A QUICK GUIDE TO

Selling US Mineral Rights When You Live Overseas

Learn what is involved in selling your United States oil and gas royalties and mineral rights when you live overseas (particularly Canada, Australia, and the UK).

Sell Your Mineral Rights (Request an Offer):

How Did You Come to Own Your Minerals?

Common Scenarios

A portion of the 12 million mineral owners live outside of the United States, either temporarily or permanently.

Feamily Members Who Received Minerals Through Estate Distribution

When a parent, grandparent, or other family member passes away, their estate is typically distributed to their heirs or beneficiaries, some of whom might live outside of the United States.

Dual Citizens who Moved Abroad

Millions of people are citizens of both the United States and another country. It’s pretty common for dual citizens to spend time in both countries or to move outside of the US, which leaves them with tax and administrative headaches.

International Investors

Oil and gas investments are a unique investment vehicle, even among international investors. Sometimes, investors find that their investments weren’t as lucrative as expected (a lot of investors were burned from 2017 – 2020). Sometimes the complexities of owning US minerals are just too much of an administrative headache.

Expats & More

What Are the Financial Challenges of Owning US Mineral Rights from Overseas?

The legal, financial, and administrative burden can be overhwleming.

Federal Taxes

Operators send 1099-MISC to anyone who receives royalty payments, and you must file a US tax return and report this income to the IRS.

State Taxes

If the minerals are located in a state with state income taxes, you will pay state income taxes in addition to federal income taxes.

Direct Deposit & ACH

Direct Deposit isn’t always available for international accounts, so you may receive paper checks mailed to a US or international address. Fees may be charged to deposit checks or convert currencies.

Quarterly Estimated Taxes

Depending on how much you earn in royalties, you may be required to make quarterly estimated tax payments.

Ad Valorem Taxes

In most states, mineral owners pay an additional local property tax called an Ad Valorem Tax. If this tax is not paid, the county can auction off your mineral rights.

Transferring Ownership

Transferring ownership from one generation to the next can be a huge burden for expats. You may have to file probate or ancillary probate in the United States. You may have to find a US attorney in the state where the mineral rights are locate,d and each person who inherits the minerals will now take on an extra tax burden.

A Quick Guide for International Sellers

How to Sell Your US Mineral Rights

Selling your oil and gas royalties and mineral rights when you live in the United States is very easy. It’s still easy if you live internationally, but there are extra complications. We have experience in a variety of situations, so we’ll walk you through the process from start to finish. It’s really not that complex or difficult.

Request an Offer

The first step to selling your mineral rights is to request an offer. We’ll ask you to send whatever documents you might have such as royalty statements and deeds (don’t worry if you have limited information – we’re used to that). We’ll do some research and get back to you with an offer.

Accept Your Offer

When an offer is accepted, we will send you a Purchase and Sale Agreement (PSA) and begin the title search and draft the closing documents.

Close (Notarize the Mineral & Royalty Deed)

- Signed by a US notary

- Or notarized at a US Consulate

- Or, if a notary in your country signs it, the notary’s stamp must be authenticated with an Apostille (or other authentication process).

We can walk you through the correct process for your country.

Get Paid

After your Mineral & Royalty deed has been notarized and, if needed, properly authenticated, we will wire the funds to your account. The Deed will be recorded in the county where your mineral rights are located, and we will work with the operator(s) to transfer the ownership.

A Quick Guide for International Sellers

About Blue Mesa Minerals

We are a Texas-based mineral rights buyer with extensive experience helping domestic and international owners sell their oil and gas royalties and mineral rights throughout the United States. We own interests in about 3,000 wells across 12 states.

We’re an end buyer – we aren’t brokers and we don’t flip minerals. We keep what we buy and use our royalties to acquire more.

We’re a small buyer, and we like it that way because it allows us to close faster and provide a better experience for our sellers.

Learn more about Blue Mesa Minerals.

Have questions? We can probably answer your questions or point you to the right path.

