Sell Your Wind Lease or Easement

We buy wind leases, easements, and other wind energy payments throughout the United States.

Sell Your Wind Rights (Request an Offer):

Selling Your Wind Lease

Our Process is Quick and Easy

We buy wind energy rights, rents, royalties, easements, and other types of accommodation payments throughout the United States, with a special focus on Texas. Request an offer to get started.

Our 4-Step Process

We won’t pressure you to sell your wind rights. We are here to give you information so you can make an informed decision.

1. Request an Offer

Request and offer, and we’ll be happy to evaluate your wind contract and provide you with an offer.

2. Submit Supporting documents

Send your last few statements (they might be quarterly or annual statements) and any supporting documents (contracts, 1099s, etc.).

3. Review and Accept Offer

We will evaluate your wind energy asset and provide you with a competitive offer. Let us know if you would like to proceed with the sale, and we will draft the closing documents.

4. Sign Deed and Receive Payment

Once we agree on a price, a closing date will be scheduled (usually a week or two). You will sign and notarize the conveyance documents. When we receive the documents, we will immediately wire the funds.

What We Buy

We Buy 6 Types of Wind Energy Assets

Landowners who host wind turbines or live near them may receive various types of wind energy compensation payments. We buy wind rights, leases, easements, royalties, rents, accommodation agreements, and participation payments.

Wind Rights

Wind rights, similar to mineral rights, are a severable right to capture and develop wind energy on a tract of land. It is a real property interest in wind resources and is sometimes referred to as the “wind estate”. No state specifically recognizes wind rights, but many have passed anti-severance laws.

Wind Leases

A wind lease is the most common type of agreement between a landowner and a wind farm developer. The lease allows the developer to build and operate turbines on your property in exchange for regular payments (often quarterly or annual). Wind leases can be conveyed or sold to another party.

Wind Easements

Wind easements grant developers the right to build access roads, run transmission lines, or secure wind flow across your property. Easement payments usually “run with the land”, so the developer keeps the right to use the land, but you can sell your right to the payment.

Wind Royalties

Wind royalties are paid to landowners who host wind turbines on their property. Royalties are often based on how much electricity a wind project produces, similar to oil and gas royalties. Royalties can vary depending on wind speed, turbine status, utility curtailment, and other factors.

Wind Accommodation Agreements

Landowners and wind developers may be paid in exchange for granting rights (easement or lease) to place turbines, or related infrastructure on the property or, in some cases, not to develop near other wind projects.

Nuisance or Participation Payments

Landowners who live near turbines but don’t host them are sometimes paid for “participating” in the wind project or wind farm. These landowners are compensated for the inconvenience of living or working near wind turbines which might be noisy or create a shadow flicker.

Read more about types of wind energy assets.

National Focus

Where We Buy

We are primarily focused on buying smaller wind energy assets nationwide.

