Types of Wind Energy Rights & Payments

Sell Your Wind Rights (Request an Offer):

A New Industry

Overview for Landowners

Unlike oil and gas mineral rights, wind power development is still relatively new, so there is not yet a robust body of law governing wind rights and royalties. As a result, each wind agreement, lease or easement must outline, in great detail, the terms of the contract between the landowner and the wind project developer. These agreements typically range from 20-40 pages and often contain terms that favor the developer rather than the landowner.

By signing the contract, the landowner agrees to a period of exploration, development, and finally, if the developer choose to host one or more wind turbines on the property, a production period with optional extensions. In exchange, the developer agrees to compensate the landowner in uartly, semi-annual, or annual payments (or a combination thereof).

These payment are often referred to as wind royalties or rents. The landowner is sometimes guaranteed a minimum payment or percentage of the energy sold, whichever is greater. Many contracts have an escalating royalty that increases over the term of the contract.

Wind contracts often have the option to renew, but many landowners do not realize that most projects need to be depowered between 8 and 15 years. The wind turbine may be decommissioned, automatically ending the contract.

There are many unknowns and risks associated with owning wind royalties, and having a long contract with multiple renewal options is not a guarantee of future revenue.

Learn the Basics

Six Types of Wind Rights, Royalties & Payments

Landowners who host wind turbines or live near them may receive various types of wind energy compensation payments.

Wind Rights

Wind rights, similar to mineral rights, are a severable right to capture and develop wind energy on a tract of land. It is a real-property interest in wind resources and sometimes referred to as the “wind estate”. No state specifically recognizes wind rights, but many have passed anti-severance laws.

Wind Leases

A wind lease is the most common type of agreement between a landowner and a wind farm developer. The lease allows the developer to build and operate turbines on your property in exchange for regular payments (often quarterly or annual). Wind leases can be conveyed or sold to another party.

Wind Easements

Wind easements grant developers the right to build access roads, run transmission lines, or secure wind flow across your property. Easement payments usually “run with the land”, so the developer keeps the right to use the land, but you can sell your right to the payment.

Wind Royalties & Rents

Wind royalties and rents are paid to landowners who host wind turbines on their property. Royalties are often based on how much electricity a wind project produces, similar to oil and gas royalties. Royalties can vary depending on wind speed, turbine status, utility curtailment, and other factors.

Wind Accommodation Agreements

Landowners and wind developers may be paid in exchange for granting rights (easements or leases) to place turbines or related infrastructure on the property, or, in some cases, for not developing near other wind projects. These payments are structured in a wind accommodation agreement (WAA).

Nuisance or Participation Payments

Landowners who live near turbines but don’t host them are sometimes paid for “participating” in the wind project or wind farm. These landowners are compensated for the inconvenience of living or working near wind turbines, which might be noisy or create a shadow flicker.

A Developing Situation

The Wind Estate

Although many landowners have attempted to sever wind rights, it is unclear if the courts will recognize the wind estate as being separate from the surface. In many states, the legal implications of severing wind rights are still unknown.

Many hope the courts will eventually recognize the wind estate as similar to the mineral estate. Unfortunately, the trend does not appear promising.

No state currently recognizes the “wind estate”. In fact, many states have enacted specific anti-severance statutes. In these states, wind rights are inherently connected to the land and cannot be severed.

Anti-severance legislation benefits the developer, who will never have to deal with fractioned ownership (unlike the oil and gas industry). Simplified title, ownership, and easier payment process are in the developer’s best interest. Wind power organizations and developers have far deeper pockets and greater influence than even the largest ranchers.

The following states have anti-wind severance statutes:

- Colorado

- Kansas

- Oklahoma

- North Dakota

- South Dakota

- Nebraska

- Montana

- Wyoming

Looking for details about wind estate, severance, and royalty/agreement laws? Check out our state-by-state summary of wind energy anti-severance legislation.

Most Common Landowner Wind Asset

Wind Leases & Easements

In wind development, the term “wind lease” is often used informally to describe agreements that grant wind developers long-term rights to use land for turbines and related infrastructure. These agreements may cover turbine sites, access roads, transmission lines, substations, and restrictions on activities that interfere with wind flow.

In practice, many agreements labeled as wind leases share characteristics more commonly associated with easements, such as long or indefinite terms, rights that run with the land, and recordation in county land records. For this reason, wind leases and wind easements are often analyzed together when evaluating wind-related assets.

Key characteristics commonly found in wind leases and easement-style agreements include:

- Long-term or multi-decade duration, sometimes with automatic extensions

- Broad surface and airspace rights tied to wind capture and infrastructure

- Limited termination rights for the landowner

- Transferability to future operators without landowner consent

- Recorded memoranda that burden the property title

From an asset perspective, the legal substance of the rights granted is typically more important than the label used in the agreement. Whether styled as a lease or an easement, these instruments function as long-term encumbrances on the land and can materially affect property use, mineral development, valuation, and marketability.