Ellery Wren, Founder of Blue Mesa Minerals LLC

A Quick Comparison

Selling Domestically vs Internationally Comparison

| Aspect | US-Based Seller | International Seller |

|---|---|---|

| Notarization | Any US notary public (wet signature required) | Local notary + apostille/authentication (wet signature) |

| Typical Timeline | 1-2 weeks | 2-4 weeks |

| Payment Method | Wire transfer or check | International wire transfer (USD) |

| Idenfitication | Government-issued ID | Government Issued ID (Passport preferred) |

| Can Close Remotely? | Yes – mail original notarized deed | Yes – mail authenticated notarized deed |

| Need to Visit the US (Texas)? | No. If you are in the DFW area, we can close locally, but most close remotely. | No. We will close remotely. |

| Seller’s Costs | Notary fee (typically $10-15) | Notary fee + apostille fee (typically $50-150 total) |

| Blue Mesa Minerals Pays | Title search, legal document drafting, recording fees, transfer taxes | Title search, legal document drafting, recording fees, transfer taxes |

| Communication | Phone, email, text | Primarily email (accommodates time zones and translation needs) |

| Property Tax (Ad Valorem) After Closing | Buyer’s responsibility | Buyer’s responsibility |

| US Tax Obligations After Sale | Report capital gains on US tax return | Report capital gains on US tax return + consult local tax advisor |

| Ownership Transfer with Operator | We handle | We handle |

Learn from Others

Three Case Studies

Let’s look at three case studies to see how mineral owners in Canada, the UK, and one who lived on a sailboat.

CASE STUDY One

Canadian Citizen Sells Her Texas Rights

Emma, a Canadian Citizen living in Ontario, was upset when Donald Trump imposed tariffs on Canada and suggested it might become the 51st state. She wanted to sell her Texas mineral rights and approached Blue Mesa Minerals for an offer.

We spent a couple of days researching her mineral rights and extended an offer, which she accepted.

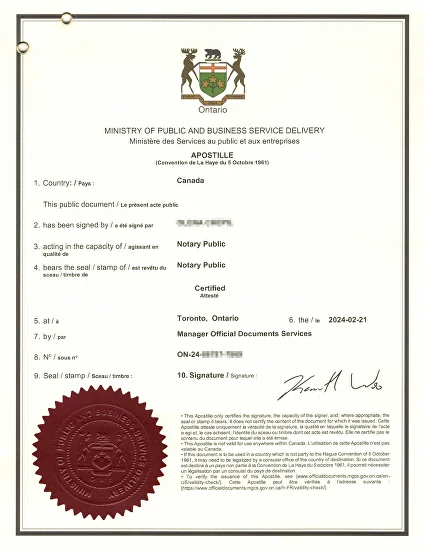

Within about a week, we emailed the Mineral & Royalty Deed for Emma to print and have notarized. Because Emma didn’t live near the US Consulate and she didn’t know a US notary, she chose to use a Canadian notary and have the notary’s signature authenticated with an Apostille through the Official Document Services office (ODS).

Once the deed was notarized and authenticated, we wired her funds, had the authenticated notarized deed recorded in the Texas county where her minerals were located, and worked with the operator to transfer her ownership. We also paid her upcoming Ad Valorem property taxes and directed the county to send future bills to us.

Update: In 2024, Canada officially joined the 1961 Hague Apostille Convention, simplifying the authentication process.

CASE STUDY Two

A Sailboat Liveaboard Sells Her Mother’s Kansas Mineral Rights

Lulu, a retired US Citizen living a nomadic life on a sailboat, was the personal representative of her mother’s Kansas mineral rights, which were located across four counties.

From her sailboat, Lulu navigated the US probate process and, once complete, was ready to sign the deeds (the minerals were in multiple counties) as a personal representative of her mother’s estate.

We worked with Lulu to identify a US Embassy in the country of her next destination, where a Mineral & Royalty Deed could be notarized and airmailed back to us.

We paid her via a wire transfer, and it was smooth sailing!

CASE STUDY Three

A UK Citizen Sells His Oklahoma Mineral Rights

Robert, an expat living in the UK, was tired of the hassle of owning small Oklahoma mineral rights. He had inherited the mineral rights from a grandparent years ago, and for a while, the “mailbox money” was welcome. But over time, the checks declined, and once he moved to the UK for work, the fees, taxes, and mineral management were not worth the $3,000 in royalties he earned each year.

Robert requested an offer and sent his royalty statements to us. After a few days of due diligence, we presented Robert with an offer, which was accepted.

Roberts’ mineral rights were pretty straightforward, so we were ready to close in about a week.

We emailed the Mineral & Royalty Deed to Robert to print and have notarized by a UK Notary Public, then sent the deed to the Legislation Office to obtain an Apostille (a certificate of authentication confirming the notary’s authority).

Once the deed was notarized and authenticated, we wired his funds, then had the deed recorded with the Oklahoma county where his minerals were located, and worked with the three operators to transfer ownership. We also asked the tax assessor to send us future tax bills.

What is an Apostille?

Understanding Apostilles: Authentication for International Mineral Rights Sales

Apostille: A Brief Overview

What is an Apostille? An Apostille is an international certificate that authenticates the signature and seal of a notary public for use in another country. Think of it as a “certification of a certification”—it verifies that your notary is legitimate and authorized.

