Sell Your Michigan Mineral Rights

We buy oil and gas royalties and mineral rights in Michigan and throughout the United States.

Sell Your Mineral Rights (Request an Offer):

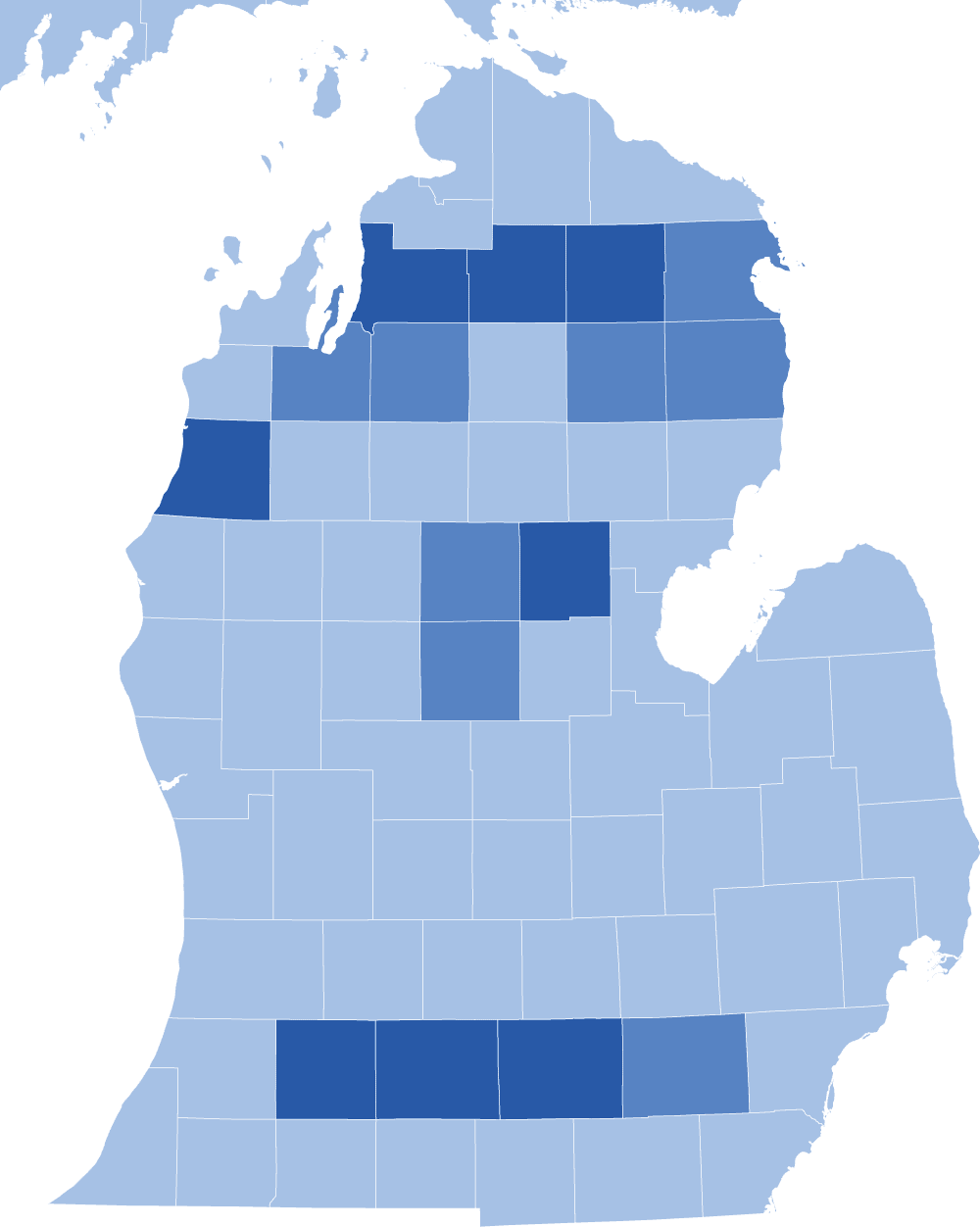

Location is Everything

Top Oil and Gas Producing Counties in Michigan

A brief overview of oil and gas activity

We buy oil and gas royalties and mineral rights throughout Michigan. We especially like Otsego, Montmorency, Jackson, Manistee, and Calhoun counties.

We buy mineral rights in the following Michigan counties:

| Otsego | Clare |

| Montmorency | Washtenaw |

| Jackson | Oscoda |

| Manistee | Alpena |

| Calhoun | Grand Traverse |

| Kalamazoo | Kalkaska |

| Gladwin | Isabella |

| Antrim | Alcona |

A Modern View

Michigan Oil and Gas Industry

Michigan has a long history of oil and gas production, which is overseen by the Oil, Gas, and Minerals Division (OGMD). Oil and gas production is mainly seen in the Antrim Shale, which covers approximately 39,000 square miles across the northern part of Michigan. Wells are vertical and quite shallow, ranging from 500 to 2000 feet deep.

Michigan vs. Other States

Modern, unconventional wells produce dozens or even hundreds of thousands of barrels of oil each month. By contrast, most of the vertical wells in Michigan generate less than 500 barrels of oil per month. Of course, there are exceptions, but in general, Michigan is an older, less productive area for oil and gas development.

