Producing vs. Non-Producing Mineral Rights

All mineral rights fall under two categories: producing and non-producing.

Sell Your Mineral Rights (Request an Offer):

A Fundamental Difference

Producing vs. Non-Producing Minerals

All mineral rights fall under two categories or statuses: producing and non-producing. Producing minerals have one or more active wells that generate royalty revenue. Non-producing minerals have no active wells and, therefore, do not generate royalty revenue. Oil and gas are finite resources, so eventually, all producing minerals will become non-producing minerals.

Two Categories of Mineral Rights

Oil and gas mineral rights are either producing or non-producing, depending on where they are in the development timeline.

Non-Producing Mineral Rights

Non-producing minerals are undeveloped oil, gas, and other minerals in the ground. There are no oil or gas wells extracting the minerals, and therefore, no royalty payments. The owner of the mineral interest has the right to explore, develop, and produce the minerals.

Producing Mineral Rights

Producing minerals have one or more active oil and gas wells. Royalty owners are paid royalties on the proceeds from the sale oil, gas, and other minerals that are produced under a specific tract of land.

Mini Case Studies

Examples of Producing and Non-Producing Mineral Rights

As the following examples show, location is extremely important in determining the value and future potential of producing and non-producing oil and gas mineral rights.

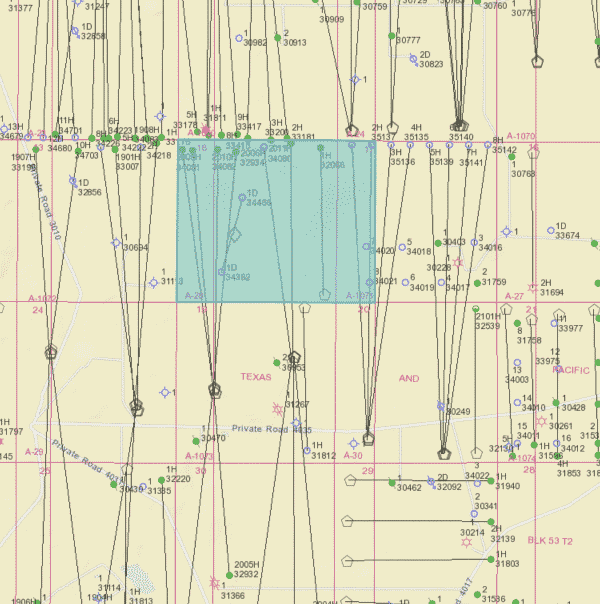

Producing Minerals Example 1

These Loving County minerals, located in the Permian Basin, are just about as good as it gets. There is a mix of successful horizontal wells and newly permitted wells. The surrounding sections also contain a mix of new and permitted unconventional wells. These minerals are among the most valuable in the country.