|

|

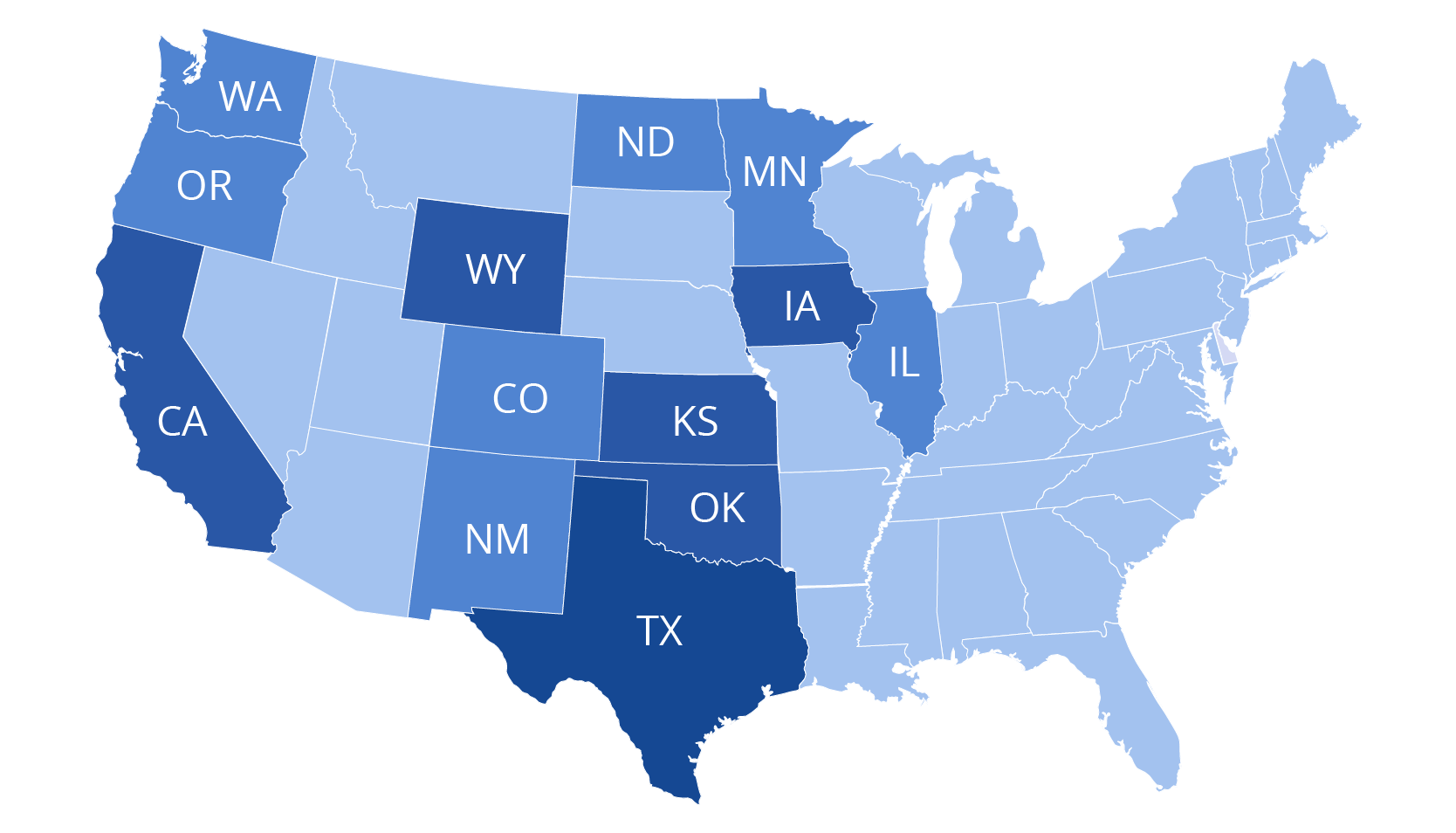

We actively purchase wind rights nationwide, with a concentration in Texas and the mid-continent states.

We like smaller properties (valued between 5K - 50K) and can usually close quickly, if needed.

Image: Top wind-energy producing states.

Valuation Factors

How Wind Leases Are Valued

There are many factors that play into the value of wind royalties and other compensation. These include location, capacity, average wind speed, current royalty percentage, wind production, lease terms, risk profile, and even the operator of the wind farm or project.

Location

Wind farms are typcially situated in areas with consistently high wind speeds, ideal terrain, and close proximity to electric transmission lines.

Capacity

Newer wind turbines are typcially rated for a higher capacity and generate more wind power and revenue.

Production

Higher producing wind turbines generate more wind power over the life of the wind farm.

Market Conditions

2025 Update: The Big Beautiful Bill (OBBA) removed tax incentives for wind energy development and wind energy permits were halted in July of 2025, impacting both new development and repowering of current projects.

Lease Terms

Favorable lease terms with generious esclation clauses positively impact the market value of wind royalties.

Operator

Large, experienced wind farm operators are often more financially sound, particuarly in times of economic instability.

Wind Lease Buyer

Wind Lease Valuation History

How Much Are Wind Leases and Easements Worth?

Wind energy development is still relatively new and has gained popularity over the last few decades, only to become unpopular again.

2018-2021: Green-Premium Era

Wind energy leases, easements, royalties, and other types of payments were highly sought after by fund managers who wanted renewables in their portfolio. These income-producing assets were not tied to oil and gas, making them ideal for investors and organizations divesting from fossil fuels.

Because of the high competition, fund managers were willing to pay a premium (6-9 years) – it was more about having renewables in the portfolio than the actual returns.

2020-2024 Market Challenges

Oil prices dropped during the pandemic, then soared again during the initial years of the Russia-Ukraine war, allowing for better returns in well-timed oil and gas investments, igniting a renewed interest.

Supply chain congestion and turbine quality problems plagued the industry, making it more costly to build and operate wind energy projects.

Prices for landowner wind leases, royalties, easements, and other accommodation agreement payments dropped to 3-5 years.

2024 – 2026: The Rise of AI & Changing Political Climate

The rise of AI, which is energy-intensive, has brought natural gas back into favor. After the 2024 election, political sentiments favored oil and gas, while disincentivizing renewables.