Payment rather than property right

Wind Accommodation Agreements (WAA)

Wind Accommodation Agreements are contracts that provide compensation to landowners or interest holders in connection with wind development activity, without necessarily granting wind development rights themselves. These agreements are commonly used to address construction impacts, operational interference, or the presence of wind facilities on or near a property.

In addition to compensating for physical or operational impacts, wind accommodation agreements are sometimes used to limit or restrict wind development on adjacent or nearby land. In these cases, the agreement functions as a form of non-development or setback arrangement, compensating the landowner in exchange for agreeing not to construct competing wind improvements that could interfere with turbine spacing, wind flow, or project design.

Common features of wind accommodation agreements include:

- Fixed annual payments or milestone-based payments

- Compensation tied to construction, operation, or turbine presence

- Limited or no grant of wind, surface, or airspace rights

- Defined terms that may or may not align with the life of the wind project

- Assignment provisions allowing transfer to project owners or affiliates

From an asset standpoint, wind accommodation agreements are generally treated as payment rights rather than real property interests, although some agreements may be recorded or structured to run with the land. The specific language of the agreement controls whether payments survive ownership changes, project transfers, or operational interruptions.

Because accommodation agreements often coexist with wind leases, easements, or options, they are typically evaluated as supplemental wind assets rather than standalone development rights.

For Landowners Ajacent to Wind Development

Nuisance & Participation Payments

Nuisance payments (sometimes called participation payments) are compensation arrangements made to landowners who do not host wind turbines but are affected by nearby wind development. These payments are typically intended to address perceived or anticipated impacts such as noise, shadow flicker, visual impact, or reduced enjoyment of the property.

Unlike wind leases or easements, nuisance or participation payments generally do not grant development rights and are often structured as personal contractual payment obligations rather than property interests. They may apply to neighboring landowners, residences within a defined distance of turbines, or owners of land affected by access roads or transmission lines.

Common characteristics of nuisance or participation payment agreements include:

- Fixed annual or periodic payments

- Eligibility based on proximity to turbines or project infrastructure

- No grant of wind, surface, or airspace rights

- Limited terms tied to project operation or defined payment periods

- Assignment rights allowing transfer to project owners or successors

From an asset perspective, nuisance and participation payments are typically treated as standalone payment rights, not real property encumbrances. They are often not recorded and may terminate automatically if turbines are removed, operations cease, or ownership changes—depending on contract language. They might even terminate at the sole discretion of the wind developer/operator.

Because these payments are discretionary and highly agreement-specific, they are usually evaluated separately from wind leases, easements, and accommodation agreements when assessing the overall wind asset profile of a property.

Contractual Payments

Wind Royalties & Rents

Wind royalties and rents refer to ongoing payments made in connection with the operation of wind energy projects. These payments may be structured as fixed rents, per-turbine payments, or revenue-based compensation tied to energy production or project performance.

Unlike oil and gas royalties, wind royalties are entirely contractual and are not governed by a uniform statutory framework. Payment terms vary widely and may be based on turbine count, installed capacity, gross revenue, net revenue, or predefined payment schedules, often with escalators or caps.

Common characteristics of wind royalty and rent arrangements include:

- Fixed annual rents or per-turbine payments

- Revenue-based or capacity-based royalties

- Payments are subject to operating thresholds or curtailment provisions

- Escalation clauses tied to time or inflation

- Assignment or transfer to project owners or financing parties

From an asset standpoint, wind royalties and rents are generally treated as income streams rather than development rights. The right to receive payments may be severable from land ownership, assigned to third parties, or sold independently, depending on the underlying agreement.

Because payment obligations are governed strictly by contract language, valuation depends heavily on factors such as project maturity, operating status, payment structure, termination rights, and transferability. Wind royalties and rents are therefore often evaluated separately from wind leases, easements, and accommodation agreements, even though they arise from the same project.

One of Many Options

Selling Wind Royalties

Most wind royalties are unfractionated (they are still owned by the original landowner). However, wind royalties will be increasingly fractioned as landowners pass the royalties to the next generation or royalty owners choose to sell their royalties.

Wind royalties generally sell for a multiple of the annual revenue. In the past, fund managers were willing to overpay for income-producing wind energy assets, simply because they were “renewable” and therefore desirable. However, the market has since cooled, and multiples of 3-6 years are increasingly common.

While oil and gas checks decline over time, wind royalties often have an escalating royalty that increases over time (but may or may not keep up with inflation).

Looking for an offer on your wind royalties, nuisance payment, or other wind accommodation agreement? Contact us.