Dormant Mineral Act

Michigan has a Dormant Mineral Act, mineral rights revert back to the surface unless one of the following conditions is met:

The severed interest is sold, leased, mortgaged, or transferred by recorded instrument.

- A drilling permit is issued.

- Oil or gas is actually produced or withdrawn from the severed property.

- The interest is utilized for underground gas storage operations.

- A record claim of interest is filed with the county Register of Deeds (Affidavit to Retain).

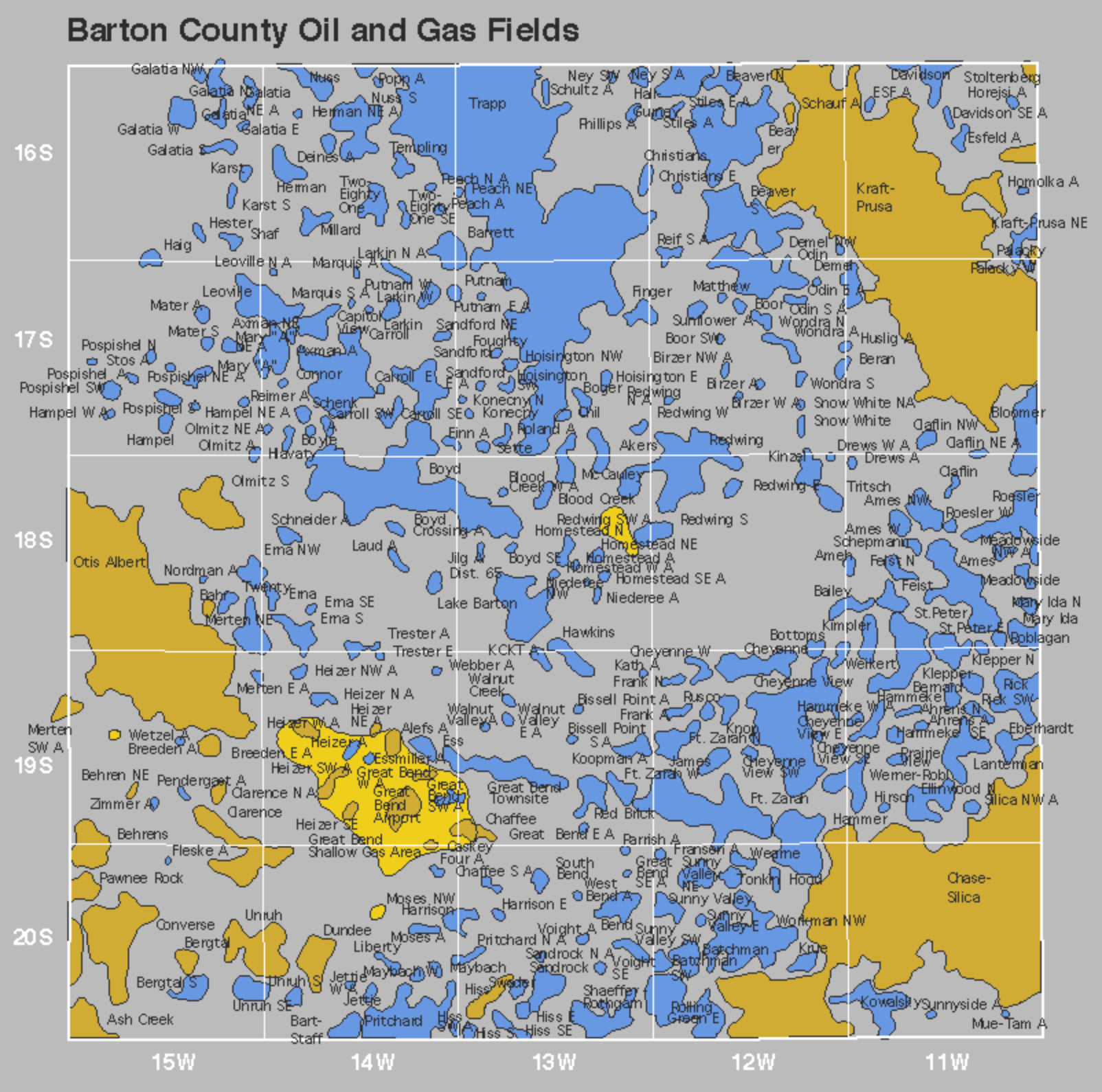

A Look Back in History

A Brief History of Oil & Gas Development

in Barton County, Kansas

Michigan has an interactive map showing all current and many past oil and gas wells.

If you know your legal description, it’s easy to locate the wells in which you own an interest. Not sure where to find the legal description? It’s on your property deed and your oil and gas lease.

- Locate wells

- View well info (depth, dates, fields, operator, etc.)

- View well status (active, plugged, water flood, dry holes, etc.)

- View production history

And more

Michigan uses the Public Lands Survey System (PLSS), so legal descriptions include a section, township and range:

Example Legal Description

Section 12 Township 29 North Range 04 West

Need more help? Contact us and we will be happy to look it up for you!

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Nationally Focused

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.