The Big Beautiful Bill (OBBA) removed vital tax incentives for wind energy development, and on July 21, 2025, Trump effectively halted all energy permits, both federal and private. This is devastating the wind energy sector.

Now, wind energy leases, easements, and other payments are viewed as highly risky, which has lowered the value to 3-4 years of cash flow, depending on a variety of factors.

Wind nucense and participation payments, with higher risk profiles (especially with no obligation to continue paying), may sell for less.

The value of your wind royalties (and other participation or accommodation payments) greatly depends on a variety of factors, including the annual revenue, escalation clause, inflation adjustments, age of equipment, risk profile, and market conditions.

Weighing Risks and Benefits

Risks Associated with Owning Wind Leases & Easements

Unlike oil and gas royalties, which deplete over time, wind leases, easements, royalties, and other accommodation payments sometimes escalate over time. So, why would a landowner sell the royalties (or participation/accommodation agreements)? There are several significant risks associated with wind royalties.

Repowering

The biggest risk is a partial or full repowering. Wind turbines are mechanical and often need to be repowered after 8-12 years. As of 2025, federal wind energy permits have been halted, which impacts the ability to repower existing projects.

Inflation

Many wind easements, royalties, and accommodation agreements fail to account for inflation (or cap inflation), making the payments less valuable over time.

Wake Effects

Additional nearby wind development may introduce wake effects, reducing turbine production and potentially causing it to be moved or removed.

Contract Terms

Wind agreements usually favor the developer/operator and can often be canceled by the operator at any time. Future revenue may not be guaranteed, even if the wind project remains operational.

Greenfield Development

Incentives, such as Investment Tax Credits (eliminated by the Big Beautiful Bill) and county tax abatements, incentivize new development in a “greenfield” rather than repowering or extending the current lease agreement.

Political Climate

The political climate can encourage or discourage wind development. The Big Beautiful Bill eliminated tax incentives for reneables and Trump halted the permitting of wind energy permits in July of 2025, which impacts new projects and older projects in need of repowering (after about 9-13 years).

Learn more about wind lease and easement risks.

Wind Lease Buyer

Why Sell to Blue Mesa Minerals?

We are not brokers or flippers.

We’re a woman-owned mineral and wind asset acquisitions company that invests our own capital for long-term royalty income. We don’t flip properties, and we are not brokers.

We’re just like you: Our founder, Ellery Wren, is not a landman and doesn’t have an MBA. She inherited her dad’s small mineral rights and bought more. The more she bought, the more fun she had, and eventually she started buying wind leases/easements.

Self-Funded: We aren’t backed by private equity or venture capital. We are entirely self-funded, using the royalties we earn to buy more energy assets. We are spending our own money (not private equity), which gives us full control and autonomy.

Woman-Owned: Blue Mesa Minerals is a woman-owned business. Our Founder and President is a woman, and you don’t see many women in the mineral or wind acquisition space.

Focus on Small Wind Assets: Many wind buyers turn away small wind assets because of the time and cost involved. We welcome small wind energy owners and treat them the same as we do those with much more valuable wind leases and easements.

We Don’t Flip Wind Assets: We are end-buyers, which means we keep what we buy. We are not brokers (connecting buyers and sellers), and we do not flip wind assets (a common strategy).

