumb,” which is a multiple of the monthly revenue. Unless the well or wells are very new or about to be plugged, the rule of thumb is 3-4 years of revenue. Whether the value is closer to the 3-year mark or the 4-year mark will depend on a variety of factors, such as location, production volume, commodity prices, lease terms, operator, and the likelihood of future drilling.

Non-Producing Mineral Rights Value

Non-producing minerals typically refer to mineral interest in one or more tracts of land that do not have a producing oil or gas well. Because there are no wells, there will be no royalty payments. However, that doesn’t mean that non-producing mineral rights are devoid of value.

Again, location comes into play. Non-producing minerals located in the best shale plays will have more value than non-producing minerals in older oil fields or areas without proven reserves. Typically, non-producing minerals are valued based on a multiple of the expected lease bonus.

For example, if the going lease bonus in the county ranges from $100-$500 dollars, you can expect to sell your mineral rights for the lease bonus times the number of net mineral acres (NMA) that you own.

The value of non-producing minerals is usually stated as a price per acre. The price per acre varies from state to state, county to county, and even within a county.

Non-Producing Minerals Rule of Thumb: Lease Bonus x NMA

What determines if your lease bonus is valued at $100, $5,000, or somewhere in between? That depends on where your minerals are located in relation to the drilling activity in the county. The closer you are to active drilling areas, the higher your lease bonus will be. This is reasonably easy to determine by looking at a couple of maps. Here’s a quick guide: How to figure out if your minerals are in a hot area.

The best way to know the value of your mineral rights is to request an offer.

How Much You Own

Decimal Interest

The decimal interest is the percentage ownership share that a mineral or royalty owner has in the revenue generated from the production of oil, gas, or other hydrocarbons from a well.

A higher decimal interest usually means a higher royalty payment. Higher checks usually translate to a higher value (but that might not be true for a newer well).

It’s relative, though. Let’s look at an example:

Jessica owns a 0.0022222 interest, while Josephine owns a 0.0002222 interest.

Most likely, Jessica will have much higher royalty checks. However, if Jessica’s well only produces a little bit of oil and Josephine’s well produces a lot of oil, this may not be true.

Regardless, once you start seeing 4 or 5 prevailing zeros (0.0000x or 0.00000x), the interest starts getting too small and more of a pain. It’s even hard to sell interest this small.

Image Description: A “family tree” showing how the mineral rights have been fractioned through multiple generations.

Lifecycle stage

Well Production

The amount of oil and gas that a well produces directly impacts its value. Generally speaking, more production results in a bigger revenue check.

Wells produce the largest quantity during the first couple of months, but production quickly declines – especially in horizontal wells. Depending on your location, at the end of the first year, your royalty check might be 40% of the initial production. It might even be 10% in some areas!

At some point, usually after two or three years, the well will “settle,” and the curve will decline more slowly, although it will still decline.

Because oil and natural gas are finite resources, all wells eventually run dry and are plugged when operating the well is no longer economically viable.

Non-Producing Mineral Rights

When considering non-producing minerals, a mineral interest surrounded by successful offset wells will be more valuable than one near unsuccessful, poor, or mediocre offset wells.

Economic Conditions

Oil & Gas Prices

The price of oil and gas can have a dramatic impact on the value of your mineral rights. When commodity prices are high, both the operator and mineral owners reap the economic benefits.

Lower commodity prices mean less revenue. Significant and long-lasting drops in the price of oil and gas can make it uneconomical to continue operating wells or even drill new wells – especially the expensive fracked horizontal wells.

Prior to the fracking boom, oil was $164 per barrel, and gas prices hit $18 per MCF. There was considerable discussion about the consequences of having reached peak oil.

The fracking boom changed all that, causing the pendulum to swing in the other direction. Massive horizontal wells recovered incredible amounts of oil and gas, saturating the market and causing the prices to drop.

Political & Global Impacts

The COVID-19 pandemic recovery and the Russia-Ukraine conflict tightened the market, causing prices to rise again. However, during Trump’s second term, tariffs and OPEC’s actions caused prices to fall again.

The oil and gas industry is cyclic – there have been and always will be boom and bust cycles that are very hard to predict.

Image Description: West Texas Intermediate (WTI) 209 – 2024 Price Chart

Royalty Reservation & More

Lease Terms

New mineral owners are usually so excited to be offered an oil and gas lease that they accept the terms without hiring an attorney to negotiate on their behalf. Sometimes, not wanting to spend money on legal fees, they rely on AI to help them negotiate. It’s always best to seek legal advice before signing an oil and gas lease because the terms of the lease can have a dramatic impact on the value of your mineral rights.

