How to Find a Landman

Find out what a Landman does, how to find one, and some viable alternatives.

Sell Your Mineral Rights (Request an Offer):

First Things First

What is a Landman?

Most landmen work for oil and gas exploration and production (E&P) companies, performing title work or negotiating with mineral owners to acquire leases prior to drilling a well. There are also independent landmen who do shorter-term work for probate attorneys, trustees, and individual mineral owners.

Many mineral owners will need the assistance of a landman or an oil and gas attorney at some point.

Landmen typically help mineral owners figure out what they own, transfer ownership after death, estimate the value of their mineral rights, negotiate oil and gas leases, and cure the title to get into pay status. There are also alternatives to hiring a landmen.

What Landmen Do

What can an AAPL landman help me with?

Landmen can help mineral owners transfer ownership, estimate the value of their mineral rights, cure title issues, negotiate oil and gas leases, and more.

Ownership Transfers

An AAPL landman can help with an affidavit of heirship, which is often required to transfer the ownership of mineral rights from one person to another when an estate was not probated.

Oil and Gas Lease Negotiation

Having an attorney and/or landman negotiate an oil and gas lease on your behalf is usually well worth the extra expense. Attorneys may be better for the prcice language and a landman may be better at coming to mutually agreeable terms.

Research Your Mineral Rights

Very often, new mineral owners do not know exactly what they have inherited. A landman can do an extensive title search to figure out what you (and your family) own.

Perform Curative Title Work

A landman may be able to help you get into pay status on producing oil and gas wells by performing curative work on the title.

Estimate the Value of Your Mineral Rights

An AAPL landman can help you estimate the value of your mineral rights. Depending on how much you own, this might be an experienced-based estimate or the landman may recommend a mineral rights appraiser for a precise valuation.

Help You Buy or Sell

An AAPL landman can help you buy or sell your mineral rights. They often have a network of buyers and sellers and can walk you through the process.

Financial Expectations

What Will it Cost to Hire a Landman?

Landmen typically charge by the day rather than by the hour. Expect to pay somewhere between $350-$600 per day, depending on the landman’s credentials and location.

Land work often requires travel to another county in order to perform title searches. When travel is required, expect to cover the landman’s daily fee in addition to travel, lodging, and meals.

Land work can vary from project to project. Recording a document with the county clerk is very different from spending weeks (or months) sorting through title records to determine mineral ownership across multiple counties.

A landman will be able to give you a rough estimate of project’s cost. It’s usually best to find a landman in your state (or county).

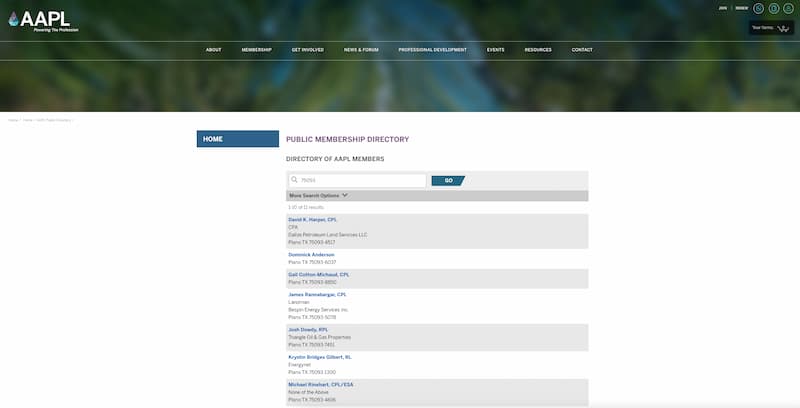

American Association of Professional Landmen (AAPL) Public Directory.

Where to Start

How Do I Find a Landman?

Most landmen are certified through the American Association of Professional Landmen (AAPL) but oddly enough, AAPL’s directory is not available to the public.

So, how does a mineral owner find a landman?

Mineral Rights Forum

There are a lot of helpful people on the Mineral Rights Forum, including landmen who would happy to do some work for you (for a fee, of course).

National Association of Royalty Owners (NARO)

The National Association of Royalty Owners (NARO) is an educational and advocacy organization for mineral owners. With strong industry connections and a variety of resources, NARO can often help connect you with an experienced, independent landman.

American Association of Professional Landmen (AAPL)

Google [your state] + "landman"

By googling your state and the term, “landman”, may be able to find local listings for landmen.

Consider Alternatives

Landmen are expensive, but there are alternatives. You can do a lot of the work yourself (or arrange for us to help).

You Have Options

Landman Alternatives

An attorney can also figure out what you own, transfer ownership, and help you get into pay status. Landmen generally charge $500 per day, while attorneys charge $300-$400 per hour. Both can be exceptionally expensive. It’s not uncommon for a project to cost 10-20K, which may be more than the value of your mineral rights!

That is expensive! Is there a cheaper alternative?

There is an alternative. We buy mineral rights, so we’re really good at figuring out what is owned, transferring ownership, and getting into pay status. We sometimes help mineral owners sort out their mineral rights and get into pay status in exchange for a percentage of their mineral rights. Each situation is unique, so contact us if you are interested in an arrangement like this.

Is this all too much?

You can also sell your mineral rights. Sometimes that’s the best and easiest solution. It won’t cost you anything to sell, and the buyer does all of the work.

Types of Landmen

Landmen typically work for oil and gas companies, researching the titles and negotiating directly with landowners to acquire oil and gas drilling leases on behalf of the oil and gas company. Landmen generally fall into three categories: company landmen, independent field landmen, and independent land consultants. Landmen are certified through the American Association of Professional Landmen (AAPL).

Registered Landman (RL)

A Registered Landman (RL) is the AAPL’s initial level of certification, indicating a fundamental knowledge of the land industry and a commitment to further education.

Registered Professional Landman (RPL)

Certified Professional Landman (CPL)

National Focus

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Frequently Asked Questions (FAQ)

Is "landman" still the right term if the professional is a woman?

Yes. The term “Landman” is the industry-standard term used by the AAPL, regardless of gender. Some women, however, may prefer the term “land professional”, even if the word Landman is in their professional credentials (i.e. Registered Landman, Certified Professional Landman, etc). If your landman is a woman, you can ask her what she prefers.

How do I know if I need an attorney or a landman?

If you need help researching mineral ownership or curing a title (depending on the problem), a landman might be the most economical option. However, you will need an attorney for:

- Legal disputes

- Probate or estate matters

- Complex contracts to review or draft

- Mineral deeds or conveyances

- Unclear or contested ownership

In many cases, landmen and attorneys work together on the same project.

Do I hire a landman in my state or where the minerals are located?

It is best to hire a landman in the area where your mineral rights are located. Some landmen have experience in many states, and others specialize in specific areas. Often, landmen have a large Rolodex, so if the first one you contact is not comfortable in a certain area, they might be able to refer you to someone else.

How do landmen verify mineral ownership across multiple generations?

Landmen trace ownership by reviewing courthouse records, probate files, and deed books. They create title runsheets, reviewing the chains of title, wills, affidavits of heirship, and tax records to reconstruct how property rights were passed from one person/entity to the next.

In complex cases, they may work with an attorney to produce a title opinion.

Can a landman help me identify non-producing minerals that I might own?

Yes. Landmen are trained to map both lease and unleased tracts of land based on public records and GIS mapping tools. This exercise can be especially helpful if you inherited mineral rights because non-producing minerals are often forgotten about as minerals change ownership from generation to generation.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.