Ellery Wren

Founder of Blue Mesa Minerals LLC

We Are an End Buyer

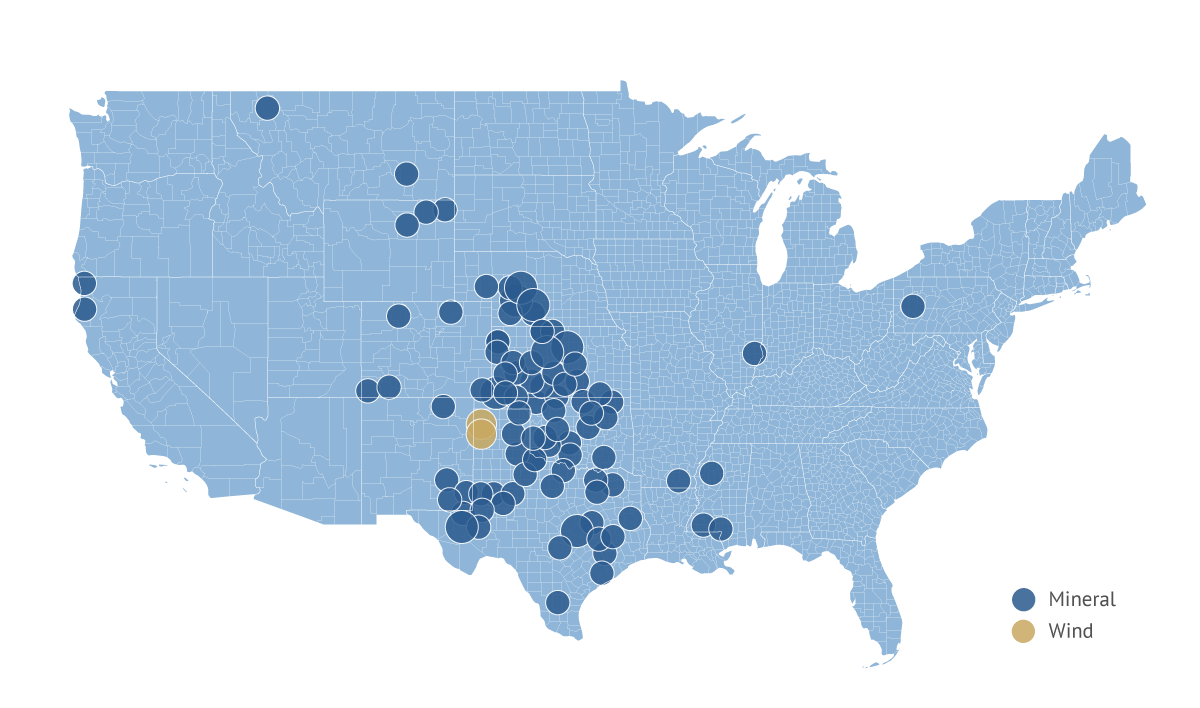

Blue Mesa Minerals Portfolio

Testimonials

“I am immensely pleased with the process of selling my inherited royalty properties to Blue Mesa Minerals. Ellery made the transaction easy and fast with quick responses on all communication and quick payment to close out the deal. My headache with managing these mineral interests and dealing with tax filings is now gone for good. HOORAY! Thank you Ellery Wren. Highly recommended”.

“My small mineral rights came with stories and sentiments that far exceeded their monetary value. Ellery understood both sides of the transaction, providing me with the documentation, perspective, and time I needed to make the best decision for me and my family. I had a million questions, and she addressed each one with professional care. Ellery is a joy to work with, and I highly recommend her exceptional services.”

“I am so glad I contacted this company to see if they would be interested in making an offer on my mineral rights. Ellery helped me from start to finish. She provided me with honest and informative answers to my never-ending questions, and made the process a lot less stressful for me. I am so thankful! I highly recommend this company.”

Read more of Blue Mesa Minerals’ reviews.

Your Questions Answered

Frequently Asked Questions (FAQ)

How much will you pay for my wind lease/easement?

Every wind energy asset is different, and the offer will depend on what you own, the contract terms, location, payment history, age and capacity of turbines, market conditions, political risk, and local factors. Request an offer, and we’ll look at your specific property.

What is the difference between a wind lease and easement?

A wind lease gives a wind company the right to possess and use your land for wind energy development, typically for 20-50 years. This creates a landlord-tenant relationship – you receive rental payments during development and royalty payments once turbines are producing. When the lease term expires, those rights end.

A wind easement gives limited rights to use your property for a specific purpose without transferring possession. Common easements include access roads, transmission lines, construction areas, and restrictions on building structures that would block wind flow to turbines. Easements can be perpetual (permanent) or for a set term, often 30-50 years. They’re recorded in county land records and typically remain binding even when you sell the property.

Many wind agreements include both a lease (for the land where turbines sit) and easements (for access roads, transmission lines, or protecting airspace where turbine blades sweep across neighboring properties). Payment structures differ – leases usually provide ongoing payments tied to production, while easements might involve one-time payments or smaller ongoing payments.

When you sell property, wind leases and easements typically transfer to the new owner for their remaining terms.

What makes a wind lease/easement more valuable?

What makes a wind lease or easement more valuable?

Several factors increase wind lease and easement values:

Property size and topography: Larger tracts with suitable terrain for turbine placement are more attractive. Each modern turbine requires approximately 60 acres of land (though the actual footprint is much smaller), so properties that can accommodate multiple turbines are more valuable.

Turbine capacity and production: Leases covering newer, higher-capacity turbines (3+ megawatts) generate more electricity and therefore higher royalty and rent payments than older, smaller turbines.

Favorable lease terms: Agreements with escalation clauses that keep pace with inflation, minimum guaranteed payments, production royalties (typically 3-6% of gross revenues), and reasonable lease durations increase value.

Power Purchase Agreements (PPAs): Wind farms with long-term PPAs providing fixed electricity prices offer more stable, predictable revenue than those selling into volatile spot markets.

