A QUICK GUIDE TO

Transferring Ownership of Mineral Rights

Learn how to transfer ownership to another person or entity and get into pay status.

Sell Your Mineral Rights (Request an Offer):

Why Mineral Rights are Transferred

There are many reasons that oil and gas royalties and mineral rights need to be transferred from one person or entity to another. Most often it’s because the mineral owner passed away or because of divorce proceedings. However, mineral rights are also transferred before the death of a mineral owner (to avoid probate, or for estate planning purposes), when transferring into or out of a trust, or upon the sale of mineral rights.

After Death

Mineral rights may be transferred by deed (from the estate) or court order (probate) after the death of a mineral owner.

After a Divorce

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording.

Gift or Before Death

Mineral rights can be deeded or assigned to heirs before the death of a mineral owner, which can make it easier to wrap up an estate.

Into a Trust

Mineral rights must be deeded or otherwise conveyed to the trust in order to be transferred into the trust.

Out of a Trust

When a trust beneficiary passes away, the assets owned by the trust are usually sold or conveyed to heirs.

Selling Mineral Rights

Mineral rights can be sold to a family member or other buyer. The buyer will typically draft the deed and take care of the transfer process.

Step-by-Step Process

Mineral Rights Transfer Overview

Transferring the ownership of oil and gas mineral rights is quite easy, but it often seems daunting to new mineral owners. You might need to hire an attorney to draft the deed or assignment (which may require probate), the overall process is quite simple.

Easier Than You Think

Three-Step Transfer Process

There are three steps to transferring the ownership of oil and gas royalties and mineral rights. Producing minerals will need to follow all three steps, but non-producing minerals only need the first two steps. Depending on the situation (death, divorce, trust, etc), the requirements may differ slightly).

1. Create Documents

Have an attorney draft a deed or assignment from the previous mineral owner (or their Estate or Trust) to the new mineral owner.

2. Record Documents

Have the document recorded with the county where the mineral rights are located (County Clerk or Register of Deeds).

3. Notify Operators

Provide the operators with a copy of the recorded conveyance document and request an ownership transfer.

Guiding You Through the Process

Situation-Specific Ownership Transfer Guide

The process of transferring the ownership of oil and gas royalties and mineral rights depends on your specific situation. The most common triggers for an ownership transfer are the death of the owner, divorce, estate planning, moving into or out of a trust, gifting to a family member, or selling your mineral rights. This guide will help you find the right path for your situation.

Interactive Transfer Guide

Find out what steps you need to take

What's triggering the transfer?

Will the estate go through probate?

Transfer After Death (With Probate)

The estate goes through probate court. This typically takes several months to over a year depending on complexity and court backlogs.

The executor/administrator receives Letters Testamentary or Letters of Administration from the probate court.

A mineral deed is prepared transferring ownership from the estate to the heirs/beneficiaries. This typically requires an attorney.

The deed and probate documents must be recorded in the county where the minerals are located. If the minerals are in a different state than where probate occurred, you may need ancillary probate—a separate probate proceeding in the state where the minerals are located.

If there are active oil or gas wells and the previous owner was receiving regular or periodic royalty checks, the new owner(s) must notify the operators of the ownership change and provide copies of the recorded documents. It's a good idea to notify the local tax office so the new owner will receive future Ad Valorem tax bills (in states that assess the mineral owners separately from the operators).

Transfer After Death (Without Probate)

When Probate Isn't Required

If the estate won't go through probate, the transfer method depends on how the deceased owned the minerals:

Possible Transfer Methods:

- Trust: If minerals were held in a trust, the successor trustee can transfer ownership according to the trust terms

- Joint Tenancy with Right of Survivorship: Ownership automatically passes to the surviving joint tenant(s)

- Affidavit of Heirship: Some states allow heirs to file an affidavit establishing their right to inherit (common in Texas, requirements vary by state)

- Transfer on Death Deed: If the deceased filed a transfer on death deed before passing, ownership transfers automatically

Work with an attorney to determine which method applies to your situation and what documentation is required.

The attorney will prepare the necessary conveyance (deed, trustee's deed, affidavit of heirship, etc.) based on how the minerals were owned.

The conveyance must be notarized and recorded in the county where the minerals are located.

