Learn About Oil & Gas

Overriding Royalty Interest (ORRI)

Sell Your Mineral Rights (Request an Offer):

Basic Overview

What is an Overriding Royalty Interest?

An Overriding Royalty Interest IORRI), commonly referred to as an override, is a fractional, undivided interest granting the right to receive proceeds from the sale of oil and gas. It is carved out of the working interest, and therefore is not an interest in the minerals themselves, but rather in the proceeds of the sale of oil and gas. ORRIs are often assigned to geologists, petroleum engineers, landmen, and other professionals as compensation for their services.

ORRI Assignment

Overrides are Cost-Free

Image Description: Picture of an oil well in North Dakota, surrounded by snow.

Carved from Working Interest

Calculating Overriding Royalty Interest

Because Overriding Royalty Interests are carved out of the working interest in an oil and gas lease and is not based on acreage, the calculation is simple.

An ORRI is a straight percentage.

For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

The exact details of an override are dependent on the language. ORRIs can be interpreted literally or may have proportionate reduction language. It is always good to have an attorney review the ORRI language and the oil and gas lease.

Just like any other mineral right, ORRIs can be purchased or sold.

A Case Study

Overriding Royalty Interest Example

The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.

Instead, most mineral owner lease their mineral rights. When this happens, the oil and gas company receives the vast majority of the revenue (usually 75 – 87.5%) and the mineral owner reserves 12.5% – 25%. In exchange for taking a smaller percentage, the mineral owner does not have to pay any of the costs associated with drilling or operating the well.

Because drilling a well is very expensive, with most of the costs incurred before the well begins producing, operators often grant landmen, geologists, petroleum engineers, and other professionals an Overriding Royalty Interest in the lease. The override is usually a small percentage that is carved out of their 75% working interest.

Overriding Royalty Interest (ORRI) can be assigned at any time. A landman may agree to acquire leases for XYZ Oil and Gas Company in exchange for 50% cash and 50% ORRI (value = 0.05 ORRI) on future wells drilled on a specific tract (or tracts) of lands. However, the ORRI will not be of economic value until an economically producing well is drilled, at which point the landman will receive his or her share of the royalties. ORRIs may also contain proportionate reduction language.

A lot of ORRI’s are sold in the first three months of production, before the well declines in value (and before anyone really knows how successful the well will be). This is a way for the owner to turn ORRI’s into cash.

Image Description: Pie chart showing the working interest, royalty interest, and overriding royalty interest.

Image Description: Screenshot of a royalty statement showing the type of interest.

Royalty Statement Details

How To Find Out if You Own an ORRI

You might have inherited an Overriding Royalty Interest (ORRI) and not realize it. How do you find out?

Your royalty statement or division order will probably indicate the type of mineral right that you own. ORRIs are abbreviated as O or OR. On EnergyLink, statements are more uniform, so you might see the word “Override Interest” spelled out (see example image).

County Records

Finding your ORRI in the Deed Records

Running the title is not as difficult as it sounds.

First, locate the county office where deed records are kept. This is often the County Clerk or the County Courthouse. Some states have an office for the “Recorder of Deeds” or the “Register of Deeds”.

Search Google for: [state] + deed records

Some counties have online records going back a few decades. Others do not. If you live closeby, you can search the deed records in person and perhaps enlist the assistance of the people working there. Being able to ask questions can be really valuable – especially when you get stuck, are having trouble reading hand-written documents, or are unsure of what something means.

What to Search For:

There are two main ways to search the deed records. The most obvious way is to enter your name (or the name of relatives who have passed away) into the grantor/grantee search box. The other is to search by legal description. You will need to follow the chain of title back to the land patent (when the land was first granted by the government).

You are looking for:

- Oil and Gas Leases

- Mineral Deeds

- Conveyance Documents

- ORRI Assignments

- Deeds (sometimes minerals are reserved or granted or a deed might reference a previous reservation)

When to Hire a Landman

If you want to perform a title search yourself, or you try but get stuck, you can hire a landman to search the records for you. Most landmen are highly skilled in running title, spending much of their careers searching for mineral owners for companies that want to extract oil and gas from a specific tract of land.

