Risks Associated with Mineral Rights

Sell Your Mineral Rights (Request an Offer):

Disclaimer:

WARNING: This information is for educational purposes and is intended to be a starting place to evaluate hypothetical risks. This is not an exhaustive or complete list. Each situation is different so contact an oil and gas attorney, financial planner, CPA or landman for professional advice regarding your situation. This information does not address the risks associated with owning any type of working interest in oil and gas operations.

Essential Overview

Types of Risks

Most mineral owners own mineral interest, royalty interest, non-participating royalty interest (NPRI) or overriding royalty interest (ORRI) and bear zero cost associated with drilling or operating the wells. However, there are still a LOT of risks associated with owning and purchasing mineral rights.

These risks can be divided into three categories: purchasing, ownership, and selling. Each of these can be further sub-divided into risks associated with producing and non-producing minerals.

Purchasing Risks

Purchasing mineral rights can be really risky – if you don’t know what you are doing. As they say, knowledge is power. The more you know, the more you can reduce your risk.

Ownership Risks

Selling Risks

Mineral Loan Risks

Risks to Consider When Purchasing Mineral Rights

Most minerals are inherited but there are people who invest in oil and gas by purchasing minerals. It is essential that buyers have extensive knowledge of the oil and gas industry before buying mineral rights. There are a lot of pitfalls associated with buying minerals at auction, from a broker, or directly from a mineral owner.

Interest in a New Well

New oil and gas wells decline sharply (especially horizontal wells). The royalties from the first few months of production should not be used to value the property. It is quite common for a 1-year old well to produce 1/2 or even 1/3 of its initial production. Using a rule of thumb and value the minerals using the first 6 to 12 months of production will result in dramatically overpaying for the interest, and you may never get a return on your investment.

Buying Interest in an Old Well

Hydrocarbons are finite resources. Successful conventional wells generally produce smaller amounts of oil and gas for long periods of time, while horizontal wells produce large amounts of hydrocarbons but only a few years. Buying interest in a well that is near the end of its life is risky. It may be plugged and abandoned before you get a return on your investment. And if your interest is terminated with the lease, you no longer have the ability to generate income in the future.

Buying Non-Producing Minerals

Non-producing minerals have no active oil or gas wells and, therefore, do not generate royalty checks. The biggest risk when purchasing non-producing minerals is that a successful well is never drilled or that they drill a dry hole or marginally successful well. Even if a successful well is drilled, there are other risks. For example, the operator may be unethical, your division orders might be incorrect, or you might have signed a lease that favors the operator (always hire an attorney to negotiate a lease).

Poor Due Diligence

More often than not, mineral owners don’t really know what they own. The onus is on the buyer to conduct extensive due diligence before purchasing minerals. Poor due diligence may result in your purchasing minerals from someone who doesn’t actually own any minerals (or who owns only a small fraction of what they thought they owned). It’s risky – especially when buying non-producing mineral rights.

Poor Lease Terms

Most mineral owners do not hire an attorney to negotiate lease terms. This is a huge mistake and often results in leaving money on the table. One of the many terrible but common lease terms is giving free gas to the operator to run the well. Some operators have started running their frack fleets on natural gas, and guess who is financing that? Buying mineral rights with poor lease terms exposes you to additional risk.

Bad Operator

Most operators try to do the right thing, but there are a few with well-earned bad reputations. Managing minerals operated by one of these companies takes a lot of extra time and effort and can potentially involve attorneys, accountants, and royalty audits. It can quickly eat away at your revenue and turn into a bad investment.

For New & Seasoned Mineral Owners

Risks Associated with Owning Mineral Rights

Most mineral owners acquired their minerals by inheritance rather than purchasing. But just because you didn’t pay for minerals doesn’t mean they are without risk. In fact, oil and gas are some of the riskiest investments available, and mineral ownership is no exception. Let’s explore some of the pitfalls for mineral owners.

Declining Oil and Gas Reserves

Oil, gas, and other minerals are finite resources. The delight that accompanies the first few royalty checks is often followed by immense disappointment as royalties drop to 1/3 or less than their initial production and eventually stop producing altogether. Conventional wells can produce for decades, but horizontal wells generally have a 10-year lifespan. In some areas, more wells can be drilled, and in other areas, the oil and gas reserves are quickly depleted. Like so many things involving real estate, location is everything when it comes to mineral rights.

Steep Decline Curves

Conventional wells can produce small quantities of oil and gas for decades, while long horizontal wells are more efficient at pulling hydrocarbons from the shale, producing large quantities of oil and gas but only for a short time. Horizontal wells have increasingly steeper decline curves and shorter lives. Some people choose to sell their minerals while the revenue is high enough to warrant a good price. Others prefer to keep their minerals, cashing declining checks throughout the lifespan of the oil or gas well.

Held By Production (HBP)

You might own minerals that are held by production (HBP). A lease is only in effect until the last well is no longer producing, so operators try to keep an oil well producing – even if it only produces a couple of barrels of oil every so often. As long as the cost of operating the well is less than the revenue generated, it is in the operator’s best interest to hold the lease. Unfortunately, this often means that another operator cannot drill a well on your tract of land. And if you leased multiple tracts of land in a single lease (a big mistake), then all of that land can be held by the production of a single well that is barely producing.