If there are active oil or gas wells and the previous owner was receiving regular or periodic royalty checks, the new owner(s) must notify the operators of the ownership change and provide copies of the recorded documents. It's a good idea to notify the local tax office so the new owner will receive future Ad Valorem tax bills (in states that assess the mineral owners separately from the operators).

Not Sure If Probate Is Required?

Whether probate is required depends on several factors:

- Did the deceased have a will?

- How were the minerals owned (solely, joint tenancy, in a trust)?

- The value of the total estate

- State law requirements

You'll need to consult with an estate attorney in the state where the minerals are located to determine if probate is necessary.

Transferring Through Sale

Agree on price and terms with the buyer. Review all documents carefully.

The buyer typically prepares the mineral deed, but you should have an attorney review it before signing.

Have the deed notarized and ensure it's recorded in the county where the minerals are located. The buyer typically handles recording and pays recording fees.

If minerals are producing, the buyer will notify operators of the ownership change.

Gifting to Family Member

The person giving the gift may need to file a gift tax return if the value exceeds $18,000 per year per recipient. Most people won't owe actual gift taxes due to the lifetime exemption, but filing may be required. Consult a tax professional before proceeding.

Have an attorney prepare a mineral deed gifting the property to your family member.

Have the deed notarized and recorded in the county where the minerals are located.

If there are active oil or gas wells and the previous owner was receiving regular or periodic royalty checks, the new owner(s) must notify the operators of the ownership change and provide copies of the recorded documents. It's a good idea to notify the local tax office so the new owner will receive future Ad Valorem tax bills (in states that assess the mineral owners separately from the operators).

Divorce Settlement Transfer

Mineral rights are divided according to the divorce decree or settlement agreement.

Have an attorney prepare a mineral deed consistent with the divorce decree terms.

Have the deed notarized and recorded in the county where the minerals are located.

If there are active oil or gas wells and the previous owner was receiving regular or periodic royalty checks, notify operators of the ownership change and provide copies of the recorded documents. It's a good idea to notify the local tax office so the new owner will receive future Ad Valorem tax bills (in states that assess the mineral owners separately from the operators).

Trust or Entity Transfer

Are you transferring minerals into or out of a trust/entity?

An attorney should prepare the appropriate deed or assignment. The specific documents depend on the entity type and structure.

Have all transfer documents notarized and recorded in the county where the minerals are located.

If there are active oil or gas wells and the previous owner was receiving regular or periodic royalty checks, notify operators of the ownership change and provide copies of the recorded documents. It's a good idea to notify the local tax office so the new owner will receive future Ad Valorem tax bills (in states that assess the mineral owners separately from the operators).

A Detailed Look

Various Transfer Scenarios in Detail

The process of transferring ownership depends heavily on the situation. Did the previous owner pass away? Was there a divorce? Are you trying to simplify your estate? These scenarios and more are described below.

Transferring Mineral Rights After a Death

(With or without probate)

What happens to mineral rights when someone dies?

When a mineral owner dies, their mineral rights can be transferred according to their will or, in the absence of a will, through the laws of intestate succession through the probate process. Mineral rights usually transferred the same way a real estate (a farm or house) is transferred – by a deed from the estate or court order.

Inheriting Oil and Gas Royalties and Mineral Rights

Often, when heirs are notified that they will be inheriting mineral rights, they know very little about mineral rights. In fact, they may know nothing more than Uncle Joe owned an interest in an old oil well in Texas. It can be a challenge to find the necessary information to transfer the mineral rights and get into pay status.

How do you find mineral rights when you aren’t sure what you’ve inherited?

Hire a landman or an attorney. A landman is a professional who is usually hired by an oil and gas company to locate the people who own mineral rights under a specific tract of land. A landman can help you figure out what your relative owned and even guide you through the process of transferring the mineral ownership to the heirs.

How do you transfer mineral ownership?

Transferring mineral rights after death depends on whether the deceased had a will and whether or not the estate is in probate. If the deceased died in a state other than where the minerals are located, ancillary probate might be required before the mineral rights can be transferred or sold.

If this process is not followed, the beneficiary or buyer may be unable to transfer ownership and get into pay status. Not every state requires ancillary probate, but many do.

Consult an attorney about the laws in the state where the mineral rights are located.