Image Description: Screenshot of an old oil and gas lease and Assignment of Overriding Royalty Interest from the deed records.

Image Description: Example Ad Valorem property tax statements from two Kansas counties.

A New Tax Burden

Paying Taxes on Your ORRI

Like all mineral rights, ORRIs are subject to three types of taxes:

Federal Income Tax:

Oil and gas royalties, including ORRIs, are taxed as ordinary income because the IRS classifies them as investment income. ORRIs qualify for a depletion deduction of 15% (check with your accountant for more info).

State Income Tax (for states that have income taxes):

Oil and gas royalties are subject to state income taxes in states with a state income tax. You will need to file state states in each state where you receive oil and gas royalties.

Severance Tax:

Severance taxes are automatically deducted from your royalty statement.

County Ad Valorem Tax:

Each county collects Ad Valorem taxes for overriding royalties. You should receive an annual bill from the county. In some states, such as Oklahoma, the Ad Valorem taxes are deducted from your check and paid by the operator.

Frequently Asked Questions

Overriding Royalty Interest (ORRI) FAQs

Overrides can a bit confusing. Let’s clarify some common misunderstandings and answer questions.

Can an ORRI be sold or transferred?

You can sell or transfer your overriding royalty interest (ORRI) to another party. Overrides are typically transferred with an assignment, usually titled Assignment of Overriding Royalty Interests, which must be notarized and recorded in the deed records where the mineral rights are located.

Why are ORRIs less valuable than Mineral/Royalty Interest?

Because an ORRI is carved out of the working interest, there is no ownership of the actual mineral rights. When the wells stop producing and the oil and gas lease is released, the overriding royalty interest ceases to exist. You no longer own anything.

However, if you own the mineral and royalty interest, and the lease is released after the wells stop producing, you still own the mineral interest and can, in lease the minerals to another operator who may drill a successful well.

Does an ORRI expire?

Overriding royalty interests (ORRI) typically expire when the lease expires or is released. They are tied to the working interest, and when the working interest expires the ORRI also expires.

Are there tax benefits for owning an ORRI?

Even though ORRIs are carved out of the working interest, ORRIs do not qualify for the tax benefits associated with working interest. Just like royalty interest, ORRIs are entitled to deduct depletion. There are no special tax benefits specific to ORRIs.

How long do ORRIs last?

An ORRI is tied to the oil and gas lease, and, therefore, will be active as long as the lease is active. Leases usually end when the last producing well stops producing economic quantities of oil and gas. Not all wells are successful. Some are dry holes, while others produce for a few months and then fizzle out. Some successful wells only produce for a few years while others last multiple decades (depending on the location and type of well).

Can ORRI owners be cut out of a lease?

One of the risks of owning an ORRI is that the operator will release the lease and then, some time later, release the minerals without the ORRI. By doing this, they retain more of the working interest and reduce their expenses. This practice is frowed upon and ORRI owners may have a legal recourse if this happens (but of course, that could be quite costly).

Top Valuation Factors

How We Value Overriding Royalties

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Nationally Focused

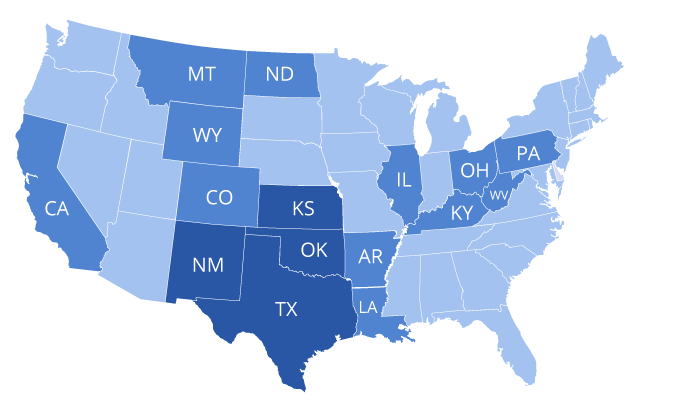

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.