Lack of Infrastructure

The hot new shale plays, such as the Permian Basin, are struggling with infrastructure constraints. Oil can be trucked from the well site to a refinery, but natural gas must be transported via a pipeline. It often takes longer to lease and build pipelines than it does to drill and complete the wells. As a consequence, there are a lot of gas wells in the Permian that are either shut-in, or the operators are flaring the gas. In the case of shut-in wells, the mineral owners are not receiving royalty payments. Operators that are flaring the gas are not paying royalties on what they flare.

Low Commodity Prices

Ten years ago, we were concerned about peak oil, but thanks to technological developments in horizontal drilling and fracking, the United States is no longer fully dependent on foreign oil. In fact, we are now an exporter. Excessive drilling, combined with geopolitical situations, can lower oil and gas prices. Lower commodity prices translate to dramatically lower royalty checks. When the price of oil or gas drops too low, wells become uneconomical to operate and are plugged, releasing the lease.

Unfavorable Political Climate

The political climate in the United States is another risk to mineral owners. Concern regarding climate change is leading to the push toward renewable energy. Renewables, such as wind and solar are only economical when:

- Price of fossil fuels is high

- Renewables are subsidized

- The government provides incentives for renewables

- Anti-drilling/export legislation (or executive orders) are enacted to limit the use of fossil fuels

Overriding Royalty Interest

Overriding Royalty Interest (ORRI) can be particularly risky. ORRIs are typically given to geologists and other professionals for their services and are frequently sold as a way for these professionals to convert the asset into cash. ORRIs end when the lease ends, which means that if the wells are plugged, you no longer own mineral rights.

Incorrect Division Orders

After a well is drilled, the operator will send division orders, which mineral owners must sign in order to receive royalty payments. The division order describes the property, the mineral owner, and the owner’s interest in the property. Many mineral owners sign division orders without verifying their ownership – often because they don’t know how to compute their ownership. Signing an incorrect division order can lead to underpayment. You might not be receiving the correct royalties.

Poor Lease Terms

One of the biggest mistakes that mineral owners make is failing to hire an oil and gas attorney to negotiate the lease on their behalf. By not seeking professional help, mineral owners are leaving money on the table and putting themselves in a position to be taken advantage of. Sometimes owners allow a single lease to tie up multiple tracts of land and depths above or below where they intend to drill a well. Some leases authorize the operator to use natural gas for free (some operators use this gas to run their frac fleets). There are so many lease terms that benefit the operator to the detriment of the mineral owner. Signing an oil and gas lease without an attorney is extremely risky.

Non-Producing Mineral Rights

Even if someone drills a well, it may be a dry hole, an unsuccessful well, or a poor performing well. All three of these will discourage further development.

Mineral interest owners often own the minerals for decades, passing the interest from one generation to the next, all hoping that a successful well will eventually be drilled. Sometimes this happens, but often it does not. The value of non-producing minerals is usually considerably lower than it would be if they were producing.

Incorrect Royalty Checks

There are many lease terms that benefit the operator to the detriment of the mineral owner. Signing an oil and gas lease without an attorney is extremely risky.

Poor Mineral Management

Trouble Proving Heirship

Owning US Minerals While Living Abroad

For owners living abroad, managing US mineral rights involves additional tax filings, currency conversion fees, and transfer complications. Many international owners choose to sell their US mineral rights.

Acquisition Mix-Up

Oil and gas companies are constantly acquiring and divesting assets. Just like banks sell mortgages to be serviced by a different company, operators buy and sell working interest and the obligation to operate the well and pay interest owners. Sometimes information gets mixed up when assets are transferred from one company to another. The new operator may not be paying based on the correct ownership figures, they might be failing to pay for gas the use – assuming your lease allows for the free use of gas. They might be charging you for deductions that are not allowed per your lease terms. They might take you out of pay status, obligating you to prove that you own the minerals via an oil and gas lease and division orders.

Dormant Minerals Act

Dormant minerals are another reason to keep detailed and organized records. Many mineral owners are not aware of the non-producing property they own and in some states, mineral ownership reverts to the current surface owner after a specified number of years.

For Potential Sellers

Risks Associated with Selling Mineral Rights

People sell their mineral rights for a variety of reasons – one of which is to reduce risks associated with owning minerals or because they do not want to obligate their heirs to these same risks. Some people simply prefer to sell and use or invest the proceeds elsewhere.

Missing Future Revenue

Selling Under Market Value

Not Having All the Facts

Did you get an offer in the mail? The company who sent it may know something that you don’t know. Perhaps there is a permitted well that will be drilled in the next 6 months? Maybe there have been successful wells drilled in nearby sections? Before you sell, look up your minerals in your state’s oil and gas GIS viewer and see if there is any activity.

Nationally Focused

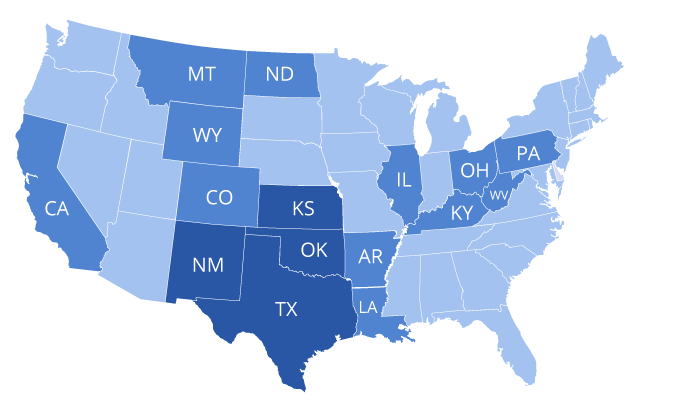

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.