We didn’t do probate. What now?

Requirements vary significantly by state:

Texas: Allows Affidavit of Heirship after 4 years have passed since date of death. Must be signed by two disinterested witnesses who knew the family. Creates marketable title but doesn’t vest legal ownership.

Oklahoma: Affidavit of Death and Heirship creates rebuttable presumption of marketable title. Title becomes marketable if no contrary instruments are recorded within 10 years.

New Mexico: Small Estate Affidavit available for estates under $50,000 (excluding homestead and exempt property).

Important: Even if operators accept an AOH and begin payments, you may not legally own the minerals until transferred by deed or probate. This creates title clouds that can make it difficult to sell the minerals in the future.

Okay, Probate is finished. Now What?

Assuming the estate has gone through probate, this is the likely process that will follow:

Step 1: Create Conveyance Documents

Ideally, the personal representative or executor should have created a conveyance document transferring the mineral rights to the heirs. That conveyance has to be recorded in the county where the minerals are located.

Sometimes, probate records are recorded instead of conveyance documents. The requirements vary by state but will often include a certified copy of probate documents, the will, and a death certificate.

If the mineral owner had non-producing minerals (i.e., there are no active wells and, therefore, no royalty checks), the transfer is complete when the documents have been recorded with the county and returned to you.

Step 2: Have Documents Recorded

Send the original deeds, assignments, or conveyance documents to be recorded in the county where the minerals are located. Sometimes, this is the County Clerk, Register of Deed, or other official tasked with keeping the deed records.

Check with the county for the recording fee and, in some counties, the appraisal district should be updated so you receive future tax bills. You may also need to record a copy of the death certificate and probate documents.

After the documents have been recorded, the county will send the originals back to you. Keep these in a safe place for future reference. It’s also a good idea to scan these documents and keep digital files.

Step 3: Transfer Ownership

Once the conveyance documents, probate, or affidavits have been recorded with the county clerk (or whoever keeps deeds and title records), send copies to the companies that operate the wells.

After analyzing the documents for correctness and completeness, the operator will transfer ownership to the new owner(s) and send out division orders.

After you verify the information and sign the division order, you should begin receiving royalty checks.

The transfer process can take one to six months. You may need to follow up with the operator several times before receiving checks.

Every situation is different, and an attorney or a landman can help you navigate this often complex situation.

Image Description: Three generations of a family sitting on a sofa and smiling, which is symbolic of passing mineral rights from generation to generation.

Image Description: A married couple sit on opposite sides of a bed, clearly unhappy with their relationship.

Division of Assets

Transferring Mineral Rights After a Divorce

During a divorce, all property is divided between the two parties in the manner agreed upon or by court order.

Transferring Non-Producing Mineral Rights After a Divorce

After a divorce, mineral rights can be transferred by submitting the divorce decree and conveyances to the county (where the minerals are located) for recording. They usually go to the same agency that records titles and property deeds.

The county will return the recorded original documents to the new owner. Because there are no producing wells on the tract of land, the transfer of ownership is complete. The only thing left to do is keep good records of what you own while you wait (and hope) for someone to offer to lease your minerals.

Transferring Producing Mineral Rights After a Divorce

The first step of transferring mineral rights is the same for both non-producing and producing mineral rights: conveyances and a divorce decree must be recorded by the county where the mineral rights are located.

When you get the recorded documents back from the county, copies can be forwarded to the operator of the well(s). The operator will review the documents for accuracy before transferring the ownership and sending out new division orders. You will start receiving checks shortly after reviewing and signing the division orders.

This is the general procedure:

- Submit divorce decree and/or conveyances to the county for recording.

- Submit the recorded conveyance and/or divorce decree to the operator.

- The operator will review the documents and transfer the ownership, sending out new division orders.

- Review and sign the division orders (and W9).

Estate Planning

Moving Mineral Rights Into or Out Of a Trust

Mineral rights can be deeded (or assigned, in the case of ORRIs) into or out of a trust. Normally, this requires the help of an attorney to draft the documents.

How are Mineral Rights Transferred Into a Trust?

A trust needs to be “funded” by transferring your assets into the trust. We see a lot of cases where mineral owners have a trust, but they never deeded (or assigned) the mineral rights to the trust, and therefore the oil and gas royalties and mineral rights are still owned personally.