Operator reputation: Projects operated by established, well-capitalized companies with strong track records reduce risk and increase lease value compared to smaller, unproven developers.

What makes wind leases and easements less valuable?

Several factors can decrease wind lease and easement values:

Poor wind resource: Lower average wind speeds or inconsistent wind patterns result in reduced energy production and lower royalty payments.

Distance from electrical infrastructure: Properties located far from substations and transmission lines require expensive infrastructure investments, reducing what developers can pay landowners.

Weak escalation clauses: Wind leases with annual payment increases of only 1-3% lose value over time since these rates typically don’t keep pace with inflation (historically 3-4% annually).

Turbine age approaching repowering timeline: Turbines older than 8-12 years face economic pressure to repower. Lease payments may stop if the developer chooses to decommission rather than repower, and landowners have little control over this decision.

Unfavorable market conditions: Properties in areas without strong electricity demand, lacking state or federal renewable energy incentives, or facing regulatory hurdles command lower payments. The second Trump administration’s anti-wind policies are having a dramatic impact on wind energy development and repowering.

Land use restrictions: Properties with conservation easements, agricultural restrictions, or environmental sensitivities that complicate development reduce lease values. Wind leases can also make land less attractive to other buyers (including for future oil and gas development) because they tie up the property for decades.

Payment structure risks: Leases based solely on production royalties (without minimum guaranteed payments) expose landowners to revenue uncertainty from equipment downtime, utility curtailment, and market price fluctuations.

Severance of payment stream: If wind payment rights have been sold separately from land ownership, the property becomes less valuable because it’s encumbered by wind infrastructure without the income stream to compensate.

What is repowering and why does it make turbines approaching 8-12 years of age more risky?

Repowering is the process of replacing aging wind turbines or their major components (blades, nacelle, control systems) with newer, more efficient technology. Developers typically replace multiple older turbines with fewer, larger, more powerful turbines to increase energy output and extend the project’s operational life.

Why 8-12 years is the critical window:

Wind turbines are designed to last 20-25 years, but economic incentives often make repowering attractive much earlier. Industry data shows that turbines older than 10-12 years can achieve capacity factor gains of 10-20% through repowering, making it economically preferable to continuing operation with aging equipment (which becomes increasingly expensive over time). The median age for partially repowered wind facilities in the U.S. is approximately 10 years.

Risk to landowners:

When turbines approach 8-12 years of age, landowners face uncertainty because:

Developer’s choice: The decision to repower, extend operations, or decommission rests entirely with the wind company, not the landowner. Lease payments typically stop if turbines are decommissioned.

Economic vs. contractual life: Even though leases run 20-50 years, economic factors (technology advances, federal tax credits, changing electricity markets) often drive repowering decisions that can interrupt or end payment streams well before the lease expires.

Turbine degradation: Studies show wind turbine output declines approximately 1.6% annually due to wear and tear. Older turbines become less efficient and more expensive to maintain, increasing the likelihood of early decommissioning.

Permit and regulatory hurdles: Repowering may require new permits that weren’t needed for the original turbines. If permits can’t be obtained, the developer may decommission rather than continue operating aging equipment.

No guarantee of repower: While some leases include language about repowering rights, developers have no obligation to repower. They may choose to decommission if repowering economics don’t work or if they can’t secure necessary approvals.

This creates a particular risk for landowners who purchased wind royalties or leases expecting 20-30 years of payments – those income streams may end much sooner if turbines are decommissioned rather than repowered. Even if repowered, specific turbines may be decommissioned to keep the total output the same while using higher capacity turbines.

Common Motivations to Sell

Why Sell Your Wind Lease?

Why People Sell Their Wind Rights

My mom just turned 90 and didn't have long to live. We decided, together, to sell her wind rights so I wouldn't have to worry about probating her estate after she passed. She had sold the farm years ago, reserving the wind rights, and received a small quarterly payment.

We decided to sell the wind rights for our two wind turbines. We were proud to be part of a wind development project, but we're ready to sell our house (on 4 acres) and move close to the grandkids. We could keep the wind payments, but at this point, we want to simplify our lives.

I decided to sell because my turbines are already nearly 10 years old and will need to be repowered soon. The current administration is cripling wind energy, and I'm not confident that the wind farm will be able to repower the turbines. I'd rather not take the risk - it's better for me to sell now.

My uncle left me his wind accommodation payment (I didn't even know that was a thing!). While I enjoy periodic payments, I'd rather receive a lump sum now and use it to expand and grow my business.