Valuation Factors

How Wind Royalties Are Valued

There are many factors that play into the value of wind royalties and other compensation. These include location, capacity, average wind speed, current royalty percentage, wind production, lease terms, risk profile, and even the operator of the wind farm or project.

Location

Wind farms are typcially situated in areas with consistently high wind speeds, ideal terrain, and close proximity to electric transmission lines.

Capacity

Newer wind turbines are typcially rated for a higher capacity and generate more wind power and revenue.

Production

Higher producing wind turbines generate more wind power over the life of the wind farm.

Market Conditions

2025 Update: The Big Beautiful Bill (OBBA) removed tax incentives for wind energy development and wind energy permits were halted in July of 2025, impacting both new development and repowering of current projects.

Lease Terms

Favorable lease terms with generious esclation clauses positively impact the market value of wind royalties.

Operator

Large, experienced wind farm operators are often more financially sound, particuarly in times of economic instability.

We Are an End Buyer

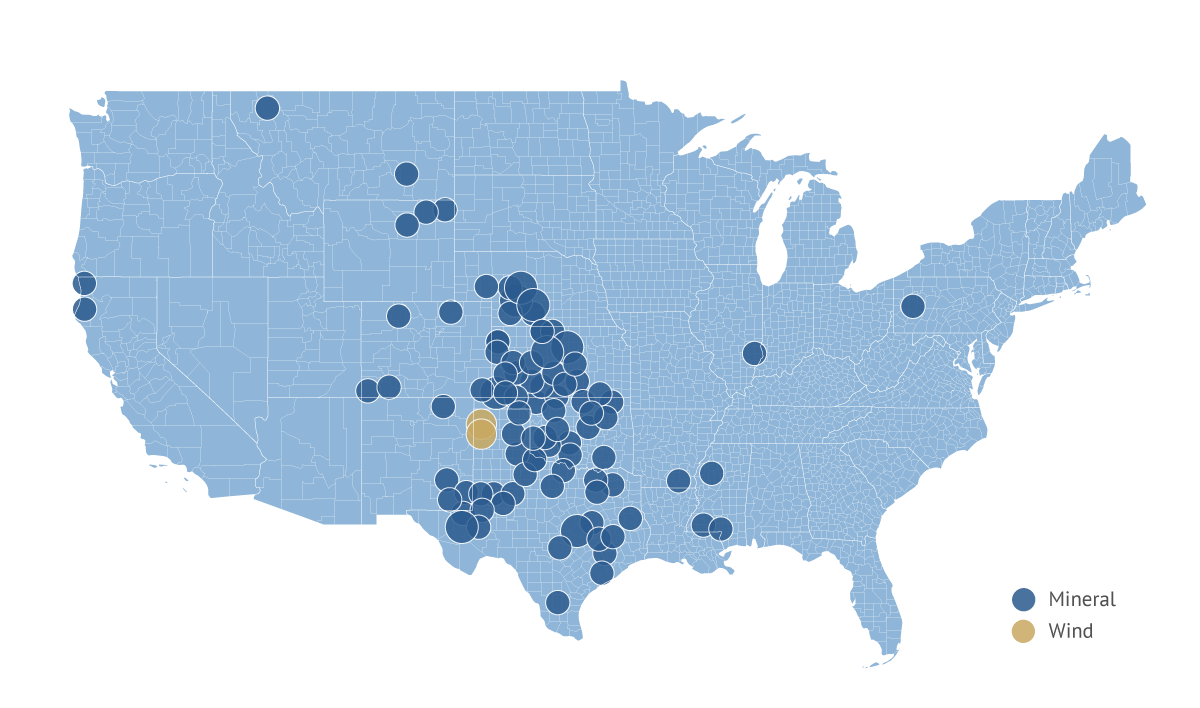

Blue Mesa Minerals' Portfolio

Common Motivations to Sell

Why Sell Your Wind Lease?

Why People Sell Their Wind Rights

My mom just turned 90 and didn't have long to live. We decided, together, to sell her wind rights so I wouldn't have to worry about probating her estate after she passed. She had sold the farm years ago, reserving the wind rights, and received a small quarterly payment.

We decided to sell the wind rights for our two wind turbines. We were proud to be part of a wind development project, but we're ready to sell our house (on 4 acres) and move close to the grandkids. We could keep the wind payments, but at this point, we want to simplify our lives.

I decided to sell because my turbines are already nearly 10 years old and will need to be repowered soon. The current administration is cripling wind energy, and I'm not confident that the wind farm will be able to repower the turbines. I'd rather not take the risk - it's better for me to sell now.

My uncle left me his wind accommodation payment (I didn't even know that was a thing!). While I enjoy periodic payments, I'd rather receive a lump sum now and use it to expand and grow my business.