You may need the help of an attorney to deed your mineral rights into the trust. The same attorney who drafted the trust can probably draft a deed or assignment to convey the mineral rights into your trust. Or, you can hire an oil and gas attorney.

The Mineral Deed or Assignment of Overriding Royalty Interest will need to be recorded in the county where the mineral rights are located. There is usually a small recording fee ranging from $20 to $100). After recording your document in the county deed records, the original will be returned to you.

If there are no producing wells on the tract of land, the ownership transfer is complete. The only thing left to do is keep good records of what you own while you wait (and hope) for someone to offer to lease your minerals.

How are Mineral Rights Transferred Out of a Trust?

When the beneficiary of a trust passes away or a trust a closed, the assets are usually liquidated by sale or conveying the assets to the beneficiaries.

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located.

If there are producing wells on the property, each operator will need to be notified of the change in ownership. Operators do not know the ownership has changed unless you tell them. You will need to send a copy of the recorded deed to each operator and follow up with them until they have transferred the mineral rights and you receive a division order. Once you review, sign, and return the division order, the operator will start paying you.

Avoiding Probate

Transfering Minerals Before Death

Why Transfer Oil and Gas Mineral Rights Before Your Death?

You might be doing your heirs a huge favor by transferring your mineral rights before you pass away.

By deeding your minerals before you die, you could help your heirs:

-

-

- Avoid probate (in some cases)

- Reduce legal expenses

- Reduce frustration and overwhelm

-

Long-Term Care Planning

You may want to consider how owning mineral rights will impact your long-term care plans. In many states, there is a 5-year look-back period, so you may want to give your minerals to the next generation (or sell them) long before your may need assisted living or skilled nursing care.

Do your heirs want the mineral rights?

We see a lot of cases where the next generation does not want to own mineral rights. Some younger people do not want to profit from fossil fuels, while others just don’t want to take on the management of small mineral rights that have been fractioned over generations.

If your heirs are going to sell the mineral rights anyway, you may prefer to sell them yourself and use the money in a way that brings you joy.

Easier Than You Think

Selling Your Mineral Rights

You can sell your mineral rights to someone you know (such as a family member) or to a mineral buyer, like Blue Mesa Minerals.

How do I Sell Mineral Rights to Family or Friends?

Many mineral owners want to keep the minerals “in the family”. Rather than splitting Mom’s minerals among four children, some families opt to have one of the kids buy out the others. This prevents the mineral estate from being further fractionated and devalued.

If you want to sell the mineral rights to a family member or friend, one (or both) of you will need to hire an attorney to draft the deed. Once the deed has been notarized, the original must be recorded in the county where the minerals are located. If there are producing wells, the operators need to be notified of the change in ownership.

Selling to a Mineral Buyer

It’s often easier to sell mineral rights to a mineral buyer rather than a family member. The mineral buyer will do all the work, saving you time, frustration, and legal fees. It shouldn’t cost you anything to sell your mineral rights, but if you pass away while owning them, your heirs will have to pay legal fees to transfer the ownership from your estate.

Selling Mineral Rights from Abroad

If you’ve inherited mineral rights but now live outside the United States, the transfer and sale process requires a few additional steps. We specialize in helping international sellers navigate the process of selling US mineral rights from overseas.

Image Description: A large mesa looms in the background of the desert landscape. The sky is purple from a looming storm.

Frequently Asked Questions

Ownership Transfer FAQs

How long does it take to transfer ownership of mineral rights and how much does it cost?

Depending on your situation, it could take weeks, months, or years to transfer mineral rights ownership from one person or entity to another. In a simple case, where the deeds are already notarized, it might only take a few weeks to have the deed recorded with the county and then notify the operator (but it might take the operator 2-7 months to process the transfer). In a more complex case, where probate is needed, the probate process might add many months to the timeline.

Probate: Takes 6-18 months (and costs $2,500 to $15,000, depending on complexity).

Recording documents: Between 2 and 6 weeks, costing $25 to $250.

Operator transfers: Between 30 and 180 days (no cost).

Title searches: Takes days to weeks and costs $500-$1,500.

Common Complications:

- Missing heirs

- Clouded title

- Multiple states of ownership

- Competing claims

- Dormant mineral acts

- Ancillary probate requirements

How do I know what needs to be transferred?