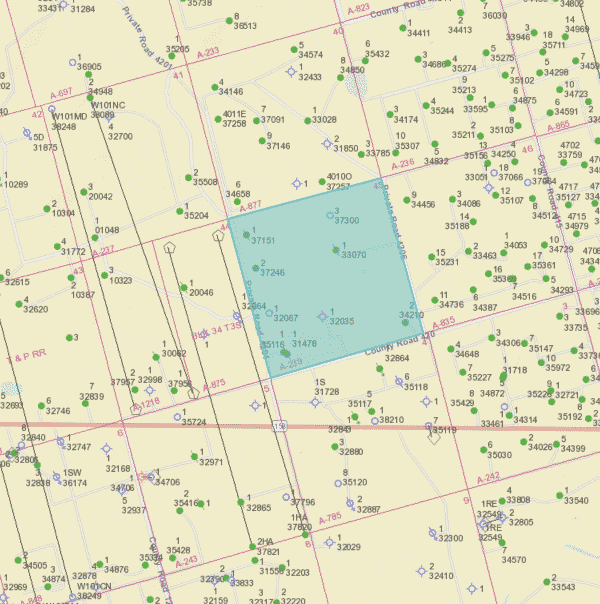

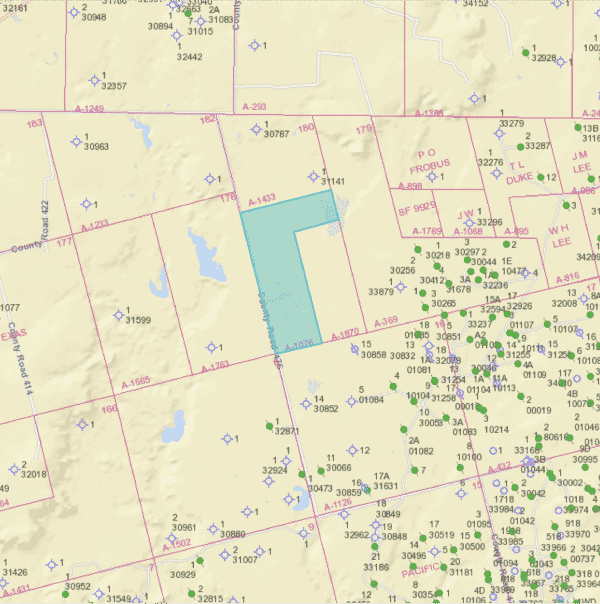

Producing Minerals Example 2

This is a great example of producing minerals in Glasscock County with good upside potential. The nearby horizontal wells are a good indicator of future horizontal drilling potential. These minerals will be quite valuable – unless the off-set production is poor. It is really important to look at the offset production when evaluating these minerals.