Royalty Reservation

When it comes to oil and gas lease terms, the royalty reservation has the biggest impact on the value of mineral rights. In Texas, the standard royalty is 25% (this wasn’t always the case, though). Older leases, especially outside of Texas, typically reserve a 12.5% – 16% royalty. As mineral owners have become more savvy and connected, the 25% royalty has gained popularity. Just think – by leasing at 25%, you can make twice what someone leased at 12.5%.

Mother Hubbard Clause

Many mineral owners unknowingly lease a lot more of their mineral rights than the company intends to develop. This can lead to a situation where your mineral rights are held by production (HBP), possibly for decades, by a single well barely producing economical quantities of oil or gas.

Cost-Free Lease

When an oil and gas lease is signed, it typically gives the mineral owner rights to 12.5% – 25% of the revenue, and the operator gets 75% – 87% of the revenue. That’s because the operator assumes all of the risks and expenses associated with drilling and operating the well. That’s how it usually is. Operators sometimes include costs in a lease, obligating the mineral owner to pay a portion of the operating expenses.

Free Use of Natural Gas

A lot of leases contain language allowing the operator free use of natural gas for the operation of the well. Companies are using this “free” natural gas to run their frack fleets and other aspects of the operation – without paying you for the natural gas.

Note: In the Appalachian states, lease terms are mostly pre-determined, so mineral owners have very little negotiating power.

Some are better than others

Operator

It’s widely known that some companies are better at drilling and completing successful wells than others. In adjacent tracts of land, two companies might drill similar wells, but one may be more successful than the other. Some companies are also more agreeable to mineral-owner-friendly lease terms.

The biggest impact the operator has on the mineral owner is how the company deals with deductions. Some operators pass part of the operating expenses onto the mineral owner (whether or not this is allowed in the lease).

Most operators are reasonably ethical. They are trying to run a successful business, follow all the rules, and turn a profit. However, there are some operators widely known for their unethical practices. If your wells are operated by one of these companies (a few are particularly infamous), your royalty checks will be a fraction of what they would be under a different operator, and this will impact the value of your mineral rights.

There are also operators with outstanding reputations. They drill great wells and stay on top of repairs. Minerals with these operators (particuarly if there is room for additional wells), might have an added value.

Upside potential

Lease Development

This can be a good thing in terms of valuing the mineral rights by using a multiple of production. However, many buyers place a premium on a lease that is not fully developed. The majority of the oil and gas is produced during the first five years of a well’s life. When there is room for additional wells, the mineral owner will benefit from the initial production of any new wells.

Solar Development

Occasionally mineral owners are approached by solar farm developers who need to purchase the mineral rights before building the solar farm. We will sometimes buy mineral rights in these situations.

Frequently asked questions

Mineral Rights Valuation FAQs

The value of mineral rights varries greatly, depending on a number of factors.

Can mineral rights lose value over time?

Mineral rights very often lose value over time. This is partly due to the fact that oil and gas are finite resources and wells produce less and less over time. Eventually all wells run dry and stop producing.

The other reason royalty checks decline, and therefore the value declines, is because mineral rights are fractioned as they are passed from generation to generation. For example, if Grandma leaves her 100 net mineral acres to her 5 children, each child owns 20 net mineral acres. When they pass away, the minerals are split among their children, leaving each child with a much smaller fraction of ownership.

How much does a formal mineral appraisal cost?

There are many companies that provide formal appraisals for oil and gas royalties and mineral rights. The cost of a formal appraisal can range from less than a thousand dollars to tens of thousands of dollars, depending on a variety of factors such as how extensive the research is (i.e., do they need to involve a petroleum engineer, are there many wells, etc).

Are mineral rights a good investment?

Are all mineral rights valuable?

Very small mineral rights also lack value, even if they are productive areas. It can be really hard to sell small mineral rights, and sometimes they can’t even be donated.

I am suddenly getting tons of offers in the mail. What is going on?

If you are getting multiple offers in the mail, there may be a new oil or gas well permit on your property (or nearby). Before you sell, it is a good idea to figure out what is going on in the area so you know what you are selling. A new well can increase the value of your mineral rights.

Do mineral rights have "comps" like real estate?

Unfortunately, mineral rights are so complex and varried that it is nearly impossible to create a comps database. Instead, mineral rights are valued based on a variety of factors that are specific to the mineral rights, including the net mineral acres (or net royalty acres), location, producing vs non-producing, operator, lease history, lease development, commodity prices, and more.

National Focus

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.