Why you need one: US counties require notarized deeds before recording them in the public records. If a notary from another country signs your deed, the US county needs proof that the notary is real and authorized to act as a notary. An Apostille provides that proof.

The 1961 Hague Convention: Over 125 countries have signed this treaty, which created the Apostille system. If your country is part of the convention, getting an Apostille is straightforward and typically takes 1-4 weeks. If your country isn’t part of the convention, you’ll need embassy authentication instead—a longer process that can take 4-8 weeks.

The Apostille Process (Simple)

For countries in the Apostille Convention:

- Have your deed notarized by a local notary in your country

- Take the notarized document to your country’s designated Apostille authority (usually a government office)

- They attach an Apostille certificate to your document

- Mail the authenticated document to us

That’s it. The entire process typically takes 2-4 weeks, depending on your country’s processing times.

What is an Apostille?

Apostille Information By Country

Below is information about the authentication process for various countires. Don’t see your country? We’ve got you covered. Over 125 countries use the Apostille system, and we can guide you through the process no matter where you live.

Countries That Use Apostilles (Hague Convention Members)

| Country | Where to Get an Apostille | Typical Cost | Processing Time |

|---|---|---|---|

| Canada | Official Document Services (provincial) – joined the Apostille Convention in January 2024 | Free (government service) | 2-5 business days |

| United Kingdom | Foreign, Commonwealth & Development Office (FCDO) | £45 per document | 1-3 weeks (standard); 1 day (express service available) |

| Australia | Department of Foreign Affairs and Trade (DFAT) | AUD $84 per document | 3-7 business days |

| Germany | Local court or regional authority | €25-50 per document | 1-2 weeks |

| France | Court of Appeal | €30-60 per document | 2-4 weeks |

| Netherlands | Ministry of Foreign Affairs | €25 per document | 5-10 business days |

| New Zealand | Department of Internal Affairs | NZD $75 per document | 5-10 business days |

| Ireland | Department of Foreign Affairs | €40 per document | 5-10 business days |

| Spain | Ministry of Justice | €3-5 per document | 1-2 weeks |

| Italy | Prefettura (local prefecture) | €16 per document | 1-2 weeks |

| Japan | Ministry of Foreign Affairs | Free | 3-5 business days |

| South Korea | Ministry of Foreign Affairs | Free – ₩700 | 2-5 business days |

| China | Ministry of Foreign Affairs or provincial Foreign Affairs Office (joined November 2023) | ¥50-150 per document | 5-10 business days |

| Mexico | Secretaría de Relaciones Exteriores (SRE) | $750-1,000 MXN per document | 5-15 business days |

Note: Over 125 countries are members of the Apostille Convention. If your country isn’t listed above, it’s likely still a member. We can guide you through the process for any Apostille country.

Non-Apostille Countries (Embassy Authentication Required)

A few countries have not joined the Apostille Convention. If you live in one of these countries, the process requires additional steps but is still manageable.

| Country | Authentication Process | Estimated Total Time |

|---|---|---|

| United Arab Emirates (UAE) | 1) Local notary signs deed 2) US State Department authenticates 3) UAE Embassy in Washington DC legalizes |

4-6 weeks |

| Vietnam | 1) Local notary signs deed 2) US State Department authenticates 3) Vietnamese Embassy legalizes |

4-6 weeks |

| Egypt | 1) Local notary signs deed 2) US State Department authenticates 3) Egyptian Embassy legalizes |

4-6 weeks |

For Non-Apostille Countries: The process is more involved, but we’ll walk you through each step. We can coordinate with the US State Department and the appropriate embassy to get your deed properly authenticated.

Frequently Asked Questions (FAQ)

Do I need to travel to the United States to sell my mineral rights?

No. The entire transaction can be completed from your home country. You’ll need to have the mineral deed notarized by a local notary in your country and obtain an Apostille (or authentication if in a non-Apostille country), then mail the original document to us. Everything else—communications, offer review, and payment—happens remotely.

How long does the entire process take?

We usually close with US owners in a week or two, but international closings take a bit longer —sometimes up to 4 weeks (or longer if it takes a while to get the apostille).

What if I don't speak English well?

We’re patient and accommodating. We communicate primarily via email, which gives you time to translate and understand documents. Our goal is clear communication regardless of language barriers.

Can multiple family members in different countries sell together?

Yes. If several heirs inherited minerals and live in different countries, each person can sign their portion of the deed in their respective country. We coordinate with all parties and handle the complexity. Payments can be sent to each heir separately.

What Documents to I need to sell?