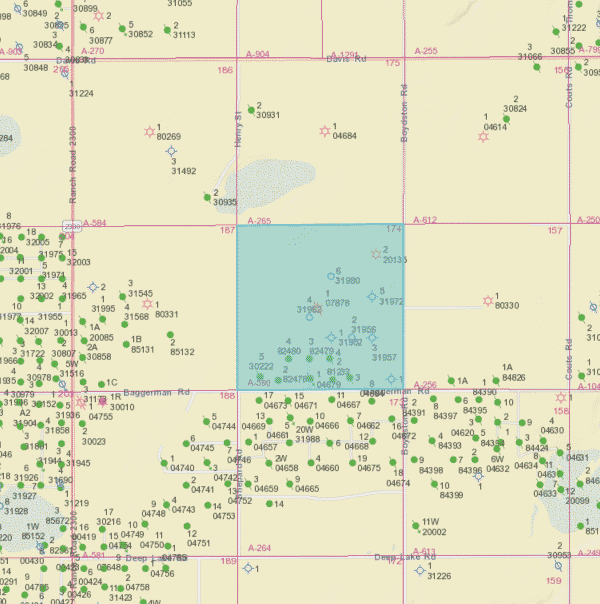

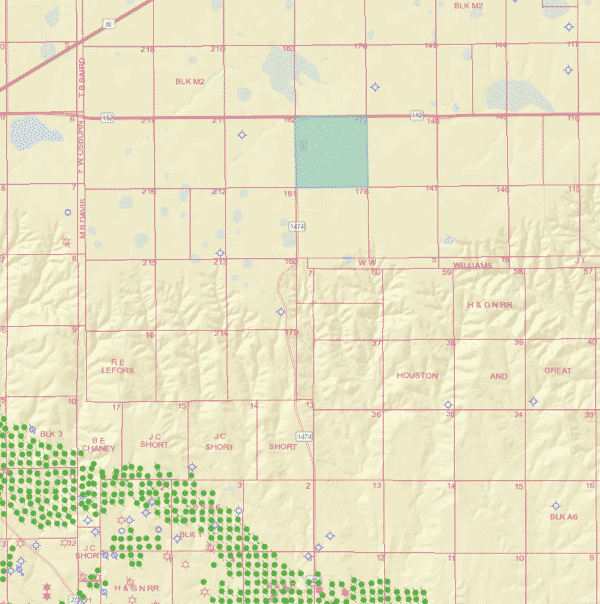

Producing Minerals Example 3

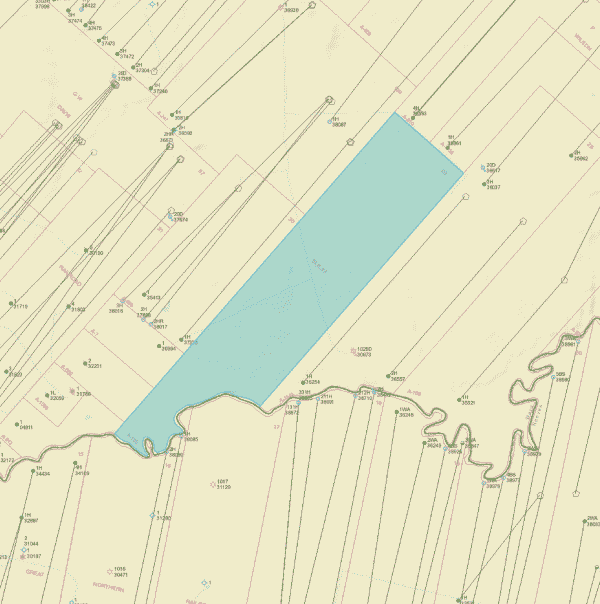

Non-Producing Minerals Example 1

Non-Producing Minerals Example 2

Non-Producing Minerals Example 3

These producing minerals are located in an older oilfield in the Texas Panhandle. Many of the wells have been plugged, and those that are still producing may be near the end of their economic life. The permits are from the 1980s and indicate planned wells that were never drilled. These non-producing minerals hold very little value.

A High Level Overview

Oil & Gas Well Lifecycle

How non-producing minerals become producing minerals and back again.

Locate

Locate Potential Oil and Gas Reserves

A geologist identifies and area that may contain economic quantities of oil or gas. Working with the surface owner (who may or may not own the mineral rights), arrangements are made for seismic and other tests that will identify the sub-surface geological structures.

Explore

Drilling Decision

After geologists, geophysicists, petroleum engineers, and reservoir engineers have reviewed the data, the exploration and production (E&P) will decide whether or not to drill a well.

Lease

Lease Mineral Rights

Once the company has decided to drill a well, they hire a landman (or a team of landmen) to locate the unleashed mineral owners. Landmen review the county’s deed records to determine who owns the mineral rights and how much they own. If sufficient mineral owners can be located, the landman will attempt to contact each and negotiate an oil and gas lease

Title Opinion

Well Site Title Opinion

Before a well is drilled, the company will order a Drillsite Title Opinion from an attorney. The title opinion lists list the ownership interest for each of the Royalty Interest (RI), Non-Participating Royalty Interest (NPRI), Overriding Royalty Interest (ORRI), and Working Interest (WI), and surface owners.

Drill

Drill the Well(s)

After leasing the mineral rights and securing the Division Order Title Opinion, it’s time to drill the well. The drill site becomes the well site. Drilling can take days or months, depending on a variety of factors. Once a well is producing oil and gas, the status of the minerals becomes “producing”.

Market

Sell the Oil, Gas, and Other Products

E&P companies negotiate contracts to sell or “market” the oil, gas, and other products. The price may include the cost of transportation or “marketing”.

Pay

Pay Interest Owners

A Division Order Title Opinion (DOTO) tells the operator who should be paid and how much interest each owner has. Each interest owner will be sent a Division Order (and a W9). Interest owners who have title issues will have to fix those issues before being paid.

Produce

Continue Producing the Well(s)

If the well is successful, it will produce for as long as commercial quantities of oil and gas can be recovered. During this time, all owners holding an interest in the well will be paid as long as their title is clear. Owners with title defects are put into suspense. As time goes on, minerals are bought, sold, and inherited. Each operator has a royalty relations department that processes changes in ownership.

Plug

Plug Well(s)

When an oil or gas well is no longer producing economic quantities (usually due to low commodity prices or because of low production), the well is plugged and the oil and gas lease is released and royalty payment end. The minerals are non-producing once again.

Nationally Focused

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.