Sell Your Barton County Mineral Rights

We buy oil and gas royalties and mineral rights in Kansas and throughout the United States.

Sell Your Mineral Rights (Request an Offer):

A Legacy of Production

Barton County, Kansas

A brief overview of oil and gas activity

Barton County ranks #4 in oil production for Kansas. The vast majority of wells are oil wells and Barton county has seen continuous development since the 1920s! Many of these older wells are no longer producing, but there are some very good, stable wells in Barton County.

Most of these wells are stripper wells, meaning they produce less than 15 barrels of oil per day. By contrast, many horizontal wells in Oklahoma and Texas produce north of 500 barrels of oil per day.

Striper wells have their place in our energy mix. In fact, they make up 7.4% of US oil production. They also disproportionately contribute to methane emissions, which hurt the environment. Attempts to curtail methane emissions, which will put financial stress on small operators and may make many stripper wells uneconomical. Once a well is uneconomical, it is plugged, and mineral owners no longer receive royalty payments.

Barton County

A Brief History of Oil & Gas Development

in Barton County, Kansas

After the financial devastation of the stock market crash of 1929 and the Dust Bowl, Barton county farmers and residents, who had been primarily dependant on farming, were facing an economic crisis. Many would have been forced to give up their property and relocate if not for oil and gas development. Oil and gas development began in the 1920s and continued for four decades until production declined in the 1970s. Today, you see agricultural fields with periodic pumpjacks still extracting oil (albeit in much smaller quantities).

Oil production has declined over time, and many are producing only a fraction of what they once produced. Additionally, many mineral owners have passed away. The mineral rights have been transferred from generation to generation, with each subsequent generation only owning a fraction of what the previous generation owned. Consequently, most Kansas mineral rights are not nearly as valuable as they were in the past.

Barton County

Modern Oil & Gas Drilling

Barton County ranks #4 in oil production for Kansas, but the development is quite small compared with other areas of the country, with much better potential.

In 2024, there were only 30 drilling permits in Barton County. The other top 10 oil-producing counties in Kansas have a similar number of permits. The typical well in Kansas is a stripper well and produces less than 15 barrels of oil per day (often less than 5) By contrast, many counties in Texas have wells that produce more than 500 barrels of oil per day.

It’s really easy to see why Kansas sees very little oil and gas development these days. Kansas contains older oilfields, with many plugged wells that stopped producing as the reservoirs ran dry. Today’s oil and gas exploration companies are more interested in drilling in the shale basins, where fracked horizontal wells generate vast amounts of oil and gas.

GIS Mapping

How do I locate my Kansas Mineral Rights?

Kansas recently updated its interactive map. It’s much more user-friendly, making it a breeze for mineral and royalty owners to find the information they need!

Knowing your legal description makes it easy to locate your oil and gas wells. Not sure where to find the legal description? It’s on your property deed and your oil and gas lease.

Kansas uses the Public Land Survey System (PLSS), so your legal description will consist of a section, range, and township.

Need more help? Contact us, and we will be happy to look it up for you!

Use the Kansas Geological Survey (KGS) GIS map to:

- Locate wells

- View well info (depth, dates, fields, operator, etc.)

- View well status (active, plugged, water flood, dry holes, etc.)

