Why Your Oil and Gas Royalty Checks

Are Low

Sell Your Mineral Rights (Request an Offer):

It’s Not the Same

Times Have Changed

Back when your grandparents or great-grandparents started receiving royalties, they were likely farming a significant number of acres. Over time, more people left farming and moved to populated areas to pursue a different lifestyle. At the same time, minerals were fractioned as they transferred from generation to generation. So, if Grandma once owned 100% of the mineral under her 100-acre farm, her 25 grandchildren and great-grandchildren might only own one or two net mineral acres each. Additionally, the wells on the property are probably not as productive as they once were and many may have been plugged as the oil and gas were extracted.

Why Your Checks May Be Lower

Your oil and gas royalty checks might be lower than your predecessors because the interest has been fractioned as it was passed from generation to generation. The wells may also be less productive (all reservoirs run dry eventually), and commodity prices fluctuate.

1. Fractioned Interest

As mineral rights are passed from generation to generation, the interest is fractioned.

2. Depleting Resources

All oil and gas wells eventually run dry, and the reservoir is depleted. This can happen in a short time or over many decades.

3. Fluctuating Prices

The oil and gas industry is cyclic and prices regularly fluctuate based on the laws of supply and demand (and geopolitical impacts).

4. Spacing Rules

From Generation to Generation

Fractioned Interest

Minerals are fractioned as they pass from one generation to the next

Several generations ago, a large part of the population were farmers. They likely owned 100% of the minerals under their farms, and when oil or gas was discovered on their property, they profited greatly. However, as the minerals were passed to the next generation, the interest was fractioned, with each subsequent generation receiving a fraction of what was owned by the previous generation.

It’s easy to see how, in just a couple of generations, a tract of land can go from having a single mineral owner to more than 25. There are many tracts with hundreds of mineral owners, each with a very small interest and correspondingly small royalty checks.

The fractionalization of mineral rights is a huge problem nowadays. Most mineral owners own a small interest. When a mineral owner passes away, the mineral rights may have such a low value that it is hard for the family to justify the legal expenses associated with probating the estate and transferring the ownership of the minerals. Because of this, several states have Donmant Mineral acts or statutes, returning the minerals to the current surface owner.

All Wells Run Dry

Depleting Oil & Gas Resources

Over time, all reservoirs run dry

Oil and gas are finite resources, and all wells eventually run dry. Depending on the location, this can happen quickly or after many decades of production.

More than likely, your predecessors owned a much greater interest, and the wells were probably far more productive. Many older oil fields are full of plugged oil wells, with a few active wells here and there. Those that remain are often near the end of their economic lives.

This is not always the case. The Shale Boom brought new life to old reservoirs once thought to be dry or nearly dry and brought new development to places that never before saw oil and gas development.

Global Market Conditions

Fluctuating Oil & Gas Prices

Oil and gas prices fluctuate based on supply and demand, as well as geopolitical issues. When your parents, grandparents, or great-grandparents owned the mineral rights, they probably had a higher interest, the wells may have been more productive, and the price of oil and gas may have been higher. All of these factors can significantly impact the royalties received.

It’s no wonder you grew up hearing, “Never sell the mineral rights”. They were extremely valuable back then, but the world is a different place now, and your tiny fraction of interest in an older well may not really be as valuable as what your predecessors owned.

Regulatory Rules

Well Spacing Requirements

Oil wells used to be drilled closely together, which turned out to be detrimental to the reservoir. Today, most states have a regulatory agency that oversees oil and gas development with the goal of protecting the state’s natural recourses by regulating development. But this also means that there can be fewer wells drilled on a particular tract of land.

Nationally Focused

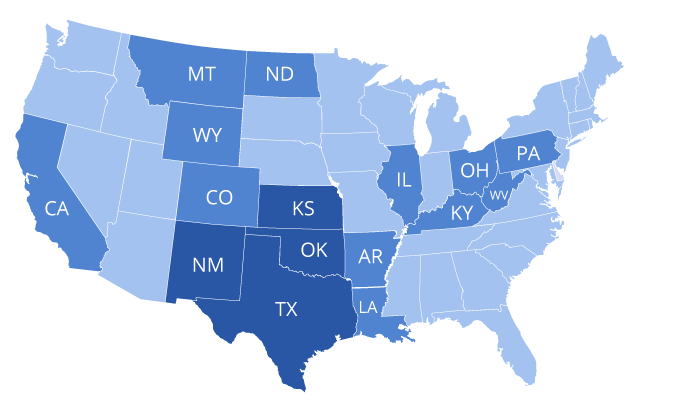

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

A Variety of Motivations

Why Sell Your Mineral Rights?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.