When someone passes away, it’s fairly common for their family to feel overwhelmed, not only by the death itself but also by the process of wrapping up someone’s life and handling their estate.

You might have to piece the ownership knowledge together from various sources. If the previous owner was receiving periodic or regular royalty checks, try to locate the royalty statements (often sent with the checks or separately). Some owners keep files in a shoebox or a filing cabinet. Others keep nothing at all. Nowadays, many operators send electronic statements, so you might find this information in the owner’s email or on EnergyLink.

Once you have located the statements, you’ll find the state, county, and property name, which will be helpful in locating your wells on a map (to see who is currently operating the wells and if they are still producing).

Now that you know the county, you can check with the county clerk, register of deeds, or other official responsible for keeping public property records. Some counties keep records online that go back to the 70s or 80s (and so go further back). If you search for the owner’s name and their predecessor’s in title, hopefully you will find the previous deeds. The previous deeds will lead you to the legal description, which you’ll need for the conveyance instrument.

Do I need to hire an attorney?

In many cases, most people will need to hire an attorney to help them with filing probate, ancillary probate (if needed), creating an Affidavit of Heirship (AOH), preparing a Mineral & Royalty Deed, performing a title search, and other similar services.

There are some individuals who are able to navigate this on their own, but legal advice is always preferred. We’ve seen a lot of families try to transfer ownership themselves and make some pretty big mistakes that end up creating a cloud on the title and either reduce the value of the mineral rights or necessitate corrective action.

If you do not have the time, energy, or funds to hire an attorney, you might want to consider selling your mineral rights. Selling will not cost you anything, and the buyer will prepare the deeds and process the transfer.

How do I estimate the value the mineral rights?

The value of mineral rights depends on a variety of factors, such as the location, production volume (if producing), commodity prices, interest rates, revenue, decline curve, operator, and more. You can get a ballpark estimate using our mineral rights valuation calculator.

What do I do with low-value mineral rights?

A lot of families end up with the common problem of deciding what to do with low-value mineral rights. Often, it does not make sense to divide the minerals among the heirs/beneficiaries and give everyone a new kind of tax headache.

Often, low-value minerals are even hard to sell – it takes almost as much time and effort to acquire low-value minerals as it does to acquire higher-value minerals. Also, it might not be worth the future management headache for these companies.

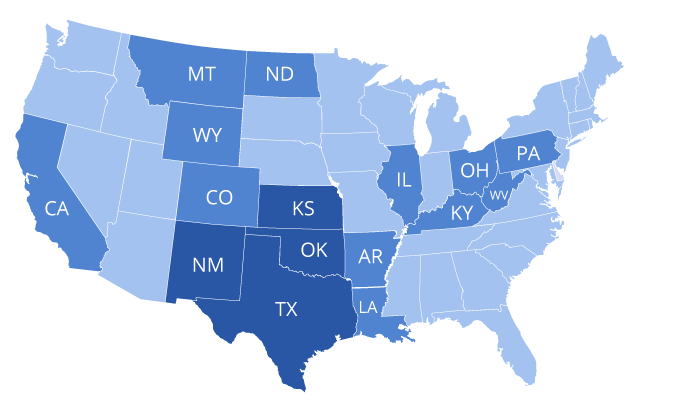

Donations

So, what do you do with low-value minerals? One of the best options is to donate your mineral rights. In fact, depending on how busy we are, we take donations of low-value minerals in certain states (TX, OK, NM, KS, WY, etc).

Surface Owner

If you cannot find a buyer or someone to accept a donation, you might contact the current surface owner to see if they would like the mineral rights.

Can I abandon mineral rights?

There is no way to abandon mineral rights by inaction. Mineral rights are real property, and personal representatives, trustees, and estate executors all have a fiduciary responsibility to distribute or sell the mineral rights. If not distributed, ownership will still pass to the heirs under the state laws.

Exceptions:

In some states, non-producing mineral rights might be subject to a dormant minerals act, and after a certain amount of time of inaction, the mineral rights ownership is returned to the surface. Contact an attorney for legal advice on your specific situation.

History and Context

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Variety of Motivations

Why Sell Your Mineral Rights?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.