- View production history

- And more

Current & Past Production

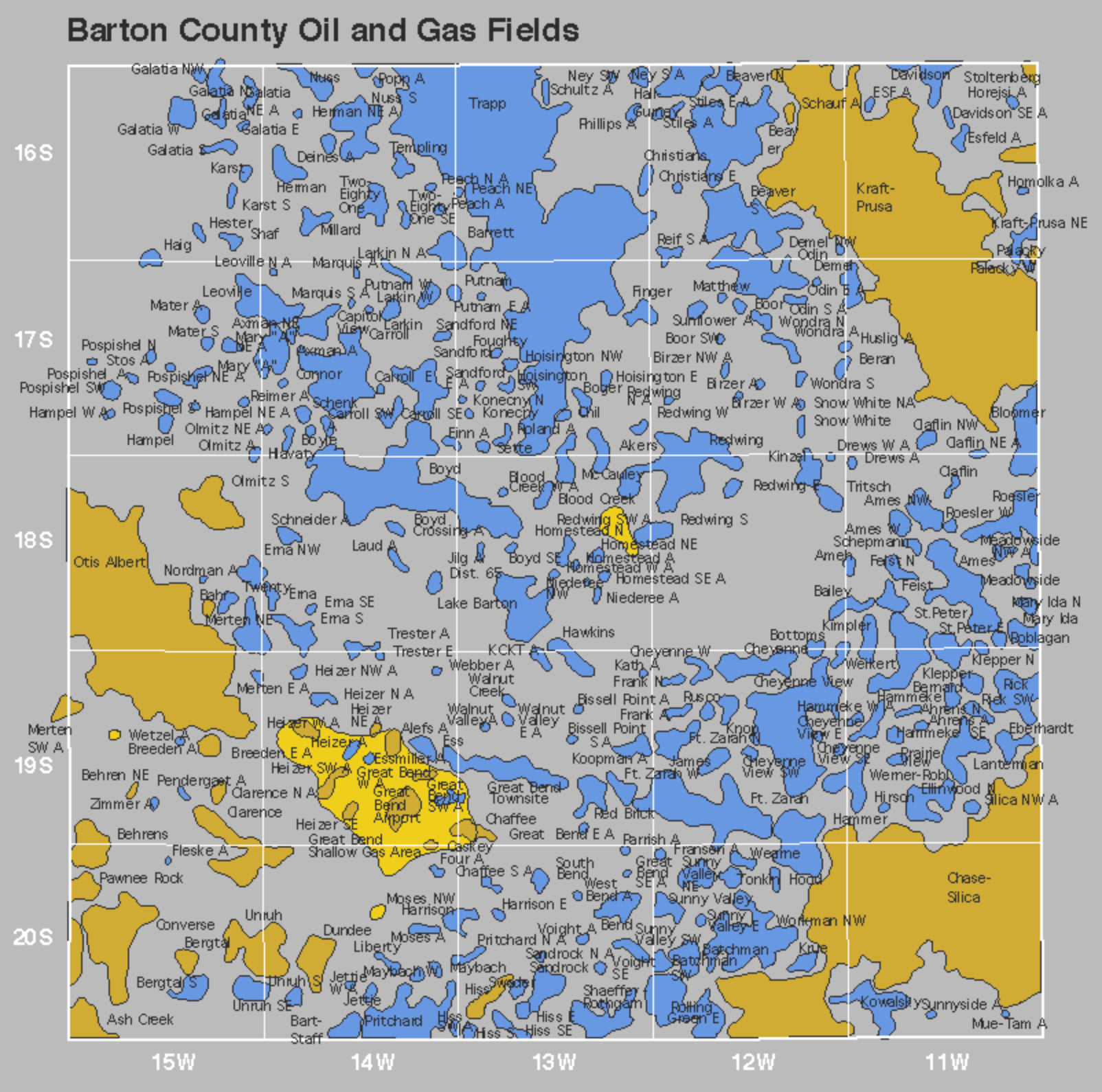

Barton County Oil GIS Map

Once you locate your Barton County mineral rights in KGS’s interactive map, you will see various symbols representing the status of both old and current oil wells.

As you can see from the sample map (taken from a random area in Ellis County), there were a lot of dry holes drilled to find oil! The majority of the once-producing oil wells have been plugged, but there are a few that are still producing.

Because these are older wells (sometimes, very old wells), they only produce a fraction of what they once produced. These wells will eventually be plugged.

If you are contemplating selling your mineral rights, it’s best to do it while there is still value (you’re still receiving regular checks).

Everything You Need

Barton County Kansas Resources for Mineral Owners

The best way to maximize your mineral rights is to know what you own. Knowledge is power and these links may help you figure out what you own and be a better mineral manager.

Interactive Oil & Gas Map

The Kansas Geological Society maintains an interactive map where you can look up your mineral rights using the legal description on your deed (or lease). Need help? Call us, and we can look it up for you.

Property Taxes

Rooks Kansas mineral owners (over a minimum value) must pay annual Ad Valorem taxes to the county treasurer. You can look up your tax account on their online system.

Deed Records

The Barton County Register of Deeds, April Brown, is responsible for keeping public records related to “real property” such as land and mineral deeds. Need a copy of your deed? The Register of Deeds should be able to provide you with a copy.

Valuation 101

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Nationally Focused

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.