At minimum, you’ll need:

- Proof of ownership (deed, will, royalty statements, or inheritance documents)

- Government-issued ID (passport or national ID)

- Banking information for wire transfer

We often help locate missing documents through US county records research. It’s okay if you don’t have much – we’re used to that.

Do I need to have the deed notarized?

Yes. US law requires mineral deeds to be notarized before they can be recorded at the county courthouse. You’ll need to visit a notary in your country who can witness your signature and apply their official seal. The notary stamp must be authenticated, typically with an Apostille. We can walk you through this process, step by step.

What is an Apostille and do I need one?

An Apostille is an international certificate that authenticates notarized documents for use in other countries. Whether you need one depends on:

- Your country (if part of the 1961 Hague Apostille Convention)

- The US state where minerals are located

We’ll let you know if you need an Apostille and provide instructions for obtaining one.

What if I don't have the original deed or documents?

Common situation! Many international owners inherited minerals but never received the original documents. We can:

- Research your ownership through US county records

- Obtain copies of recorded deeds

- Use royalty statements and tax records to verify ownership

- Help you get royalty statements from your operators.

What about payment of taxes in my country?

You should consult with a tax professional in your home country. The sale proceeds may be taxable income in your country depending on local tax laws. We provide documentation of the transaction for your tax records.

Does it cost anything to sell my mineral rights?

No, it shouldn’t cost you anything to sell your mineral rights (other than a potential fee to have the deed notarized and authenticated.

We pay the closing costs, including legal fees for drafting documents, title searches, recording fees, and transfer taxes.

History and Context

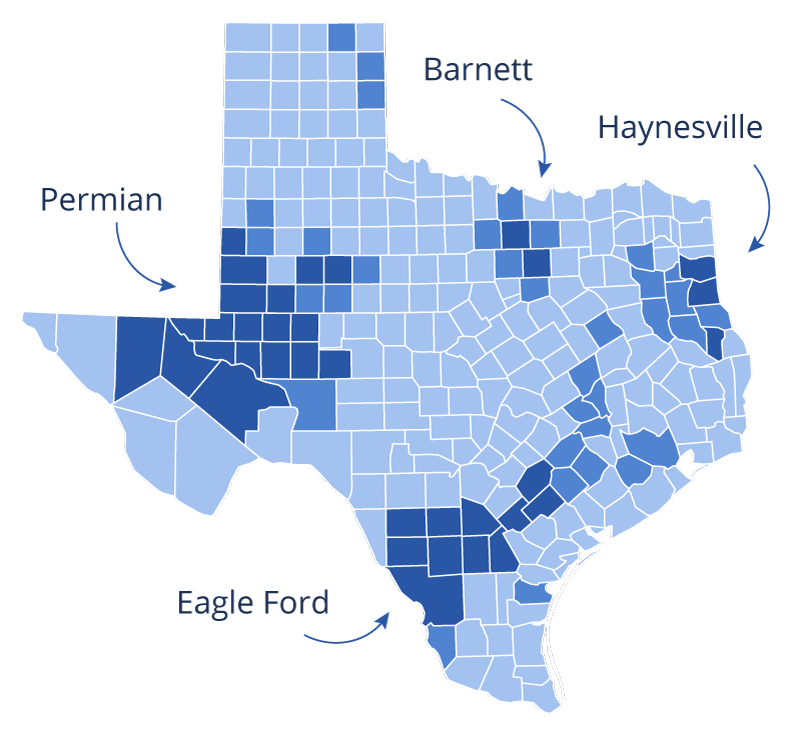

Where We Buy Mineral Rights

We buy both producing and non-producing minerals in all oil and gas states. However, we are especially interested in Texas and Kansas mineral rights.

|

We even buy minerals in more obscure states, which produce very little oil and gas compared to other states.

Why Sell?

Why People Sell Their Mineral Rights

I am putting my affairs in order. I don’t want to burden my kids with the hassle of transferring ownership and managing small mineral rights. When my sister passed away, my niece and nephew had to hire an attorney to help them with the minerals. I don’t want my kids to go through that.

I inherited my mineral rights so they were sentimental, but I don’t really want to bother with managing them and filing extra tax returns. I decided to sell and use the money as a down payment on my house.

I had no idea how fast the oil production would decline. My checks are only 20% of what they were a few years ago. I should have sold my mineral rights when the wells were brand new and still generating huge royalties.

My oil wells have been producing for decades and the reserves are almost depleted. Once the wells are plugged, the value will be significantly lower. I’d rather cash out now.

I inherited mineral rights, but don’t want to be involved with fracking and fossil fuels. I would prefer to support renewable energy and do my part to reverse climate change.