Avoiding Predatory Mineral Loans

Before you use your mineral rights as collateral or take out a mineral loan, make sure you don’t fall prey to these common predatory loan practices!

Sell Your Mineral Rights (Request an Offer):

What to Look Out For

Watch Out for These Predatory Lending Practices

As an oil and gas mineral owner, you might be especially susceptible to predatory lending practices. Lenders know you need the money, and most likely, you won’t understand the legal jargon in your loan and probably won’t hire an attorney to protect your interest. This list is not comprehensive, but it might help you avoid some of the major pitfalls.

High Interest Rates

Watch out for interest rates that are higher than what your bank might charge for a similar loan.

Default Inteest Rate

If you default on your loan, the interest rate may skyrocket, which can be financially crippling and make it difficult for you to pay off the loan.

Prepayment Penalty

A prepayment penalty can be a red flag in predatory lending, as it discourages borrowers from paying off their debt early, thereby ensuring the lender maximizes interest income.

Easy to Trigger Default

The conditions for default are broad and can be triggered easily. For instance, failure to pay any amount by the due date or any inaccuracy in representations can lead to default.

Immediate Acceleration

Upon default, the entire loan amount becomes immediately due and payable, which can be financially devastating for the borrower.

Ignorance May Cost You

Not fulling understanding your mineral rights may cause you to misreprenst what you own and cause an automatic default on your loan.

Loss of Mineral Ownership

In the event of default, the lender has the right to record the Mineral and Royalty Deed, permanently transferring the ownership of valuable mineral rights from the borrower to the lender.

Waiver of Jury Trial

You may be waving your right to a jury trial, which can limit your ability to seek redress in court and may indicate an imbalance in negotiating power.

Indemnification

The borrower may be required to indemnify the lender against various liabilities, further increasing the borrower’s risk and financial burden.

Confidential Information

The loan may place strict confidentiality requirements on the borrower, limiting transparency and the borrower’s ability to seek external advice or support.

Repayment Options

The borrower may have to wave the option to make a small number of installment payments in favor of 24 – 60 monthly payments, which, if not clearly detailed may confuse borrowers about their repayment obligations and lead to default.

Right of First Refusal

The lender may require a Right of First Refusal with no expiration date, meaning they get the buy your mineral rights, if you at some point in the future, you decide to sell (even if you want to sell to someone else). This can follow the mineral ownership and impact your children and grandchildren.

Learn By Experience

Case Study and How to Protect Yourself

Let’s go over a real-life example so you can see how easy it is to be taken advantage of. Then, we’ll explore ways you can protect yourself.

Case One

The Case of Jessica Davis

(Names and essential details have been changed for privacy reasons)

Jessica inherited significant mineral rights in Eddy County, NM, valued at around $160,000.

Despite making a pretty good royalty income, she needed additional money but didn’t want to sell her mineral rights. So, she took out a loan for 10K using her mineral rights as collateral. Jessica is not an attorney so she didn’t fully understand what she was signing. The also didn’t get a loan from her local bank or credit union – she went to a company that specializes in mineral loans.

Unfortunately, Jessica became the victim of a predatory lender. Here are some of the really bad parts of her loan agreement:

High Interest Rate of 18%

Jessica’s interest rate was 18%, which is likely much higher than a comparable loan at her bank.

Default Interest of 28%

If Jessica defaults on her payments, her interest rate jumps to 28%, the maximum allowed by Texas law.

Default Causes Loss of Mineral Ownership

That’s right! If Jessica makes one late payment, she might lose her mineral rights because she signed a deed that the lender can record in the event of a default. The lender would get Jessica’s $160,000 mineral rights for just 10K!

Aggressive Default Terms

Because the default terms are broad and can be triggered easily, Jessica will likely lose her mineral rights – unless she does everything exactly right.

Balance of Loan Due Upon Default

If Jessica does one thing wrong (i.e., sends a payment 1 day late or doesn’t fully understand her mineral rights and misrepresents something), the balance of the loan immediately becomes due. What if she cannot pay it? Then Jessica forfits ownership of her mineral rights!

Waving a Jury Trial

Jessica’s loan document agrees to wave a jury trial, limiting her options to remedy this unfair and unethical situation.

Right of First Refusal

One document signed with the loan was a “Right of First Refusal,” which had no expiration date and would stay attached to the mineral title. This means that in the future if Jessica (or her heirs) want to sell the mineral rights, the lender has the right to buy the mineral rights.

Don’t you feel outraged on Jessica’s behalf? We did (which is why we created this page). We don’t want you to end up in Jessica’s position.

Action Items

How to Protect Yourself

The first step to protecting yourself from predatory mineral loans is to know what you are signing.

It’s always best to consult an attorney – that’s the gold standard.

However, we also recognize that if you are taking out a loan, you might not be able to afford an attorney. In that case, consider enlisting the help of AI (via ChatGPT).

ChatGPT is free but the paid version is way better. You can upload your loan document and ask ChatGPT to act as an attorney and explain the terms of the document.

While this is not the same as hiring an attorney (and AI does hallucinate and produce errors), it can be incredibly helpful in translating your contract into simple English.

Knowing what your contract says may empower you to either walk away or negotiate better terms with the lender.

You Have Choices

Consider Alternatives

You will probably get a better interest rate and non-predatory terms by going through your local bank or credit union. However, if your credit is not good, you’ll be considered “high risk” and may face some of the same challenges.

It might be better to sell your oil and gas mineral rights rather than using them as collateral for a loan.

Nationally Focused

Where We Buy Mineral Rights

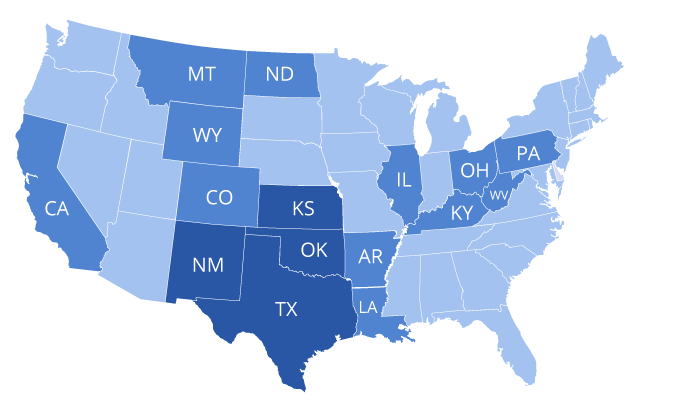

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Top Valuation Factors

How We Value Mineral Rights

There are many factors that play into the value of mineral rights. These include location, producing vs. non-producing properties, current oil and gas prices, well production figures, lease terms, and even the operator of the well or wells. We also look at the risks of buying and owning minerals that you are interested in selling.

Location

Minerals in the hottest shale plays are more valuable than those in older fields with conventional wells.

Producing vs. Non-Producing

Producing minerals are often worth more than non-producing minerals because they are generating revenue.

Oil & Gas Prices

When oil and gas prices drop, revenue drops, and sometimes operators are unable to continue operating the well.

Production

Highly productive wells (and off-set wells) can increase the value of your minerals.

Lease Terms

Favorable lease terms (such as a 25% royalty reservation) positively impact the value of the leased minerals.

Operator

A small number of operators are unethical, and their reputation automatically devalues your minerals.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.