Sell Your Finney County Mineral Rights

Learn about mineral rights in Finney County, Kansas.

Sell Your Mineral Rights (Request an Offer):

A History of Oil Development

Finney County, Kansas

A brief overview of oil and gas activity

Finney County ranks #3 in oil and #7 in gas production for Kansas. The vast majority of wells are oil wells and Finney county has seen continuous development since 1928! Many of these older wells are no longer producing, but there are some very good, stable wells in Finney County.

Most of these wells are stripper wells, meaning they produce less than 15 barrels of oil per day. By contrast, many horizontal wells in Texas and Oklahoma produce north of 500 barrels of oil per day.

Striper wells have their place in our energy mix. In fact, they make up 7.4% of US oil production. They also disproportionally contribute to methane emissions which hurt the environment. The current administration is attempting to curtail methane emissions, which will put financial stress on small operators and may make many stripper wells uneconomical. Once a well is uneconomical, it is plugged and mineral owners no longer receive royalty payments.

Western Finney County

A Brief History of Oil & Gas Development

in Finney County, Kansas

After the financial devastation of the stock market crash of 1929 and the Dust Bowl, Finney county farmers and residents, who had been primarily dependant on farming, were facing an economic crisis. Many would have been forced to give up their land and relocate if not for oil and gas development. Oil and gas development began in the 1920s and thrived for four decades until production declined in the 1970s. Today, you see fields of golden grain with occasional pump-jacks that are still extracting comparatively small amounts of oil and provide a still-needed supplemental income to farmers.

Many farming families sold their property, reserving the mineral rights passed from generation to generation, with each subsequent generation usually owning a fraction of the original.

What’s Happening Now?

Modern Oil & Gas Drilling

Finney County ranks #3 in oil and #7 in gas production for Kansas, but the development is quite small compared with other areas of the United States with much better potential.

In 2021, there were only 13 drilling permits in Finney County. The other top-10 oil and gas producing counties in Kansas have a similar number of permits. The typical well in Kansas produces less than 15 barrels of oil per day. By contrast, many counties in Texas and Oklahoma have wells that produce more than 500 barrels of oil per day.

It’s really easy to see why Kansas sees very little oil and gas development these days. Kansas contains older oilfields, with many plugged wells that stopped producing as the reservoirs ran dry. Today’s oil and gas exploration companies are more interested in drilling in the shale basins where fracked horizontal wells generate vast amounts of oil and gas.

Interactive GIS Maps

How Do I locate My Kansas Mineral Rights?

Kansas recently updated its interactive map. It’s much more user-friendly, making it a breeze for mineral and royalty owners to find the information they need!

Knowing your legal description makes it easy to locate your oil and gas wells. Not sure where to find the legal description? It’s on your property deed and your oil and gas lease.

Kansas uses the Public Land Survey System (PLSS), so your legal description will consist of a section, range, and township.

In Finney County, you might see something like:

Section 16, Township 22 South, Rage 32 West

Need more help? Contact us, and we will be happy to look it up for you!

Us KGS’s GIS map to:

- Locate wells

- View well info (depth, dates, fields, operator, etc.)

- View well status (active, plugged, water flood, dry holes, etc.)

- View production history

- And more

Find Your Wells

Finney County Oil GIS Map

Once you locate your Finney County mineral rights in KGS’s interactive map, you will see various symbols representing the status of both old and current oil wells.

Finney county is largely a natural-gas producing county with pockets of oilfields. The majority of the once-producing gas wells in the highlighted sections have been plugged, but there are a couple that are still producing.

Because these are older wells (sometimes, very old wells), they only produce a fraction of what they once produced. These wells will eventually be plugged.

If you are contemplating selling your minenral rights, it’s best to do it while there is still value (you’re still receiving regular checks).

Know What You Own

Finney County Kansas Resources for Mineral Owners

The best way to maximize your mineral rights is to know what you own. Knowledge is power and these links may help you figure out what you own and be a better mineral manager.

Interactive Oil & Gas Map

Finney County Treasurer

Finney County mineral owners must pay annual Ad Valorum taxes to the county treasurer. You can look up your information using their online property tax information search.

Deed Records

The Finney County Register of Deeds is responsible for keeping public records related to “real property,” such as land and mineral deeds. Need a copy of your deed? The Register of Deeds should be able to provide you with a copy.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Nationally Focused

Where We Buy Mineral Rights

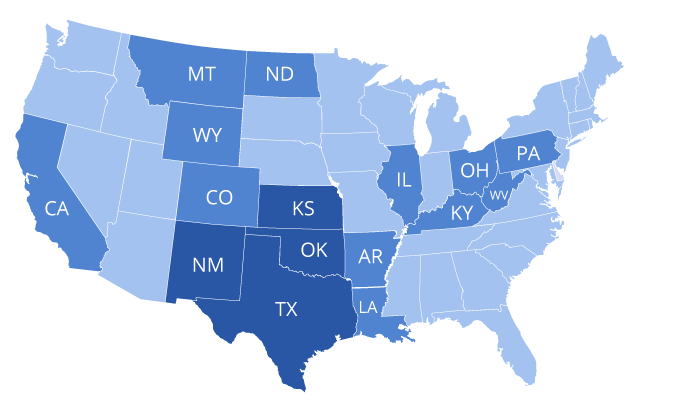

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.